Answered step by step

Verified Expert Solution

Question

1 Approved Answer

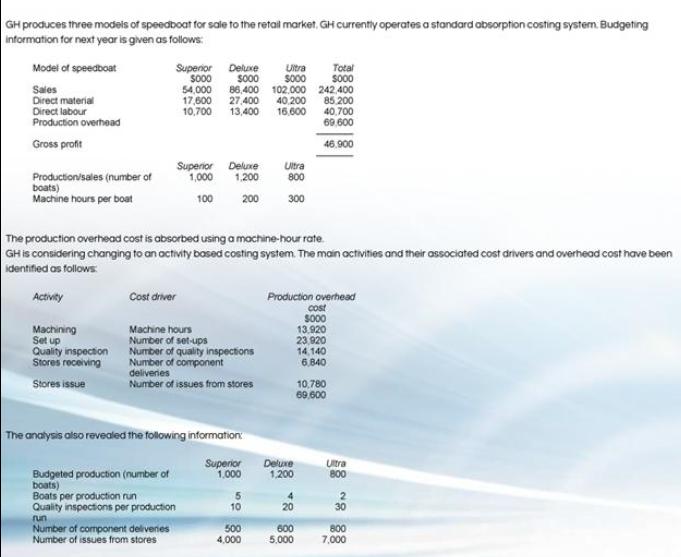

GH produces three models of speedboat for sale to the retail market, GH currently operates a standard absorption costing system: Budgeting information for next

GH produces three models of speedboat for sale to the retail market, GH currently operates a standard absorption costing system: Budgeting information for next year is given as follows: Model of speedboat Sales Direct material Direct labour Production overhead Gross profit Production/sales (number of boats) Machine hours per boat Machining Set up Superior Deluxe Ultra $000 $000 $000 54,000 86,400 102.000 242,400 Ty 17,600 27,400 40,200 85.200 10,700 13,400 16,600 40.700 Quality inspection Stores receiving Stores issue Superior 1,000 100 Cost driver Deluxe 1,200 200 Machine hours Number of set-ups Number of quality inspections Number of component deliveries Number of issues from stores Budgeted production (number of boats) Boats per production run Quality inspections per production run The production overhead cost is absorbed using a machine-hour rate. GH is considering changing to an activity based costing system. The main activities and their associated cost drivers and overhead cost have been identified as follows: Activity The analysis also revealed the following information: Superior 1,000 Number of component deliveries Number of issues from stores 5 10 Ultra 800 300 500 4,000 Deluxe 1,200 20 Total 600 5,000 $000 69.600 Production overhead cost $000 13.920 23,920 14,140 6,840 46.900 10,780 69,600 Ultra 800 30 800 7,000 The machines are set up for each production run of each model. What is the total cost attributed to the Superior speedboat for component deliveries using the proposed activity-based costing system?

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started