Question

GGG Bikes, a Canadian MNC, signed in Oct-19 an agreement to export bikes to the British cycling team INEOS. The agreement included two payments,

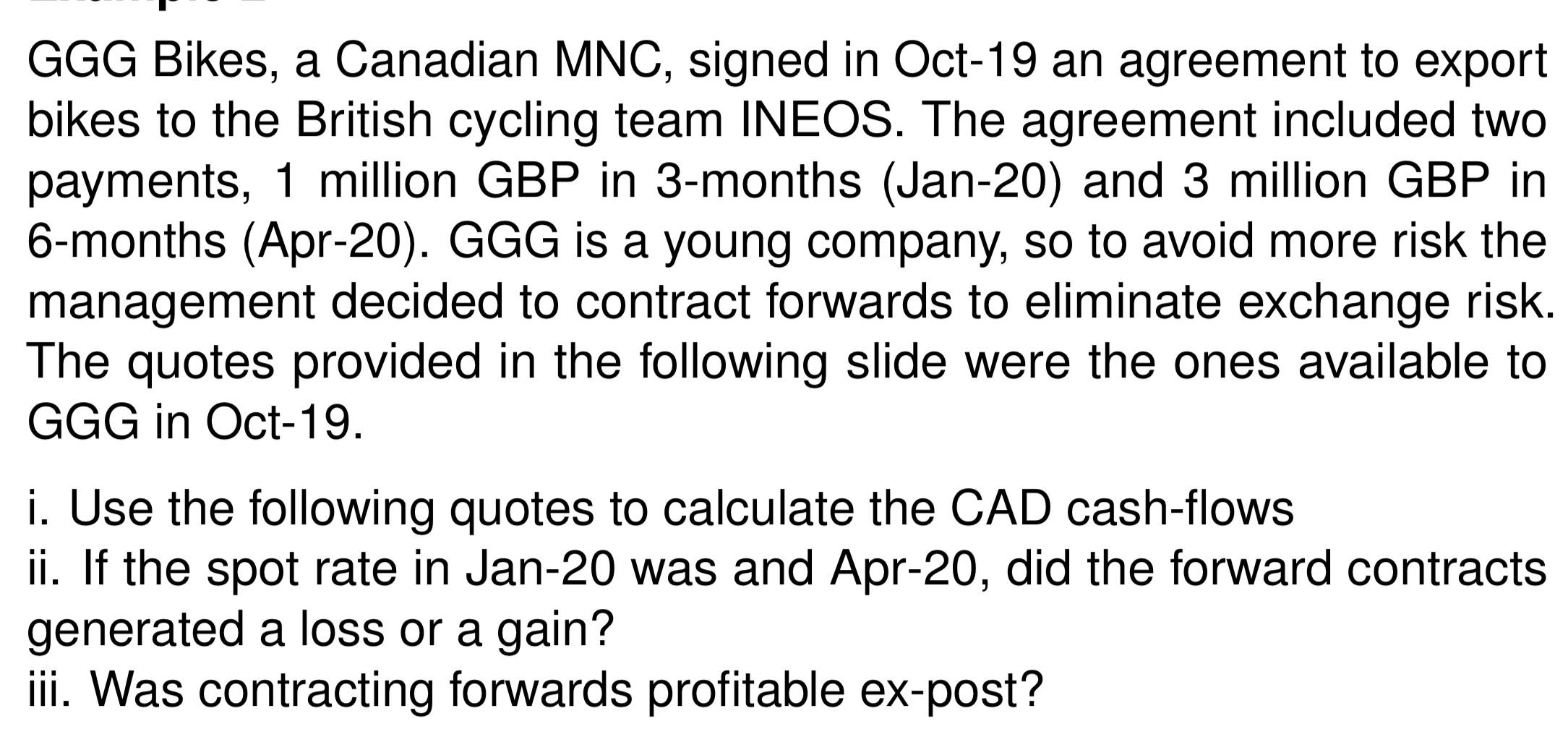

GGG Bikes, a Canadian MNC, signed in Oct-19 an agreement to export bikes to the British cycling team INEOS. The agreement included two payments, 1 million GBP in 3-months (Jan-20) and 3 million GBP in 6-months (Apr-20). GGG is a young company, so to avoid more risk the management decided to contract forwards to eliminate exchange risk. The quotes provided in the following slide were the ones available to GGG in Oct-19. i. Use the following quotes to calculate the CAD cash-flows ii. If the spot rate in Jan-20 was and Apr-20, did the forward contracts generated a loss or a gain? iii. Was contracting forwards profitable ex-post?

Step by Step Solution

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Solution i Use the following quotes to calculate the CAD cashflows Oct19 GBPCAD 17000 Jan20 GBPCAD 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics

Authors: Christopher T.S. Ragan, Richard G Lipsey

14th canadian Edition

321866347, 978-0321866349

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App