Question

Gina purchased an annuity contract at a cost of $240,000. She will receive a benefit of $20,000 every year (on her birthday) for the

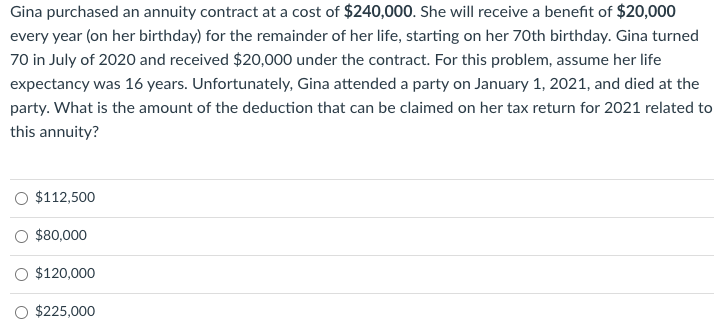

Gina purchased an annuity contract at a cost of $240,000. She will receive a benefit of $20,000 every year (on her birthday) for the remainder of her life, starting on her 70th birthday. Gina turned 70 in July of 2020 and received $20,000 under the contract. For this problem, assume her life expectancy was 16 years. Unfortunately, Gina attended a party on January 1, 2021, and died at the party. What is the amount of the deduction that can be claimed on her tax return for 2021 related to this annuity? O $112,500 O $80,000 $120,000 O $225,000

Step by Step Solution

3.58 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

nnuity Conract east 24 0000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting And Analysis Using Financial Accounting Information

Authors: Charles H Gibson

12th Edition

1439080607, 978-1439080603

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App