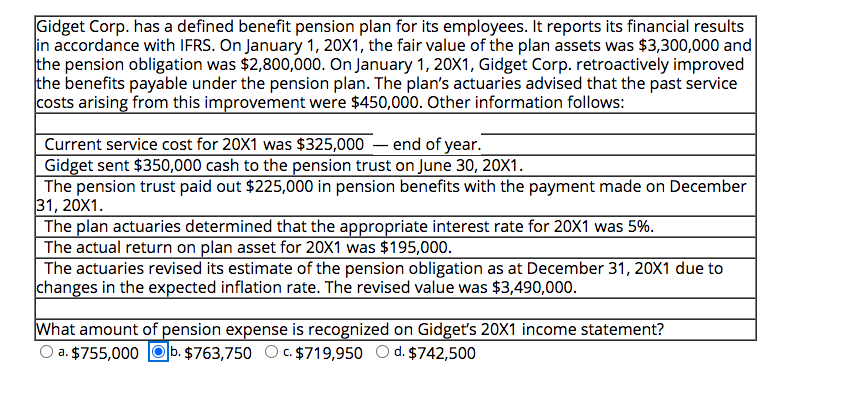

Question

Gidget Corp. has a defined benefit pension plan for its employees. It reports its financial results in accordance with IFRS. On January 1, 20X1, the

Gidget Corp. has a defined benefit pension plan for its employees. It reports its financial results in accordance with IFRS. On January 1, 20X1, the fair value of the plan assets was $3,300,000 and the pension obligation was $2,800,000. On January 1, 20X1, Gidget Corp. retroactively improved the benefits payable under the pension plan. The plan's actuaries advised that the past service costs arising from this improvement were $450,000. Other information follows: Current service cost for 20X1 was $325,000 - end of year. Gidget sent $350,000 cash to the pension trust on June 30, 20X1. The pension trust paid out $225,000 in pension benefits with the payment made on December 31, 20X1. The plan actuaries determined that the appropriate interest rate for 20X1 was 5%. The actual return on plan asset for 20X1 was $195,000. The actuaries revised its estimate of the pension obligation as at December 31, 20X1 due to changes in the expected inflation rate. The revised value was $3,490,000. What amount of pension expense is recognized on Gidget's 20X1 income statement? a. $755,000 b. $763,750 c. $719,950 d. $742,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started