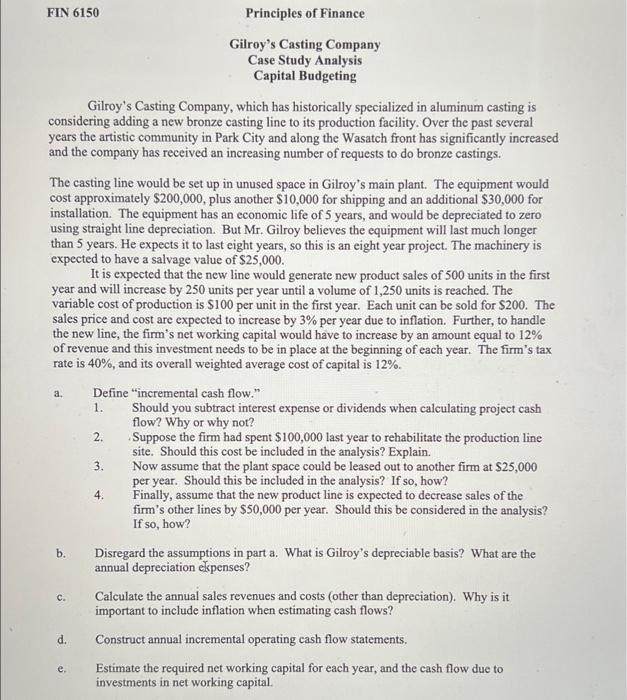

Gilroy's Casting Company Case Study Analysis Capital Budgeting Gilroy's Casting Company, which has historically specialized in aluminum casting is considering adding a new bronze casting line to its production facility. Over the past several years the artistic community in Park City and along the Wasatch front has significantly increased and the company has received an increasing number of requests to do bronze castings. The casting line would be set up in unused space in Gilroy's main plant. The equipment would cost approximately $200,000, plus another $10,000 for shipping and an additional $30,000 for installation. The equipment has an economic life of 5 years, and would be depreciated to zero using straight line depreciation. But Mr. Gilroy believes the equipment will last much longer than 5 years. He expects it to last eight years, so this is an eight year project. The machinery is expected to have a salvage value of $25,000. It is expected that the new line would generate new product sales of 500 units in the first year and will increase by 250 units per year until a volume of 1,250 units is reached. The variable cost of production is $100 per unit in the first year. Each unit can be sold for $200. The sales price and cost are expected to increase by 3% per year due to inflation. Further, to handle the new line, the firm's net working capital would have to increase by an amount equal to 12% of revenue and this investment needs to be in place at the beginning of each year. The firm's tax rate is 40%, and its overall weighted average cost of capital is 12%. a. Define "incremental cash flow." 1. Should you subtract interest expense or dividends when calculating project cash flow? Why or why not? 2. Suppose the firm had spent $100,000 last year to rehabilitate the production line site. Should this cost be included in the analysis? Explain. 3. Now assume that the plant space could be leased out to another firm at $25,000 per year. Should this be included in the analysis? If so, how? 4. Finally, assume that the new product line is expected to decrease sales of the firm's other lines by $50,000 per year. Should this be considered in the analysis? If so, how? b. Disregard the assumptions in part a. What is Gilroy's depreciable basis? What are the annual depreciation kpenses? c. Calculate the annual sales revenues and costs (other than depreciation). Why is it important to include inflation when estimating cash flows? d. Construct annual incremental operating cash flow statements. e. Estimate the required net working capital for each year, and the cash flow due to investments in net working capital