Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Giovani operates his golf shop on a cash basis. On December 20, XX02 Giovani shipped and invoiced Pro Golf 50 cases of personalized golf

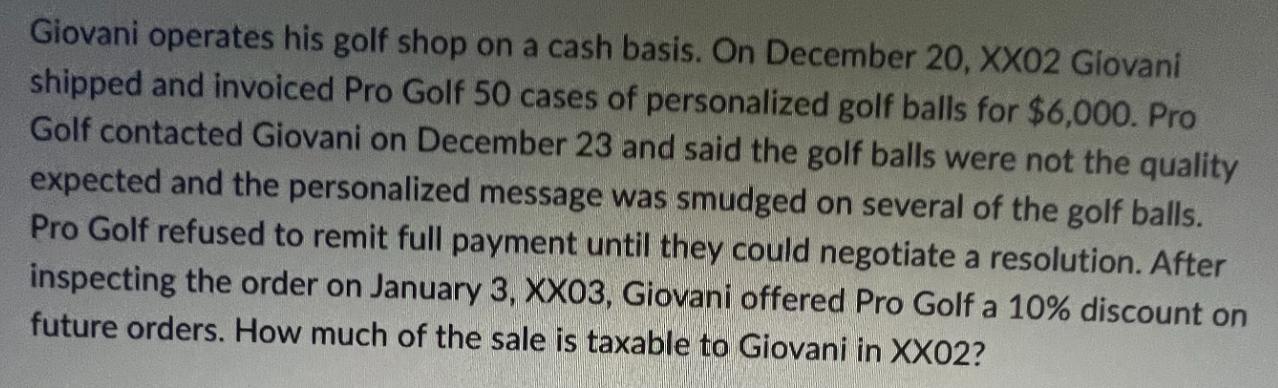

Giovani operates his golf shop on a cash basis. On December 20, XX02 Giovani shipped and invoiced Pro Golf 50 cases of personalized golf balls for $6,000. Pro Golf contacted Giovani on December 23 and said the golf balls were not the quality expected and the personalized message was smudged on several of the golf balls. Pro Golf refused to remit full payment until they could negotiate a resolution. After inspecting the order on January 3, XX03, Giovani offered Pro Golf a 10% discount on future orders. How much of the sale is taxable to Giovani in XX02?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

In this scenario Giovani operates his golf shop on a cash basis which means he recognizes i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started