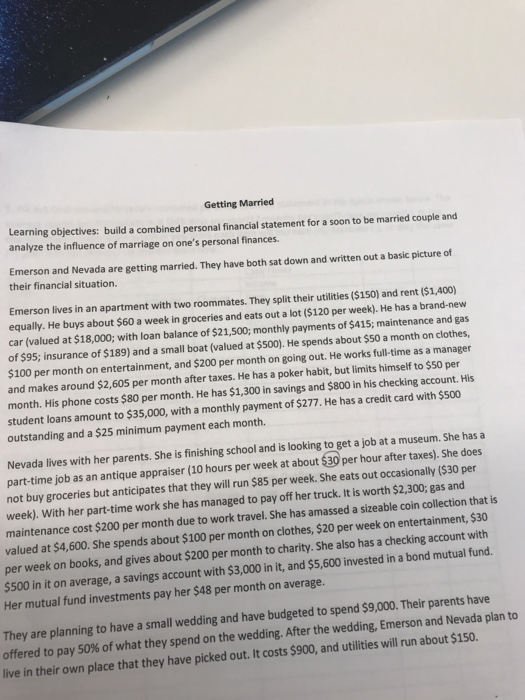

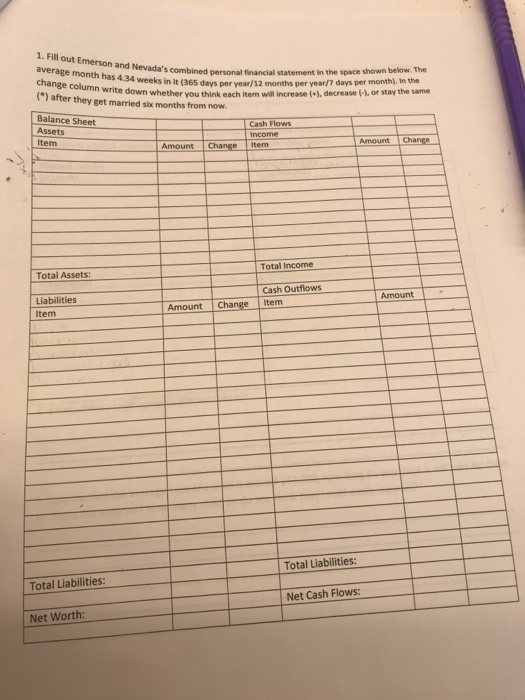

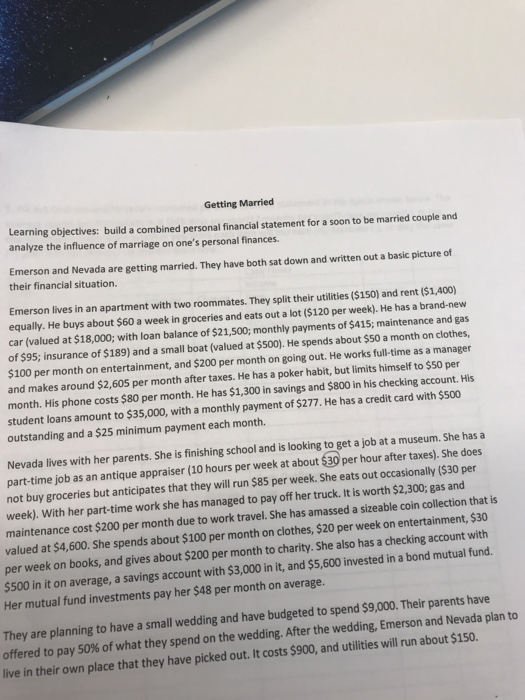

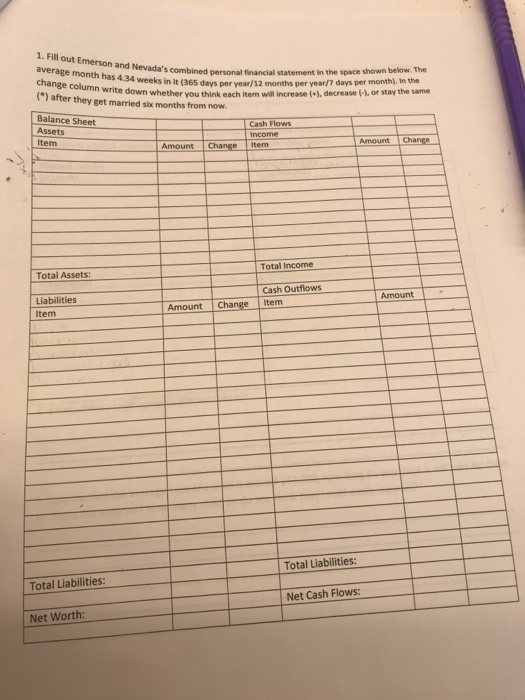

Getting Married Learning objectives: build a combined personal financial statement for a soon to be married couple and analyze the influence of marriage on one's personal finances. Emerson and Nevada are getting married. They have both sat down and written out a basic picture of their financial situation. Emerson lives in an apartment with two roommates. They split their utilities ($150) and rent ($1,400) equally. He buys about $60 a week in groceries and eats out a lot ($120 per week). He has a brand-new car (valued at $18,000; with loan balance of $21,500; monthly payments of $415; maintenance and gas of $95; insurance of $189) and a small boat (valued at $500). He spends about $50 a month on clothes, $100 per month on entertainment, and $200 per month on going out. He works full-time as a manager and makes around $2,605 per month after taxes. He has a poker habit, but limits himself to $50 per month. His phone costs $80 per month. He has $1,300 in savings and $800 in his checking account. His student loans amount to $35,000, with a monthly payment of $277. He has a credit card with $500 outstanding and a $25 minimum payment each month. Nevada lives with her parents. She is finishing school and is looking to get a job at a museum. She has a part-time job as an antique appraiser (10 hours per week at about $30 per hour after taxes). She does not buy groceries but anticipates that they will run $85 per week. She eats out occasionally ($30 per week). With her part-time work she has managed to pay off her truck. It is worth $2,300, gas and maintenance cost $200 per month due to work travel. She has amassed a sizeable coin collection that is valued at $4,600. She spends about $100 per month on clothes, $20 per week on entertainment, $30 per week on books, and gives about $200 per month to charity. She also has a checking account with $500 in it on average, a savings account with $3,000 in it, and $5,600 invested in a bond mutual fund. Her mutual fund investments pay her $48 per month on average. They are planning to have a small wedding and have budgeted to spend $9,000. Their parents have offered to pay 50% of what they spend on the wedding. After the wedding, Emerson and Nevada plan to live in their own place that they have picked out. It costs $900, and utilities will run about $150. 1. Fill out Emerson and Nevada's combin average month has 4.34 weeks in it (365 days per year change column write down whether you thin (*) after they get married six months from now. Balance Sheet evada's combined personal financial statement in the space shown below. The 54.34 weeks in it (365 days per year/12 months per year days per month). In the write down whether you think each item will increase (+), decrease (-), or stay the same Assets Cash Flows Income item Amount Change Total Income Total Assets: Cash Outflows Item Amount - Liabilities