Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Give answers in detail most tax-effective way. 20.4 Tom runs a small retail business selling men's clothing in the suburb of Glen Waverley, Melbourne. The

Give answers in detail

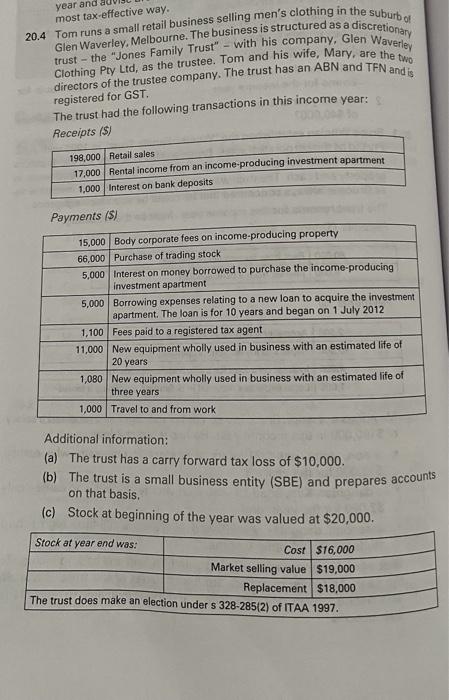

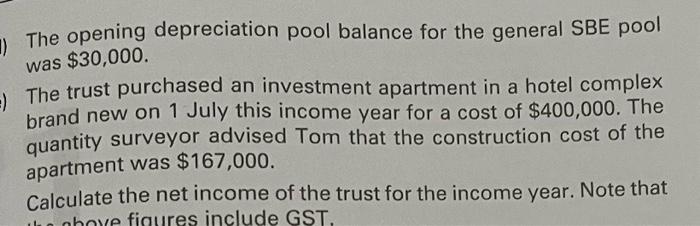

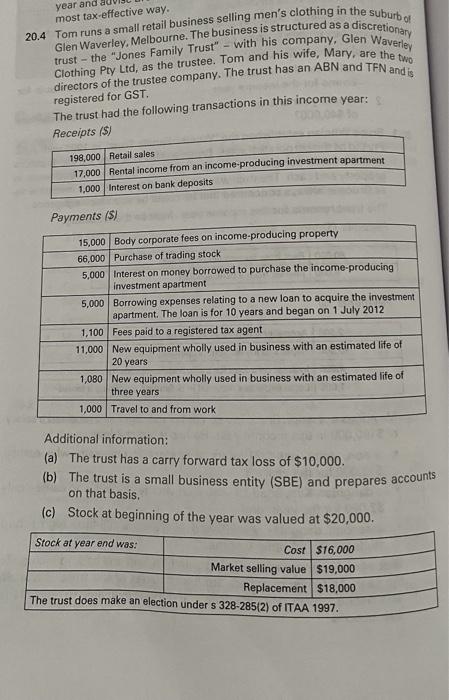

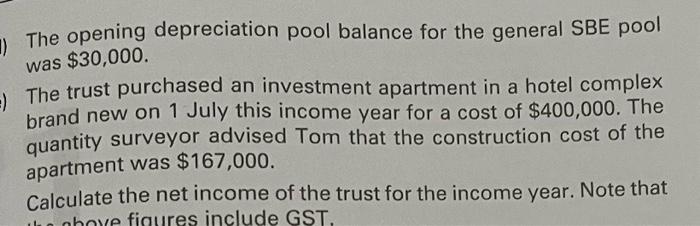

most tax-effective way. 20.4 Tom runs a small retail business selling men's clothing in the suburb of Glen Waverley, Melbourne. The business is structured as a discretionary trust - the "Jones Family Trust" - with his company, Glen Waverley Clothing Pty Ltd, as the trustee. Tom and his wife, Mary, are the two directors of the trustee company. The trust has an ABN and TFN and is registered for GST. The trust had the following transactions in this income year: Receipts (\$) Payments (\$) Additional information: (a) The trust has a carry forward tax loss of $10,000. (b) The trust is a small business entity (SBE) and prepares accounts on that basis. (c) Stock at beginning of the year was valued at $20,000. The opening depreciation pool balance for the general SBE pool was $30,000. The trust purchased an investment apartment in a hotel complex brand new on 1 July this income year for a cost of $400,000. The quantity surveyor advised Tom that the construction cost of the apartment was $167,000. Calculate the net income of the trust for the income year. Note that

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started