Answered step by step

Verified Expert Solution

Question

1 Approved Answer

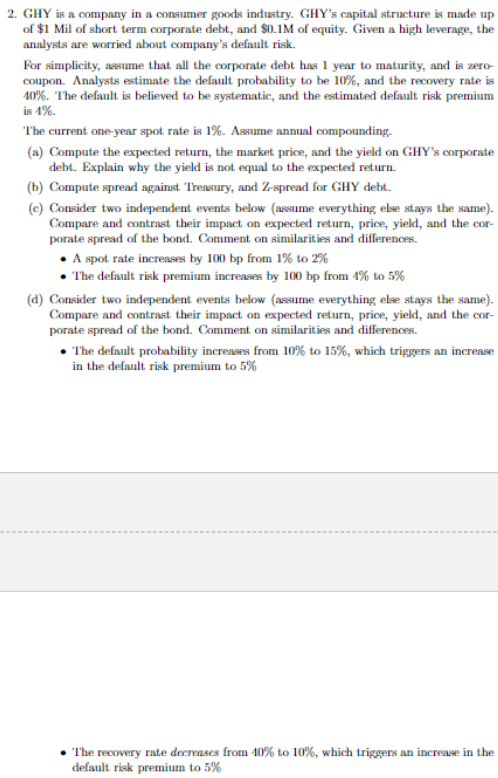

GHY is a company in a consumer goods industry. GHY ' s capital structure is made up of $ 1 Mil of short term corporate

GHY is a company in a consumer goods industry. GHYs capital structure is made up of $Mil of short term corporate debt, and $ of equity. Given a high leverage, the analysts are worried about company's default risk. For simplicity, assume that all the corporate debt has year to maturity, and is zerocoupon. Analysts estimate the default probability to be and the recovery rate is The default is believed to be systematic, and the estimated default risk premium is

The current oneyear spot rate is Assume annual compounding.

a Compute the expected return, the market price, and the yield on GHYs corporate

debt. Explain why the yield is not equal to the expected return.

b Compute spread apainst 'Tressury, and Zspread for GHY debt.

c Consider two independent events below asume everything else stays the sameCompare and contrast their impact on expected return, price, yield, and the corporate spread of the bond. Comment on similarities and differences.

A spot rate increases by bp from to

The default risk premium increases by from to

d Consider two independent events below assume everything else stays the sameCompare and contrast their impact on expected return, price, yield, and the corporate spread of the bond. Comment on similarities and differenoes.

The default probability increases from to which triggers an increase in the default risk premium to

The recovery rate decrenses from to which triggers an increase in the default risk premium to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started