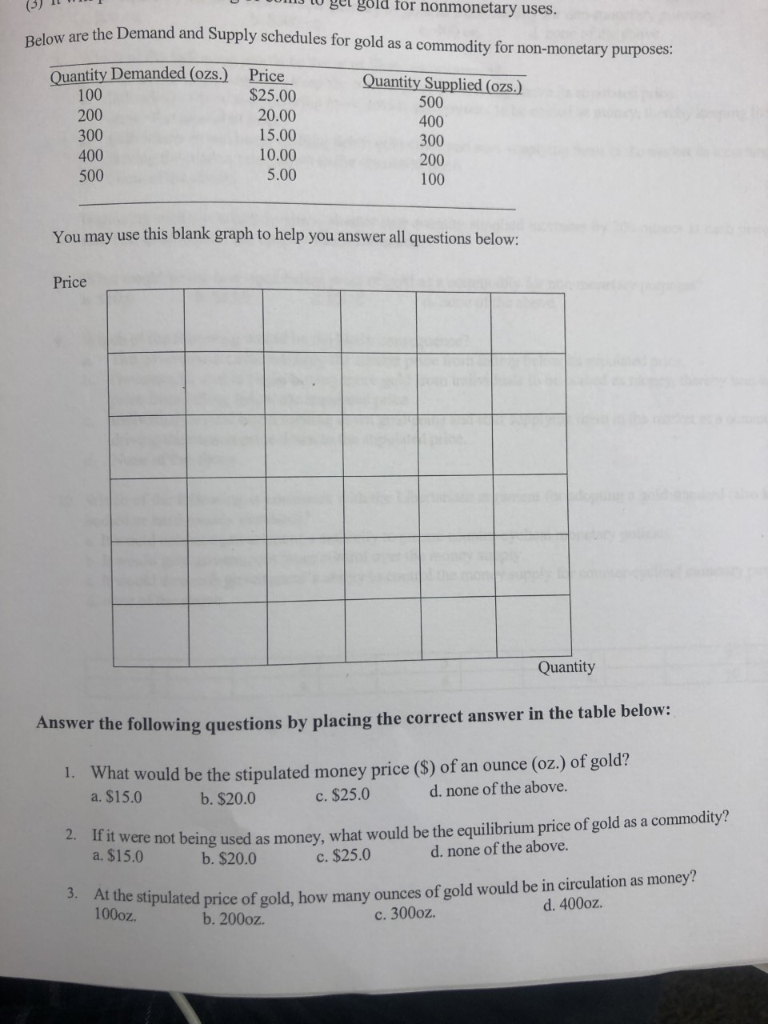

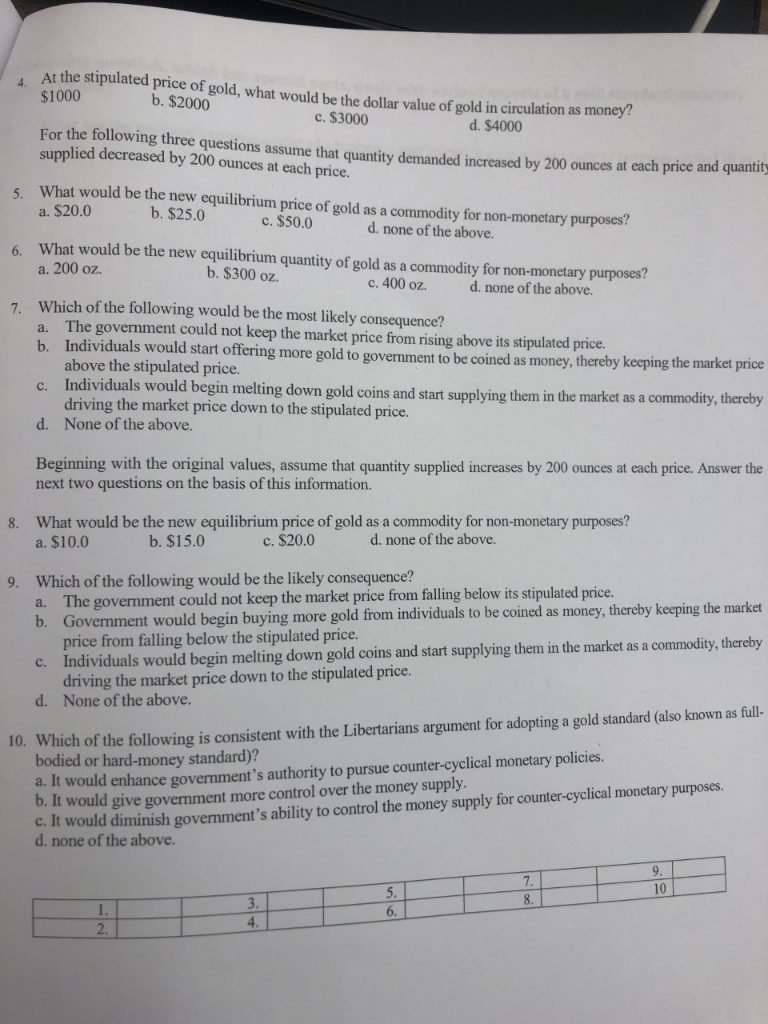

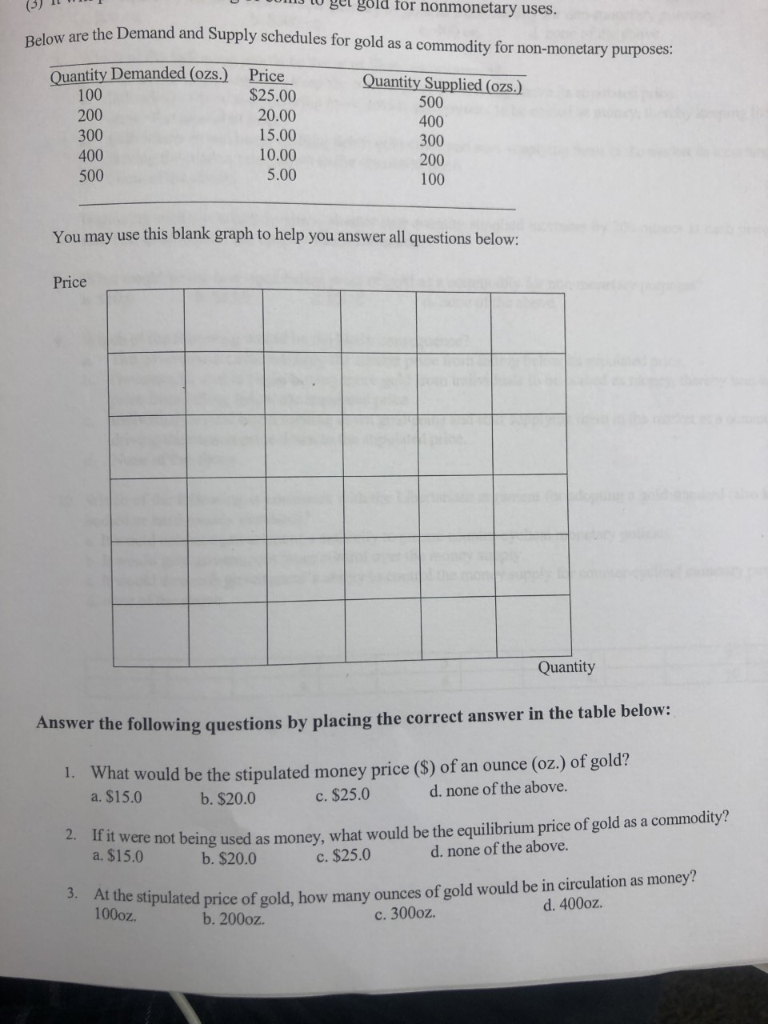

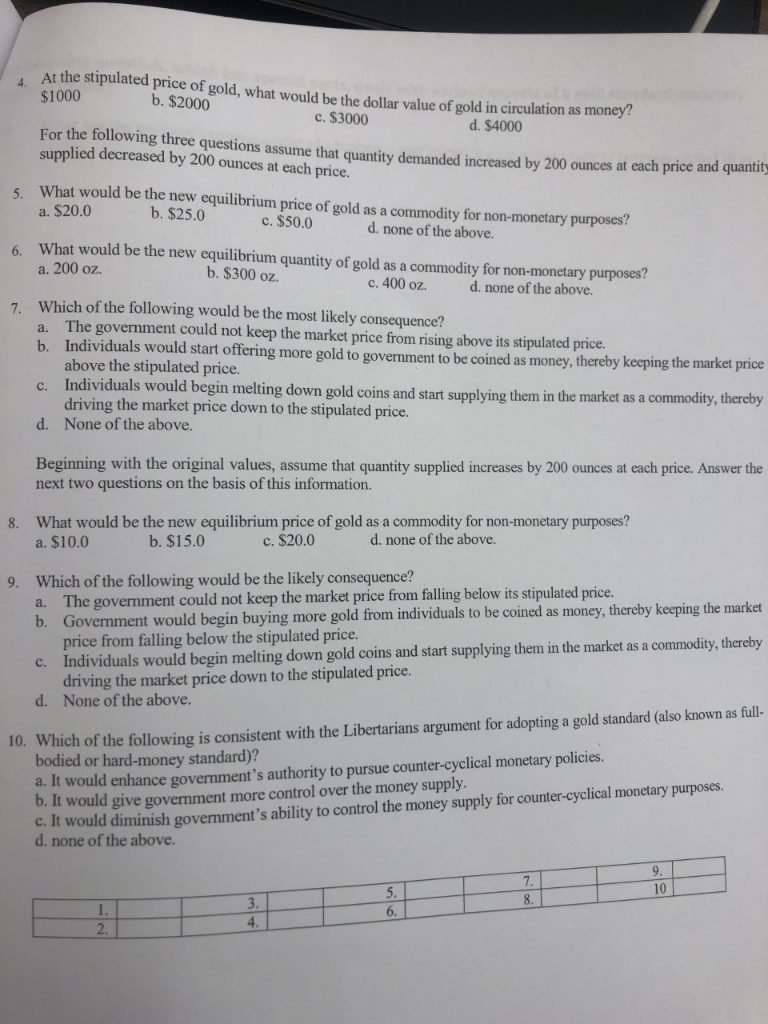

get gold for nonmonetary uses. Below are the Demand and Supply schedules for gold as a commodity for non-monetary puroses: Quantity Demanded (ozs.) 100 200 Price $25.00 Quantity Supplied (ozs.) 500 20.00 400 15.00 300 300 10.00 400 200 5.00 500 100 You may use this blank graph to help you answer all questions below Price Quantity Answer the following questions by placing the correct answer in the table below: What would be the stipulated money price ($) of an ounce (oz.) of gold? a. $15.0 1. d. none of the above. c. $25.0 b.$20.0 2If it were not being used as money, what would be the equilibrium price of gold as a commodity? a. $15.0 d. none of the above. c.$25.0 b. $20.0 3. At the stipulated price of gold, how many ounces of gold would be in circulation as money? 100oz d. 400oz. c. 300oz. b. 200oz At the stipulated price of gold, what would be the dollar value of gold in circulation as money 4 $1000 b. $2000 c. $3000 d. $4000 For the following three questions assume that quantity demanded increased by 200 ounces at each price and quantity supplied decreased by 200 ounces at each price. What would be the new equilibrium price of gold as a commodity for non-monetary purposes? a. $20.0 b. $25,0 c. $50.0 d. none of the above. What would be the new equilibrium quantity of gold as a commodity for non-monetary purposes? 