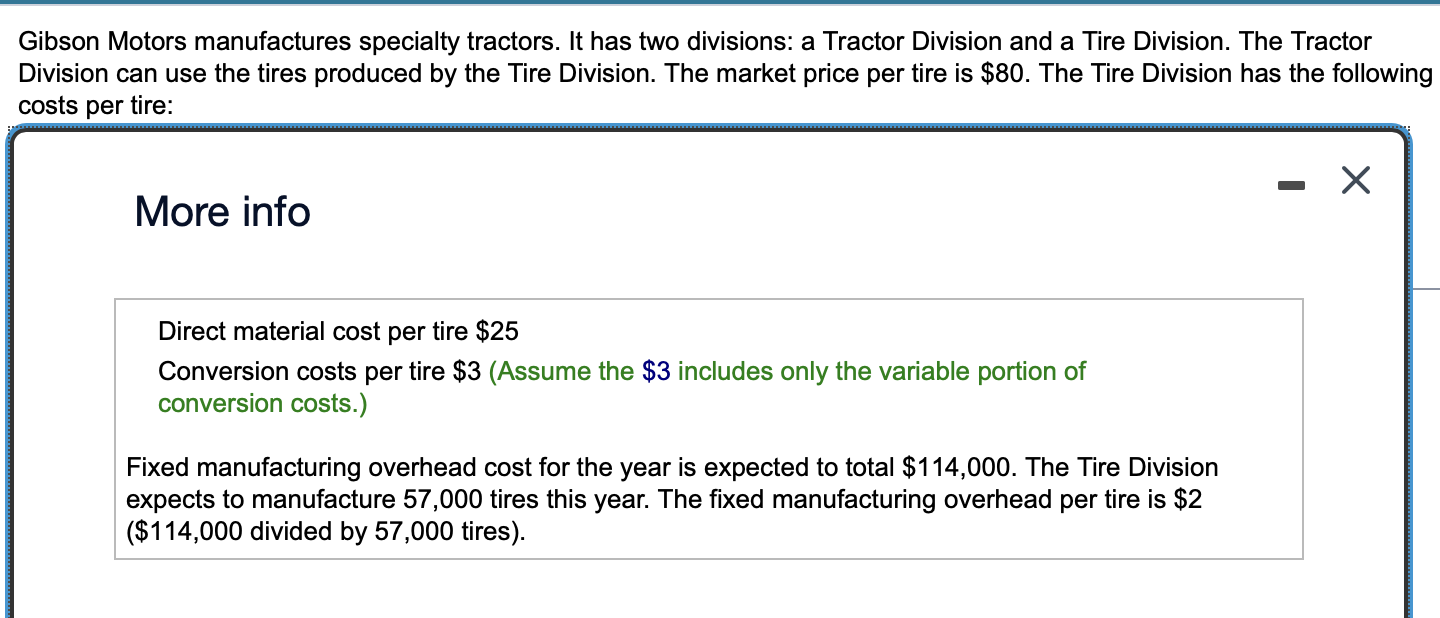

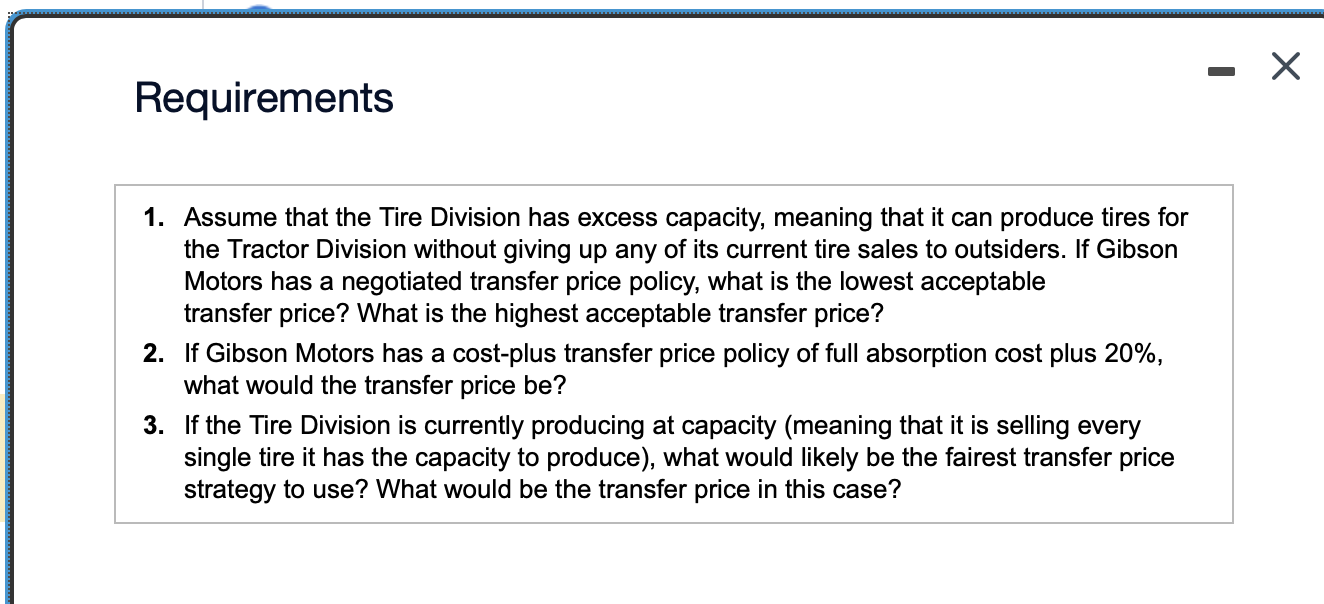

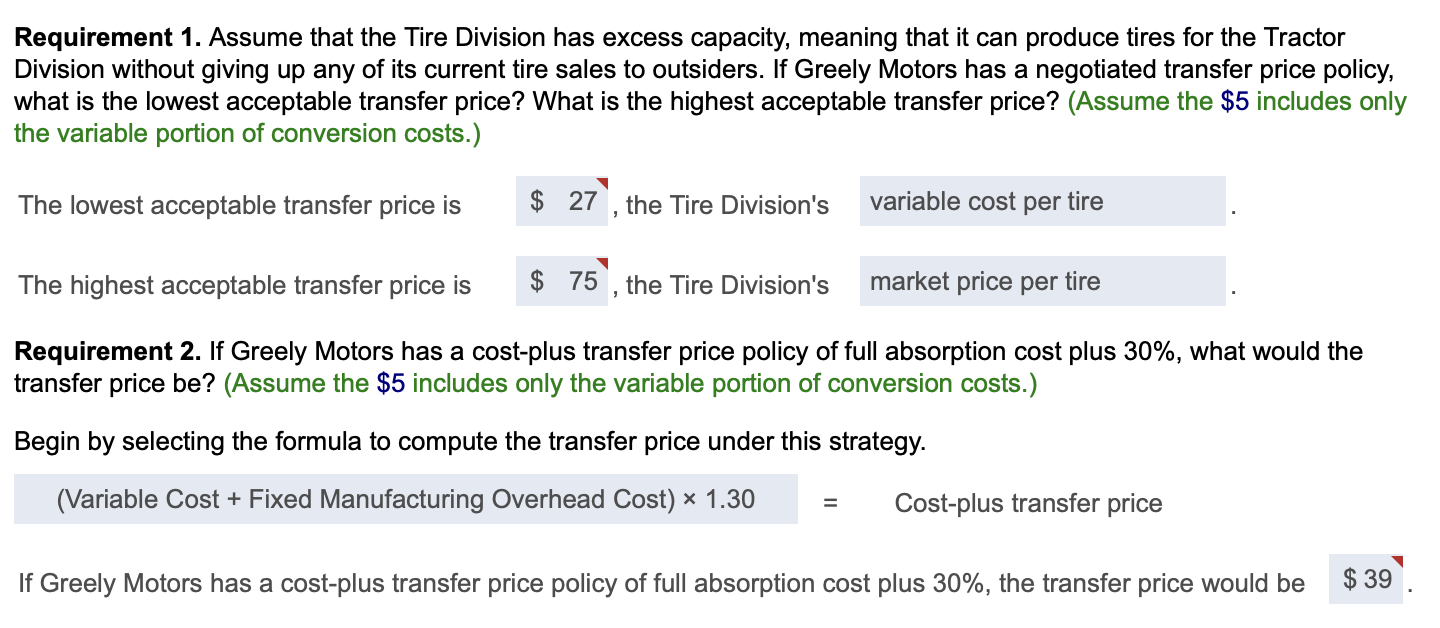

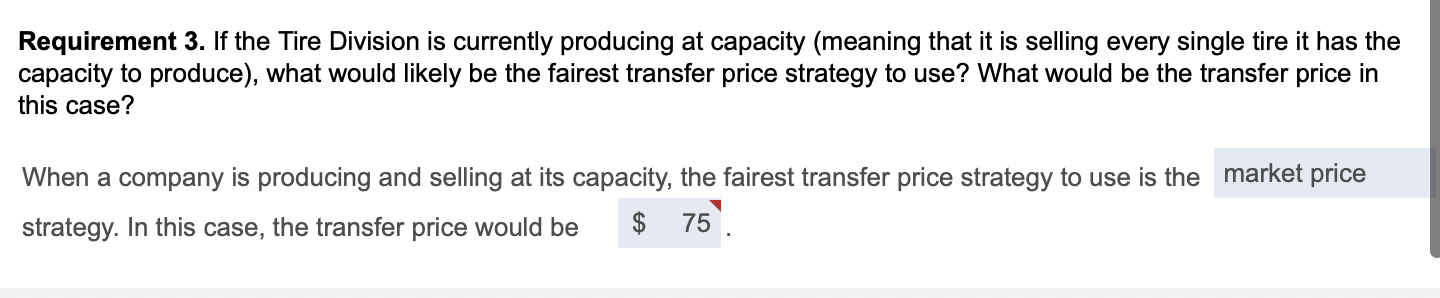

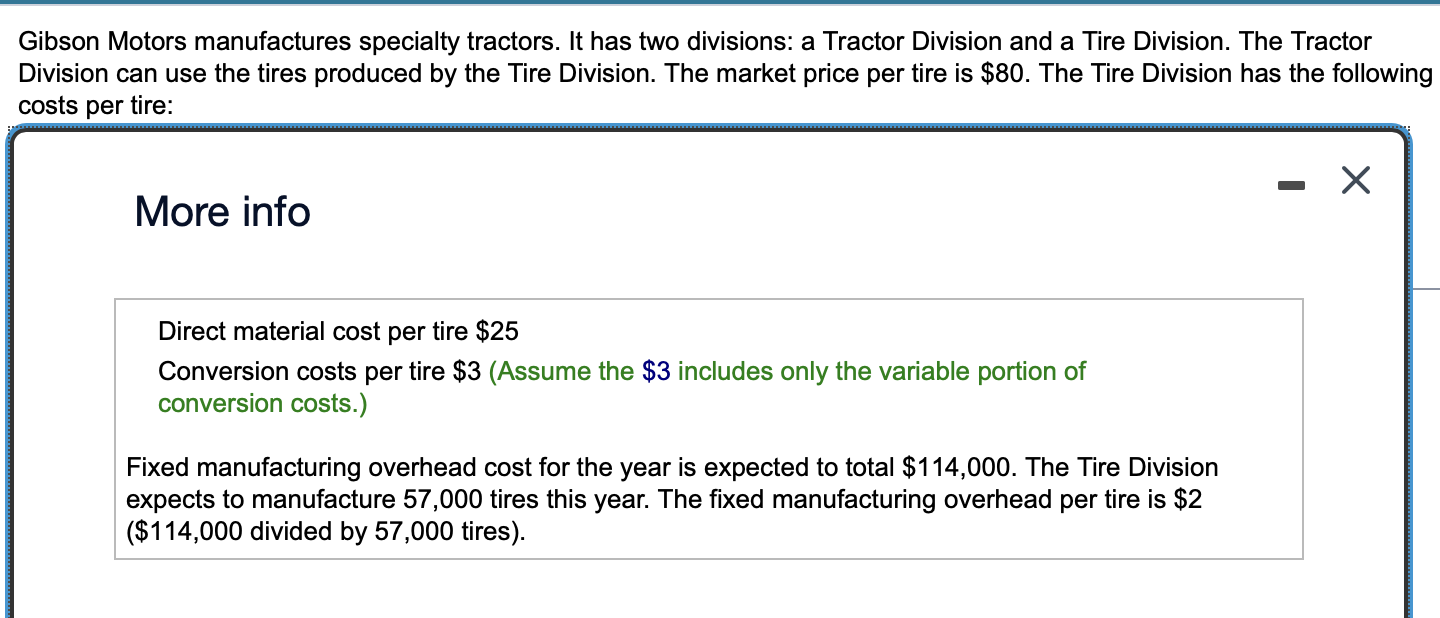

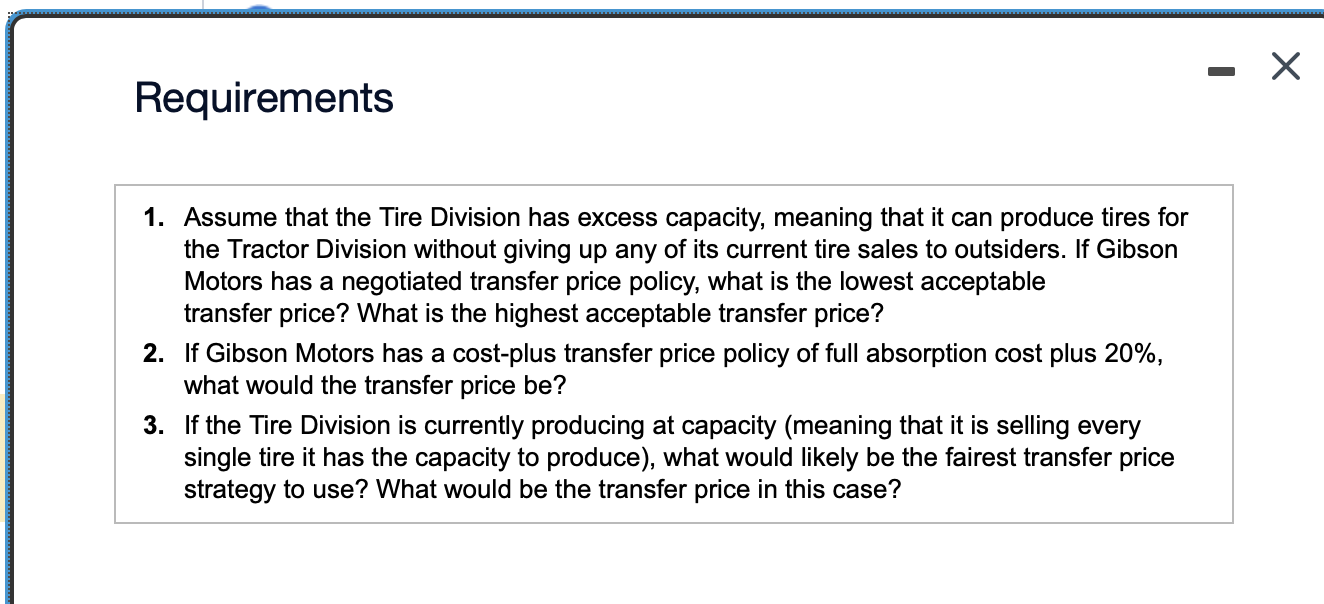

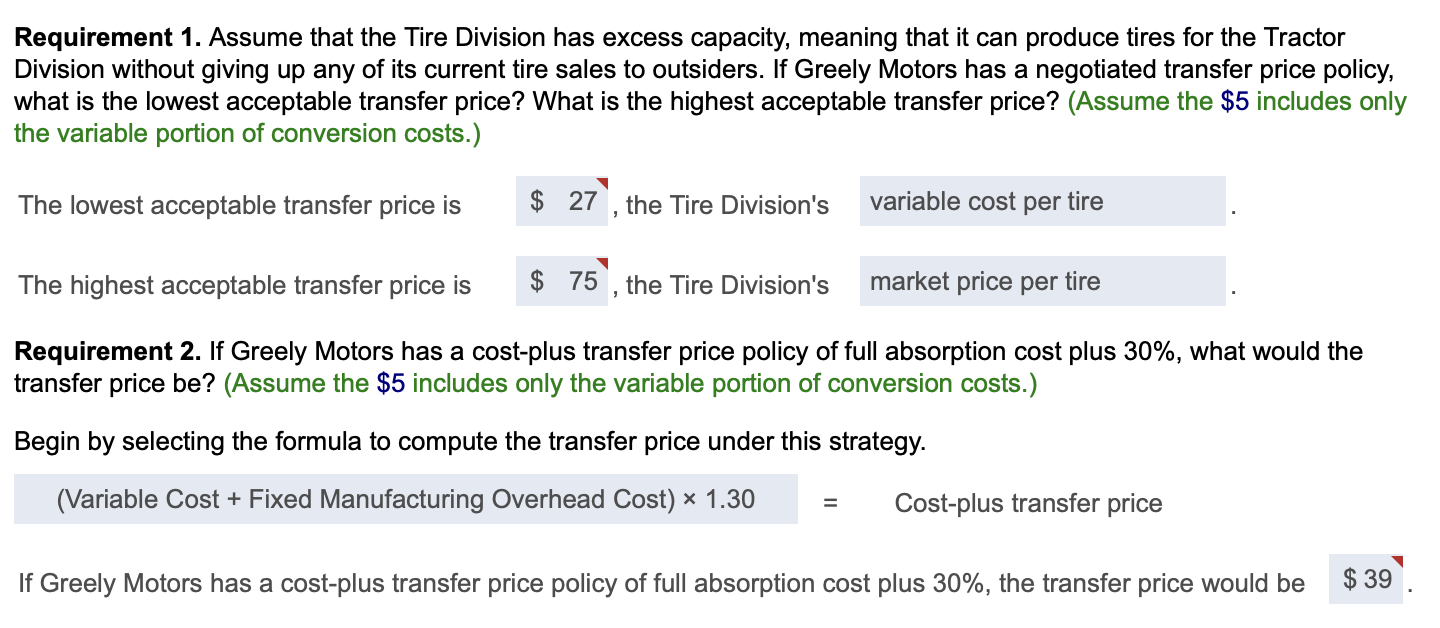

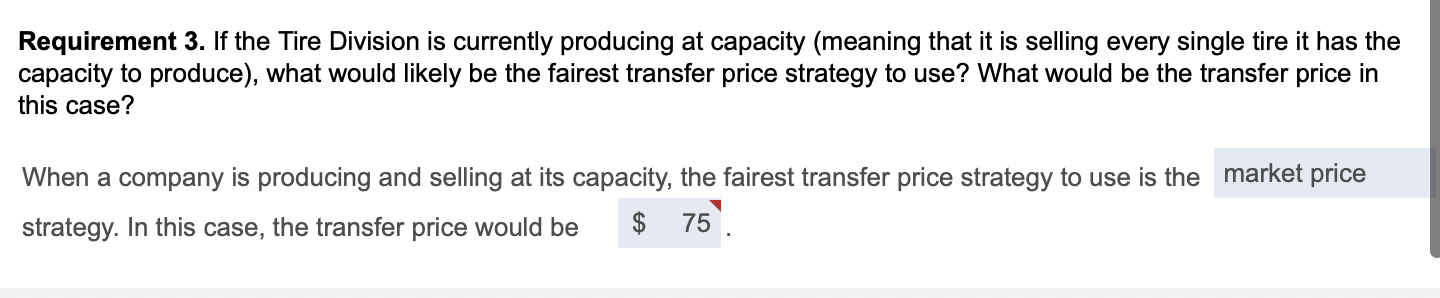

Gibson Motors manufactures specialty tractors. It has two divisions: a Tractor Division and a Tire Division. The Tractor Division can use the tires produced by the Tire Division. The market price per tire is $80. The Tire Division has the following osts per tire: More info