Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gifts to charities receive a credit of 15% on the first $200 and 29% on the remainder to the extent the individual's income does

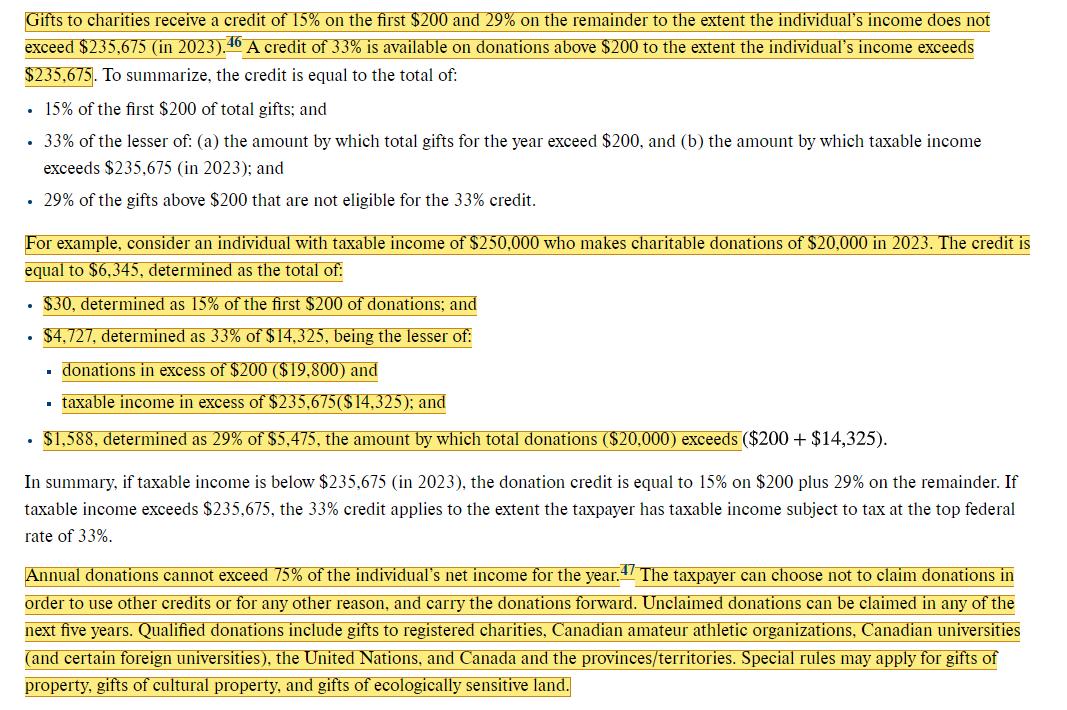

Gifts to charities receive a credit of 15% on the first $200 and 29% on the remainder to the extent the individual's income does not exceed $235,675 (in 2023).46 A credit of 33% is available on donations above $200 to the extent the individual's income exceeds $235,675. To summarize, the credit is equal to the total of: . 15% of the first $200 of total gifts; and . 33% of the lesser of: (a) the amount by which total gifts for the year exceed $200, and (b) the amount by which taxable income exceeds $235,675 (in 2023); and 29% of the gifts above $200 that are not eligible for the 33% credit. For example, consider an individual with taxable income of $250,000 who makes charitable donations of $20,000 in 2023. The credit is equal to $6,345, determined as the total of: $30, determined as 15% of the first $200 of donations; and $4,727, determined as 33% of $14,325, being the lesser of: donations in excess of $200 ($19,800) and taxable income in excess of $235,675 ($14,325); and $1,588, determined as 29% of $5,475, the amount by which total donations ($20,000) exceeds ($200 + $14,325). In summary, if taxable income is below $235,675 (in 2023), the donation credit is equal to 15% on $200 plus 29% on the remainder. If taxable income exceeds $235,675, the 33% credit applies to the extent the taxpayer has taxable income subject to tax at the top federal rate of 33%. Annual donations cannot exceed 75% of the individual's net income for the year. 47 The taxpayer can choose not to claim donations in order to use other credits or for any other reason, and carry the donations forward. Unclaimed donations can be claimed in any of the next five years. Qualified donations include gifts to registered charities, Canadian amateur athletic organizations, Canadian universities (and certain foreign universities), the United Nations, and Canada and the provinces/territories. Special rules may apply for gifts of property, gifts of cultural property, and gifts of ecologically sensitive land.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer This passage explains the Canadian charitable donation tax credit system in detail Heres a br...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started