6. a. 200 oz. b. $300 oz c. 400 oz. d. none of the above. Which of the following would be the most likely consequence? The government could not keep the market price from rising above its stipulated price. Individuals would start offering more gold to government to be coined as money, thereby keeping the market price above the stipulated price. Individuals would begin melting down gold coins and start supplying them in the market as a commodity, thereby driving the market price down to the stipulated price. 7 a C. None of the above. d. Beginning with the original values, assume that quantity supplied increases by 200 ounces at each price. Answer the next two questions on the basis of this information. What would be the new equilibrium price of gold as a commodity for non-monetary purposes? a. $10.0 d. none of the above. b. $15.0 c. $20.0 Which of the following would be the likely consequence? The government could not keep the market price from falling below its stipulated price. b. Government would begin buying more gold from individuals to be coined as money, thereby keeping the market price from falling below the stipulated price. Individuals would begin melting down gold coins and start supplying them in the market as a commodity, thereby driving the market price down to the stipulated price d. None of the above. 9 a 10. Which of the following is consistent with the Libertarians argument for adopting a gold standard (also known as full- bodied or hard-money standard)? a. It would enhance government's authority to pursue counter-cyclical monetary policies. D. It would give government more control over the money supply C. It would diminish government 's ability to control the money supply for counter-cyclical monetary purposes. d. none of the above. 