Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gilbert owns 255 shares of Pine Corporation common stock, purchased during the prior year: 125 shares on July 5, for $22,000; and 130 shares

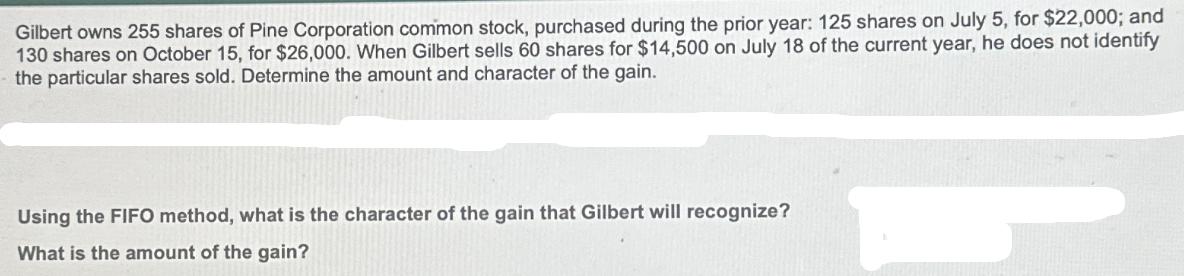

Gilbert owns 255 shares of Pine Corporation common stock, purchased during the prior year: 125 shares on July 5, for $22,000; and 130 shares on October 15, for $26,000. When Gilbert sells 60 shares for $14,500 on July 18 of the current year, he does not identify the particular shares sold. Determine the amount and character of the gain. Using the FIFO method, what is the character of the gain that Gilbert will recognize? What is the amount of the gain?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Determining Character and Amount of Gain using FIFO 1 Identify the cost basis of the 60 shares sold ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d6fe0009e1_967019.pdf

180 KBs PDF File

663d6fe0009e1_967019.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started