Answered step by step

Verified Expert Solution

Question

1 Approved Answer

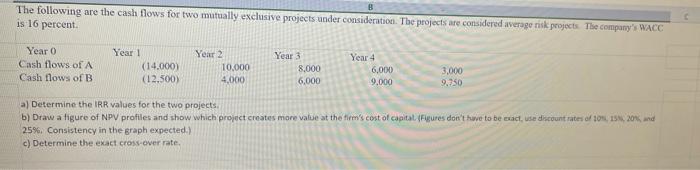

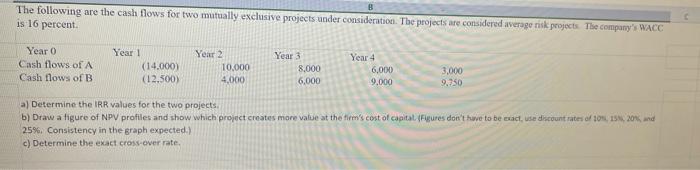

give all answers correctly The following are the cash flows for two mutually exclusive projects under consideration. The projects are considered average risk projects. The

give all answers correctly

The following are the cash flows for two mutually exclusive projects under consideration. The projects are considered average risk projects. The company's WACC is 16 percent Year 0 Year 1 Year 2 Year 3 Year 4 Cash flows of A (14.000) 10.000 8,000 6,000 3,000 Cash flows of B (12.500) 4,000 6,000 9,000 9.750 a) Determine the IRR values for the two projects b) Draw a figure of NPV profiles and show which project creates more value at the firm's cost of capital (Figures don't have to be exact, use discount rates of 10, 15, 20%, and 25%. Consistency in the graph expected.) c) Determine the exact cross-over rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started