Item Amount Change Total Liabilities: Total Liabilities: Net Cash Flows: Net Worth: Getting Married Learning objectives: build a combined personal financial statement for a soon to be married couple and analyze the influence of marriage on one's personal finances. Emerson and Nevada are getting married. They have both sat down and written out a basic picture of their financial situation. Emerson lives in an apartment with two roommates. They split their utilities ($150) and rent ($1,400) equally. He buys about $60 a week in groceries and eats out a lot ($120 per week). He has a brand-new car (valued at $18,000; with loan balance of $21,500; monthly payments of $415; maintenance and gas of $95; insurance of $189) and a small boat (valued at $500). He spends about $50 a month on clothes, $100 per month on entertainment, and $200 per month on going out. He works full-time as a manager and makes around $2,605 per month after taxes. He has a poker habit, but limits himself to $50 per month. His phone costs $80 per month. He has $1,300 in savings and $800 in his checking account. His student loans amount to $35,000, with a monthly payment of $277. He has a credit card with $500 outstanding and a $25 minimum payment each month. Nevada lives with her parents. She is finishing school and is looking to get a job at a museum. She has a part-time job as an antique appraiser (10 hours per week at about $30 per hour after taxes). She does not buy groceries but anticipates that they will run $85 per week. She eats out occasionally ($30 per week). With her part-time work she has managed to pay off her truck. It is worth $2,300, gas and maintenance cost $200 per month due to work travel. She has amassed a sizeable coin collection that is valued at $4,600. She spends about $100 per month on clothes, $20 per week on entertainment, $30 per week on books, and gives about $200 per month to charity. She also has a checking account with $500 in it on average, a savings account with $3,000 in it, and $5,600 invested in a bond mutual fund. Her mutual fund investments pay her $48 per month on average. They are planning to have a small wedding and have budgeted to spend $9,000. Their parents have offered to pay 50% of what they spend on the wedding. After the wedding, Emerson and Nevada plan to live in their own place that they have picked out. It costs $900, and utilities will run about $150. 1. Fill out Emerson and Nevada's combin average month has 4.34 weeks in it (365 days per year change column write down whether you thin (*) after they get married six months from now. Balance Sheet evada's combined personal financial statement in the space shown below. The 54.34 weeks in it (365 days per year/12 months per year days per month). In the write down whether you think each item will increase (+), decrease (-), or stay the same Assets Cash Flows Income item Amount Change Total Income Total Assets: Cash Outflows Item Amount - Liabilities Item Amount Change Total Liabilities: Total Liabilities: Net Cash Flows: Net Worth