7 10 5. 3. 1 6. 4 2 get gold for nonmonetary uses. Below are the Demand and Supply schedules for gold as a commodity for non-monetary puroses: Quantity Demanded (ozs.) 100 200 Price $25.00 Quantity Supplied (ozs.) 500 20.00 400 15.00 300 300 10.00 400 200 5.00 500 100 You may use this blank graph to help you answer all questions below Price Quantity Answer the following questions by placing the correct answer in the table below: What would be the stipulated money price ($) of an ounce (oz.) of gold? a. $15.0 1. d. none of the above. c. $25.0 b.$20.0 2If it were not being used as money, what would be the equilibrium price of gold as a commodity? a. $15.0 d. none of the above. c.$25.0 b. $20.0 3. At the stipulated price of gold, how many ounces of gold would be in circulation as money? 100oz d. 400oz. c. 300oz. b. 200oz At the stipulated price of gold, what would be the dollar value of gold in circulation as money 4 $1000 b. $2000 c. $3000 d. $4000 For the following three questions assume that quantity demanded increased by 200 ounces at each price and quantity supplied decreased by 200 ounces at each price. What would be the new equilibrium price of gold as a commodity for non-monetary purposes? a. $20.0 b. $25,0 c. $50.0 d. none of the above. What would be the new equilibrium quantity of gold as a commodity for non-monetary purposes? 