Answered step by step

Verified Expert Solution

Question

1 Approved Answer

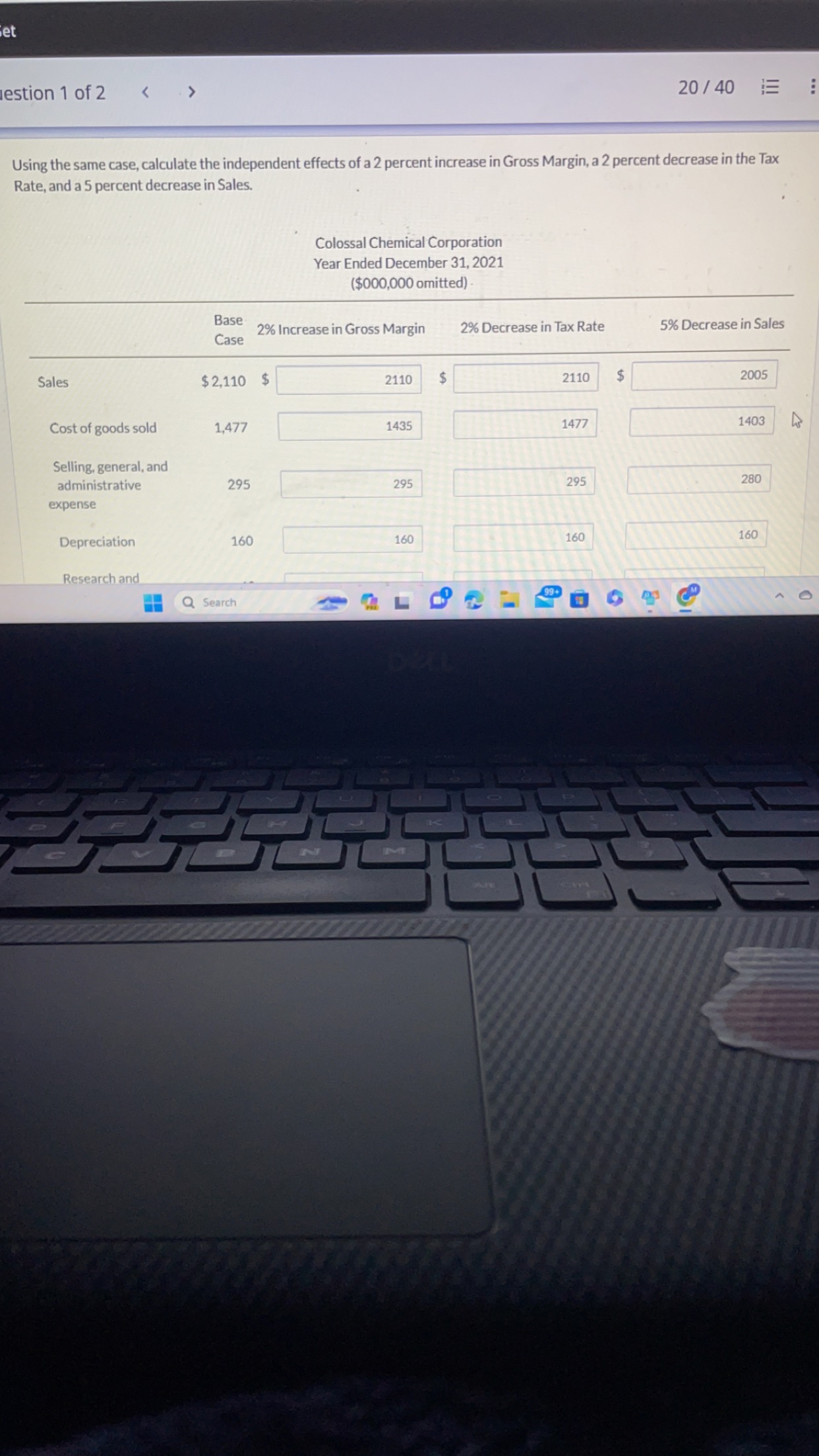

Set estion 1 of 2 < > 20/40 E Using the same case, calculate the independent effects of a 2 percent increase in Gross

