Answered step by step

Verified Expert Solution

Question

1 Approved Answer

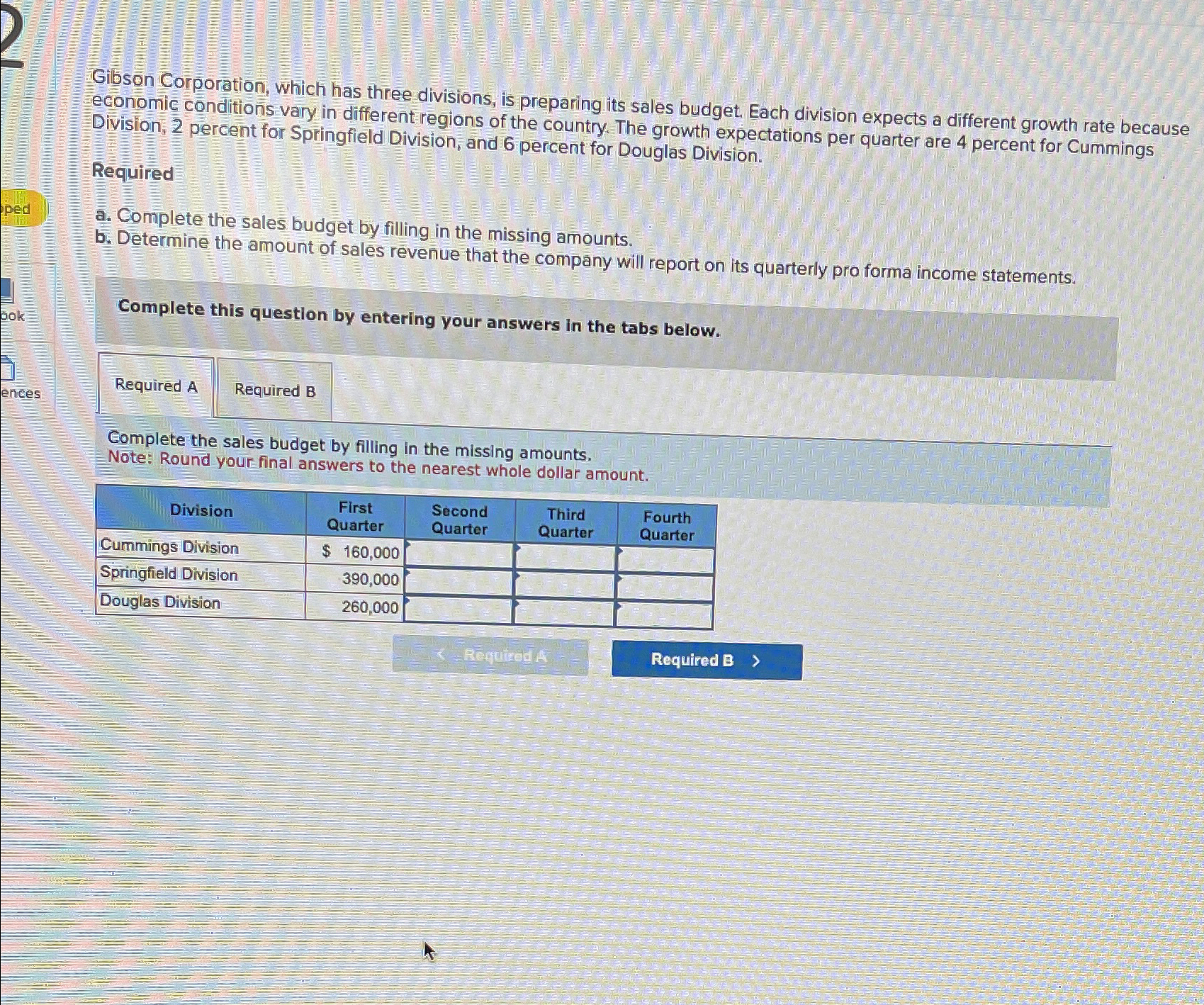

Gibson Corporation, which has three divisions, is preparing its sales budget. Each division expects a different growth rate because economic conditions vary in different regions

Gibson Corporation, which has three divisions, is preparing its sales budget. Each division expects a different growth rate because economic conditions vary in different regions of the country. The growth expectations per quarter are percent for Cummings Division, percent for Springfield Division, and percent for Douglas Division.

Required

a Complete the sales budget by filling in the missing amounts.

b Determine the amount of sales revenue that the company will report on its quarterly pro forma income statements.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Complete the sales budget by filling in the missing amounts.

Note: Round your final answers to the nearest whole dollar amount.

tableDivisiontableFirstQuartertableSecondQuartertableThirdQuartertableFourthQuarterCummings Division,$Springfield Division,Douglas Division,

Requiredia

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started