6. a. 200 oz. b. $300 oz c. 400 oz. d. none of the above. Which of the following would be the most likely consequence? The government could not keep the market price from rising above its stipulated price. Individuals would start offering more gold to government to be coined as money, thereby keeping the market price above the stipulated price. Individuals would begin melting down gold coins and start supplying them in the market as a commodity, thereby driving the market price down to the stipulated price. 7 a C. None of the above. d. Beginning with the original values, assume that quantity supplied increases by 200 ounces at each price. Answer the next two questions on the basis of this information. What would be the new equilibrium price of gold as a commodity for non-monetary purposes? a. $10.0 d. none of the above. b. $15.0 c. $20.0 Which of the following would be the likely consequence? The government could not keep the market price from falling below its stipulated price. b. Government would begin buying more gold from individuals to be coined as money, thereby keeping the market price from falling below the stipulated price. Individuals would begin melting down gold coins and start supplying them in the market as a commodity, thereby driving the market price down to the stipulated price d. None of the above. 9 a 10. Which of the following is consistent with the Libertarians argument for adopting a gold standard (also known as full- bodied or hard-money standard)? a. It would enhance government's authority to pursue counter-cyclical monetary policies. D. It would give government more control over the money supply C. It would diminish government 's ability to control the money supply for counter-cyclical monetary purposes. d. none of the above. 7 10 5. 3. 1 6. 4 2