Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Give correct answer for each for thumbs up! On your ninth birthday, you received $1,000 which you invested at 5.7 percent interest, compounded annually. Your

Give correct answer for each for thumbs up!

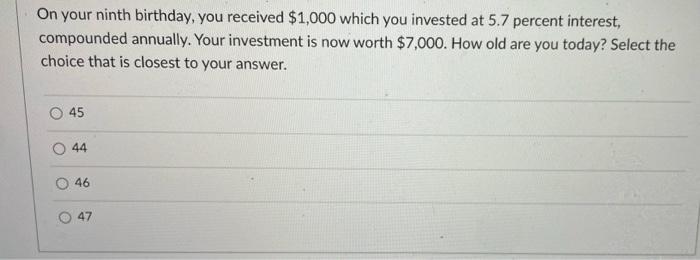

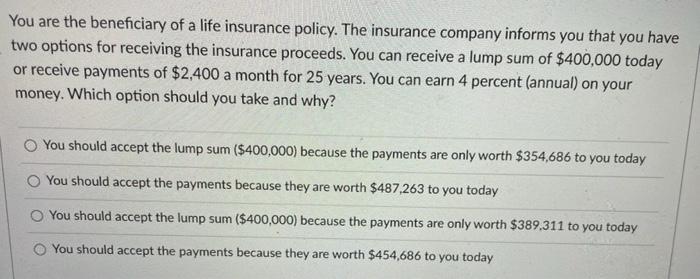

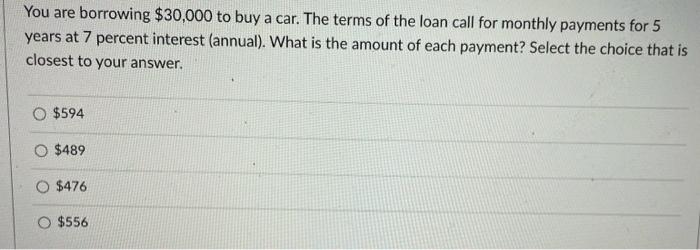

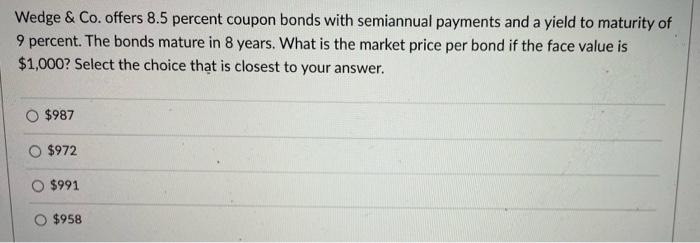

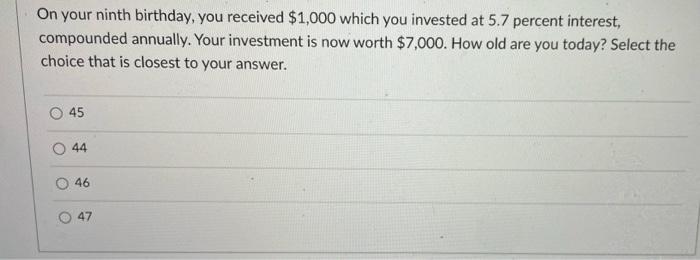

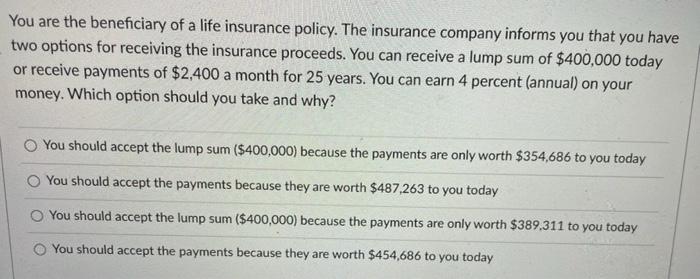

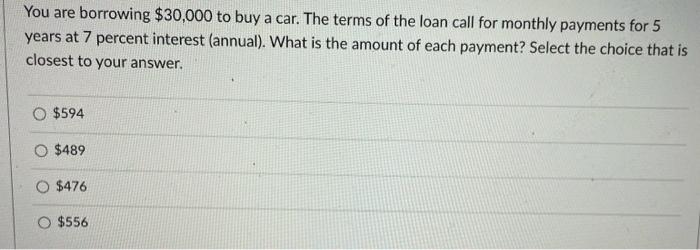

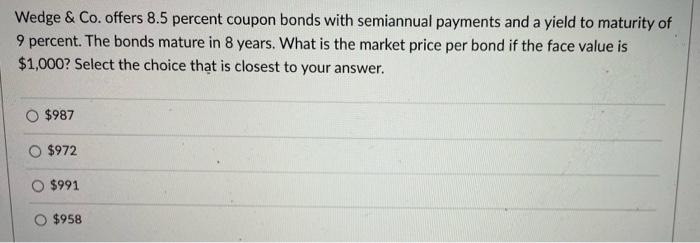

On your ninth birthday, you received $1,000 which you invested at 5.7 percent interest, compounded annually. Your investment is now worth $7,000. How old are you today? Select the choice that is closest to your answer. 45 44 46 47 You are the beneficiary of a life insurance policy. The insurance company informs you that you have two options for receiving the insurance proceeds. You can receive a lump sum of $400,000 today or receive payments of $2,400 a month for 25 years. You can earn 4 percent (annual) on your money. Which option should you take and why? You should accept the lump sum ($400,000) because the payments are only worth $354,686 to you today You should accept the payments because they are worth $487,263 to you today You should accept the lump sum ($400,000) because the payments are only worth $389.311 to you today You should accept the payments because they are worth $454,686 to you today You are borrowing $30,000 to buy a car. The terms of the loan call for monthly payments for 5 years at 7 percent interest (annual). What is the amount of each payment? Select the choice that is closest to your answer. O $594 O $489 $476 $556 Wedge & Co. offers 8.5 percent coupon bonds with semiannual payments and a yield to maturity of 9 percent. The bonds mature in 8 years. What is the market price per bond if the face value is $1,000? Select the choice that is closest to your answer. $987 $972 $991 $958

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started