Direct material cost per tire $25 Conversion costs per tire $3 (Assume the $3 includes only the variable portion of conversion costs.) Fixed manufacturing overhead cost for the year is expected to total $114,000. The Tire Division expects to manufacture 57,000 tires this year. The fixed manufacturing overhead per tire is $2 (\$114,000 divided by 57,000 tires). Requirements 1. Assume that the Tire Division has excess capacity, meaning that it can produce tires for the Tractor Division without giving up any of its current tire sales to outsiders. If Gibson Motors has a negotiated transfer price policy, what is the lowest acceptable transfer price? What is the highest acceptable transfer price? 2. If Gibson Motors has a cost-plus transfer price policy of full absorption cost plus 20%, what would the transfer price be? 3. If the Tire Division is currently producing at capacity (meaning that it is selling every single tire it has the capacity to produce), what would likely be the fairest transfer price strategy to use? What would be the transfer price in this case? Requirement 1. Assume that the Tire Division has excess capacity, meaning that it can produce tires for the Tractor Division without giving up any of its current tire sales to outsiders. If Greely Motors has a negotiated transfer price policy, what is the lowest acceptable transfer price? What is the highest acceptable transfer price? (Assume the $5 includes only the variable portion of conversion costs.) The lowest acceptable transfer price is , the Tire Division's The highest acceptable transfer price is , the Tire Division's Requirement 2. If Greely Motors has a cost-plus transfer price policy of full absorption cost plus 30%, what would the transfer price be? (Assume the $5 includes only the variable portion of conversion costs.) Begin by selecting the formula to compute the transfer price under this strategy. = If Greely Motors has a cost-plus transfer price policy of full absorption cost plus 30%, the transfer price would be Requirement 3 . If the Tire Division is currently producing at capacity (meaning that it is selling every single tire it has the capacity to produce), what would likely be the fairest transfer price strategy to use? What would be the transfer price in this case? When a company is producing and selling at its capacity, the fairest transfer price strategy to use is the strategy. In this case, the transfer price would be