GHI Corp. prepares it financial statements in accordance with U.S.GAAP. Its inventory valuation method is LIFO. Assume all purchases and sales are on credit

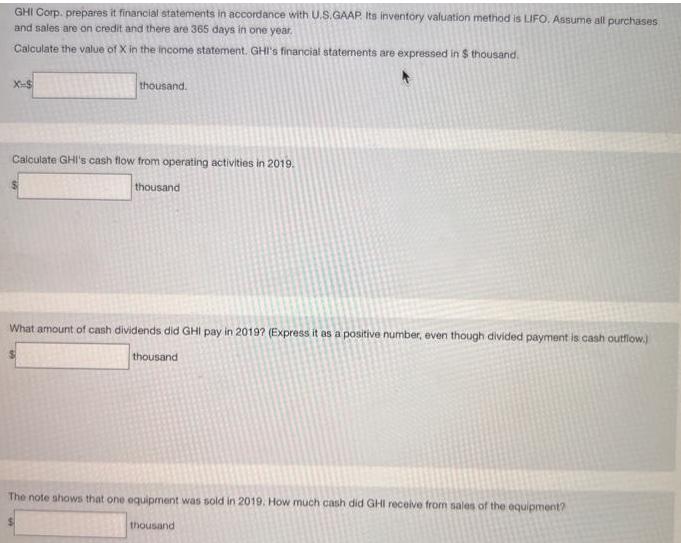

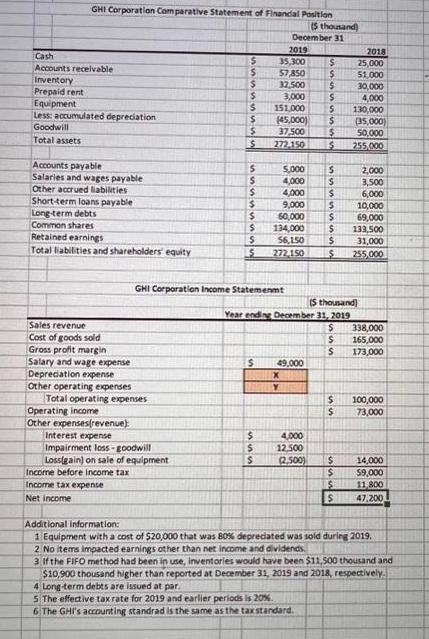

GHI Corp. prepares it financial statements in accordance with U.S.GAAP. Its inventory valuation method is LIFO. Assume all purchases and sales are on credit and there are 365 days in one year. Calculate the value of X in the income statement. GHI's financial statements are expressed in $ thousand. X-S thousand. Calculate GHI's cash flow from operating activities in 2019. thousand What amount of cash dividends did GHI pay in 2019? (Express it as a positive number, even though divided payment is cash outflow.) thousand The note shows that one equipment was sold in 2019. How much cash did GHI receive from sales of the equipment? thousand GHI Corporation Comparative Statement of Financial Position Cash Accounts receivable Inventory Prepaid rent Equipment Less: accumulated depreciation Goodwill Total assets Accounts payable Salaries and wages payable Other accrued liabilities Short-term loans payable Long-term debts Common shares Retained earnings Total liabilities and shareholders equity Sales revenue Cost of goods sold Gross profit margin Salary and wage expense Depreciation expense Other operating expenses Total operating expenses Operating income Other expenses(revenue) Interest expense Impairment loss-goodwill Loss(gain) on sale of equipment Income before income tax Income tax expense Net income $ $ $ S $ $ $ $ $ S $ $ $ $ S S S 4,000 $ 9,000 $ 60,000 $ 134,000 $ 56,150 $ $ 272,150 $ 255,000 GHI Corporation Income Statement $ S55 $ December 31 2019 35,300 $ 57,850 $ 32,500 $ 3,000 151,000 $ $ S (45,000) $ 37,500 $ 272.150 $ 5,000 4,000 (5 thousand) (5 thousand) Year ending December 31, 2019 49,000 X Y 4,000 12,500 (2,500) $ $ $ 6 The GHI's accounting standrad is the same as the tax standard. 55 2018 25,000 51,000 30,000 4,000 130,000 (35,000) 50,000 255,000 $ 2,000 3,500 6,000 10,000 69,000 $ $ $ $ 133,500 31,000 338,000 165,000 173,000 100,000 73,000 14,000 $9,000 11,800 47,200 Additional Information: 1 Equipment with a cost of $20,000 that was 80% depreciated was sold during 2019. 2 No items impacted earnings other than net income and dividends 3 If the FIFO method had been in use, inventories would have been $11,500 thousand and $10,900 thousand higher than reported at December 31, 2019 and 2018, respectively. 4 Long-term debts are issued at par 5 The effective tax rate for 2019 and earlier periods is 20%.

Step by Step Solution

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1Necessary Ledger accounts Accumulated Depreciation Equipmentsale 16000 Opening Balance 35000 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started