Giroud plc is considering two alternative investment opportunities. Each of the two projects has an expected life of five years and requires an initial

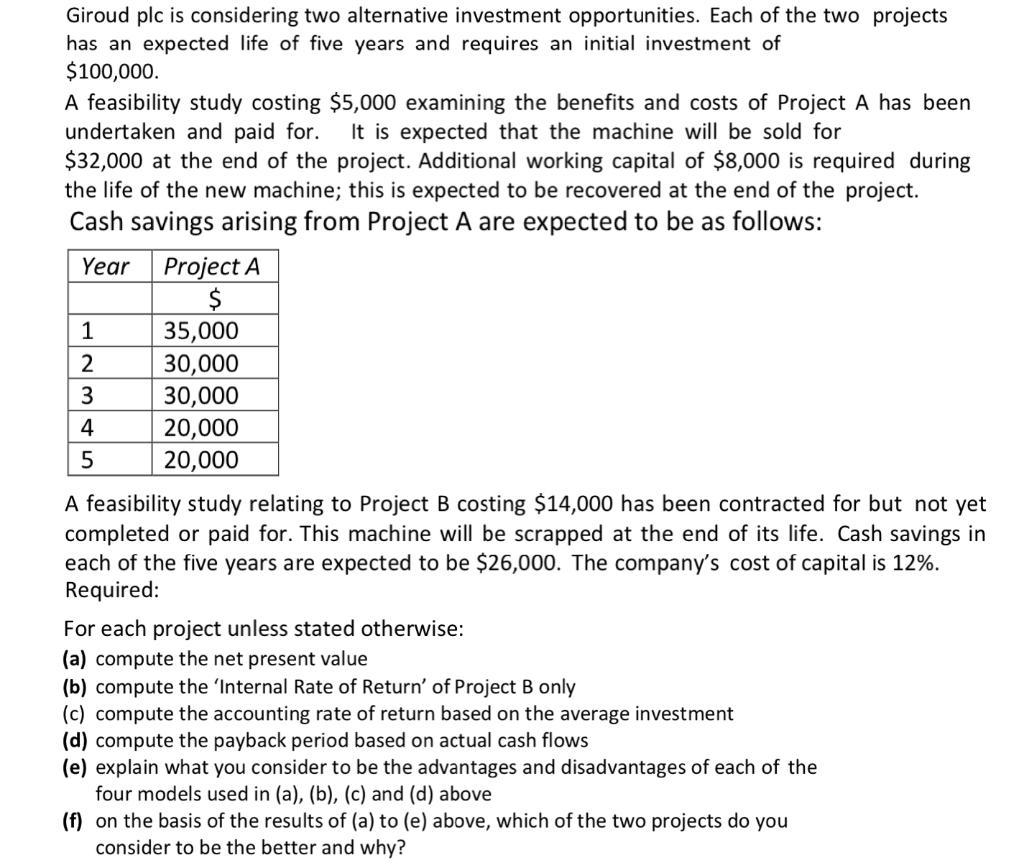

Giroud plc is considering two alternative investment opportunities. Each of the two projects has an expected life of five years and requires an initial investment of $100,000. A feasibility study costing $5,000 examining the benefits and costs of Project A has been undertaken and paid for. It is expected that the machine will be sold for $32,000 at the end of the project. Additional working capital of $8,000 is required during the life of the new machine; this is expected to be recovered at the end of the project. Cash savings arising from Project A are expected to be as follows: Year Project A $ 35,000 30,000 30,000 20,000 20,000 1 2 3 4 5 A feasibility study relating to Project B costing $14,000 has been contracted for but not yet completed or paid for. This machine will be scrapped at the end of its life. Cash savings in each of the five years are expected to be $26,000. The company's cost of capital is 12%. Required: For each project unless stated otherwise: (a) compute the net present value (b) compute the 'Internal Rate of Return' of Project B only (c) compute the accounting rate of return based on the average investment (d) compute the payback period based on actual cash flows (e) explain what you consider to be the advantages and disadvantages of each of the four models used in (a), (b), (c) and (d) above (f) on the basis of the results of (a) to (e) above, which of the two projects do you consider to be the better and why?

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the investment opportunities lets calculate the required metrics for each project a Net Present Value NPV The NPV is calculated by discounting the cash flows of each period to their present ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started