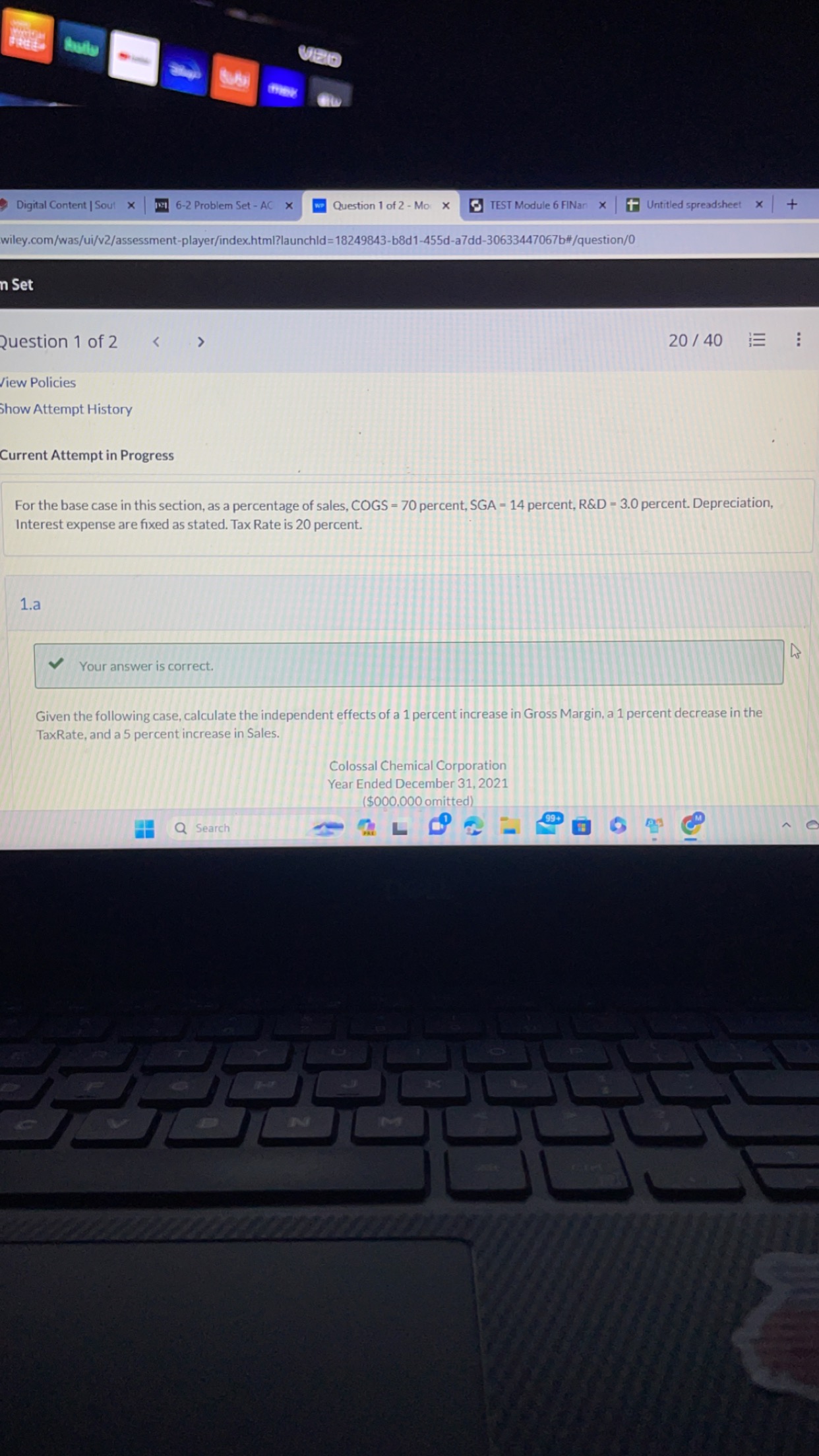

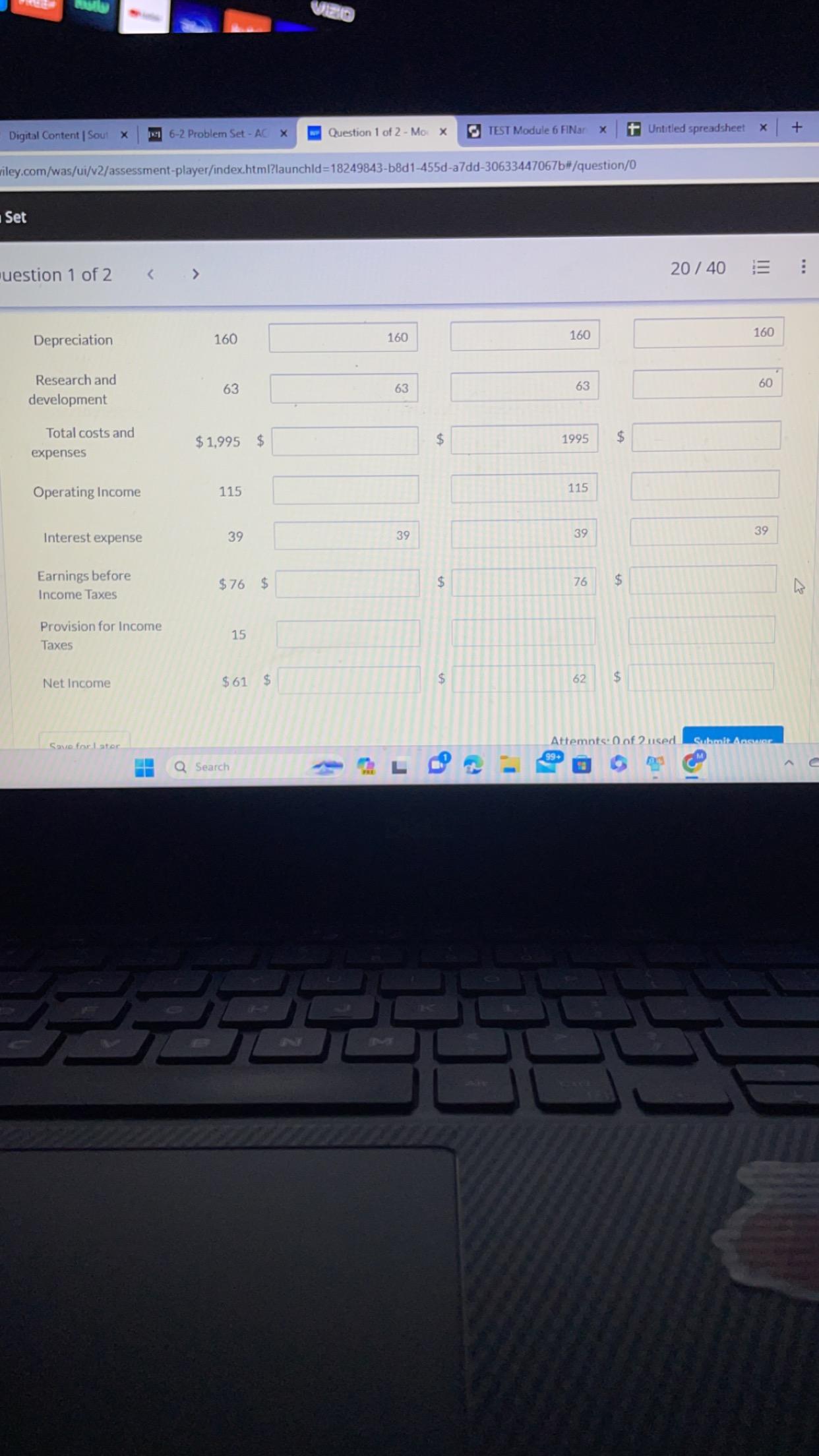

Set estion 1 of 2 < > 20/40 E Using the same case, calculate the independent effects of a 2 percent increase in Gross Margin, a 2 percent decrease in the Tax Rate, and a 5 percent decrease in Sales. Colossal Chemical Corporation Year Ended December 31, 2021 ($000,000 omitted) Base Case 2% Increase in Gross Margin 2% Decrease in Tax Rate 5% Decrease in Sales Sales $2,110 $ 2110 $ 2110 $ 2005 Cost of goods sold 1,477 1435 1477 1403 Selling, general, and administrative 295 295 295 280 expense Depreciation Research and Q Search 160 160 Det M ALE 99- 160 160 0 FREEP Digital Content | Sout X 216-2 Problem Set - AC VIZIO Question 1 of 2 - Mo x TEST Module 6 FINan Untitled spreadsheet X + wiley.com/was/ui/v2/assessment-player/index.html?launchld=18249843-b8d1-455d-a7dd-30633447067b#/question/0 m Set Question 1 of 2 View Policies < > 20/40 Show Attempt History Current Attempt in Progress For the base case in this section, as a percentage of sales, COGS = 70 percent, SGA - 14 percent, R&D = 3.0 percent. Depreciation, Interest expense are fixed as stated. Tax Rate is 20 percent. 1.a Your answer is correct. Given the following case, calculate the independent effects of a 1 percent increase in Gross Margin, a 1 percent decrease in the TaxRate, and a 5 percent increase in Sales. Q Search N Colossal Chemical Corporation Year Ended December 31, 2021 ($000.000 omitted) M K VIZIO Digital Content | Sout X 6-2 Problem Set - AC X Question 1 of 2 - Mo X TEST Module 6 FINar X Untitled spreadsheet X + wiley.com/was/ui/v2/assessment-player/index.html?launchld=18249843-b8d1-455d-a7dd-30633447067b#/question/0 Set uestion 1 of 2 < > Depreciation 160 160 160 Research and 63 development Total costs and $1,995 $ expenses Operating Income 115 Interest expense 39 Earnings before $76 $ Income Taxes Provision for Income Taxes Net Income 15 63 39 63 $ 1995 $ 115 39 $ 76 $61 $ $ 62 22 Save for Later. Q Search Z +A $ $ 20/40 E 160 60 39 Attempts: 0 of 2 used Submit Answer C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the independent effects of a 2 percent increase in Gross Margin a 2 percent decrease in the Tax Rate and a 5 percent decrease in Sales fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started