Question

Gernhardt Company was formed on July 1, 2010. It was authorized to issue 1,000,000 shares of $1 par value common stock and 2,000,000 shares of

Gernhardt Company was formed on July 1, 2010. It was authorized to issue 1,000,000 shares of $1 par value common stock and 2,000,000 shares of 4% $100 par value, cumulative, nonparticipating preferred stock. The company has a July 1-June 30 fiscal year.

Excerpts from the companys balance sheet as of June 30, 2014, provided the following under stockholders equity:

Preferred stock, 200,000 shares issued $20,000,000

Common stock, 350,000 shares issued $ 350,000

Additional paid-in capital (including $100,000 from treasury stock) $ 8,400,000

Retained earnings $ 1,000,000

Treasury stock, 25,000 common shares, at average cost $ (550,000)

Total stockholders equity $29,200,000

The following stockholders equity-related transactions occurred during fiscal 2015.

Nov. 25: 5,000 treasury shares were resold for $20 per share.

Dec. 1: Gernhardt declared a 5% stock dividend (not a cash dividend) for common stockholders of record on December 20, 2014, to be issued on January 15, 2015. The companys common stock was selling at $28 per share on December 1, 2014. The company makes a memorandum entry on record dates for dividends.

June 1: The company declared its annual combined (preferred and common) cash dividends, totaling $1,900,000. One years dividends were in arrears (from fiscal 2014) at the time. The dividends are payable June 30 to stockholders of record on June 15. The company uses separate dividends payable accounts for preferred and common stock. The company also makes a memorandum entry on record dates for dividends.

June 30: Year-end closing procedures resulted in net income for fiscal 2015 of $1,400,000. The income summary account must now be closed. (Prepare the journal entry.)

Required:

a. Prepare journal entries for each of the fiscal 2015 transactions above in proper form, including dates, explanations, and computations.

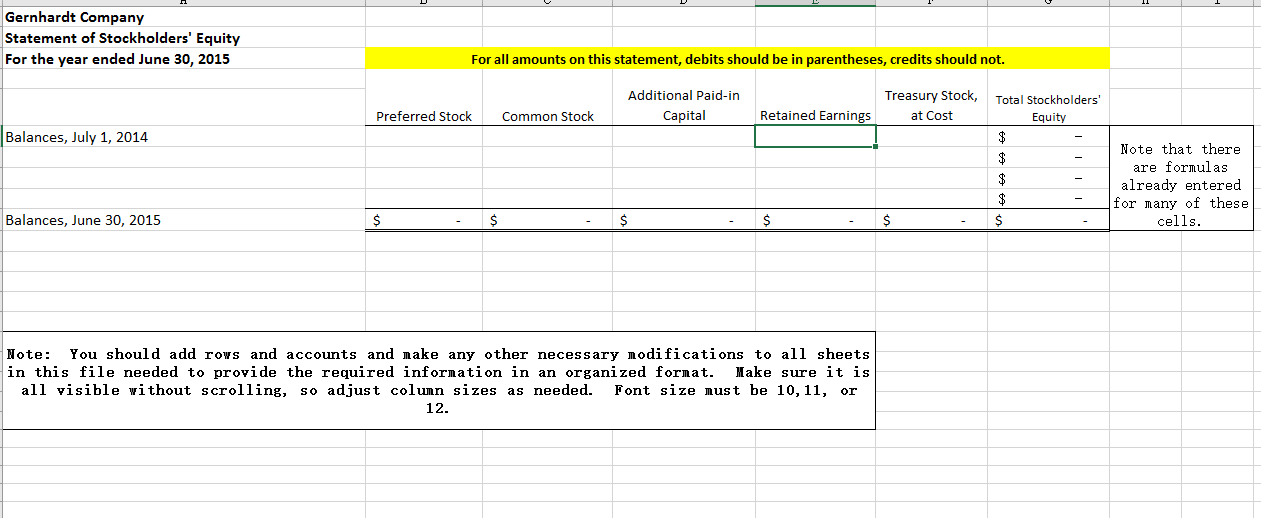

b. Prepare a Statement of Stockholders Equity from June 30, 2014 to June 30, 2015. A separate Excel file is provided which has a template for this. It also has worksheets titled for parts a) and c).

c. Prepare the stockholders equity section of the balance sheet, including appropriate notes, for Gernhardt Company as of June 30, 2015, as it should appear in its annual report to the shareholders. Include all formalities, i.e., shares authorized, issued, outstanding, and in treasury, par values, dividend features of preferred stock, etc. Format with dollar signs and no decimal places, and use single- and double-underlining as conventional. Include a proper heading.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started