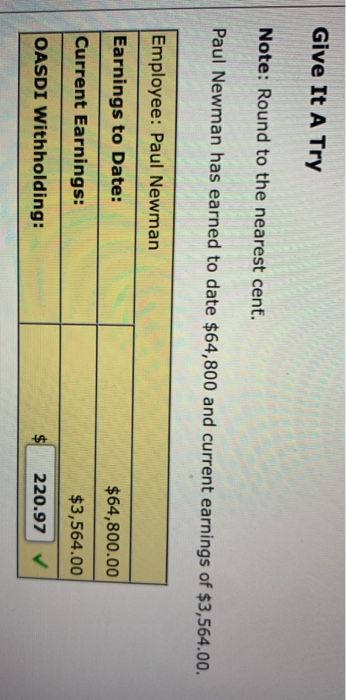

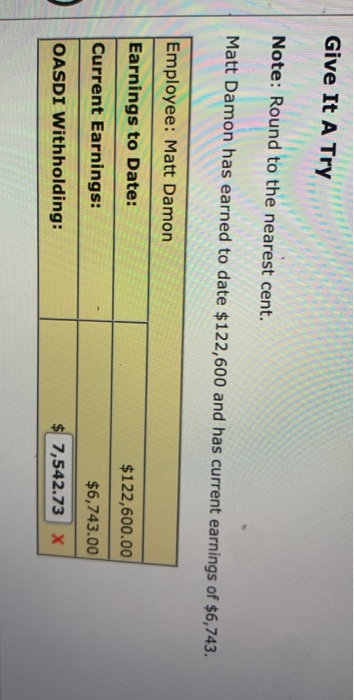

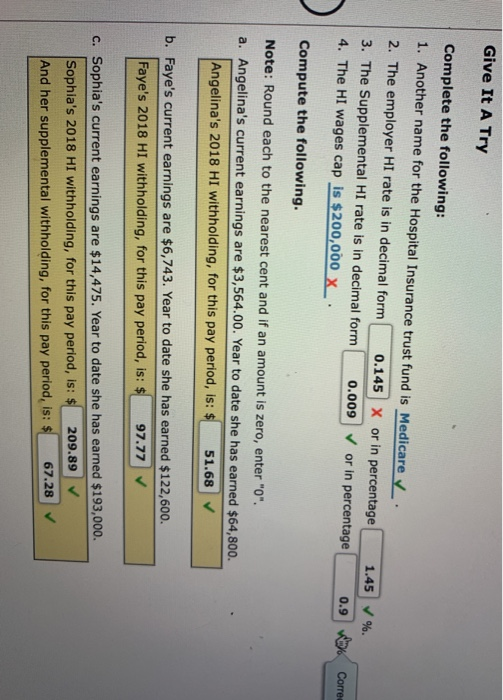

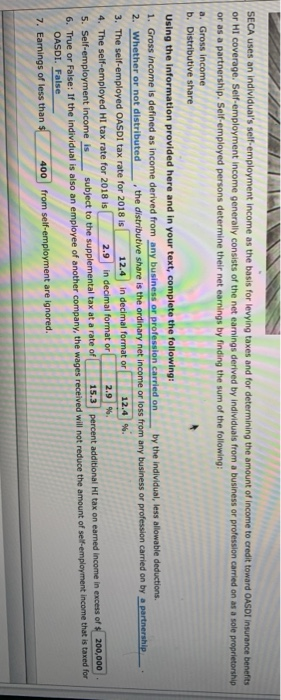

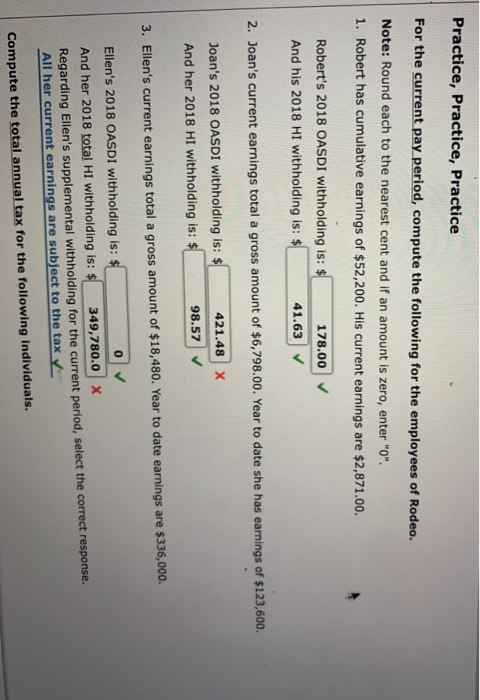

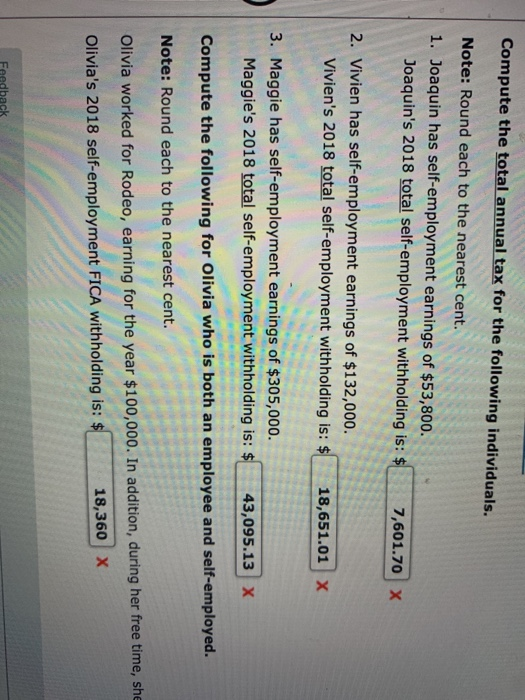

Give It A Try Note: Round to the nearest cent. Paul Newman has earned to date $64,800 and current earnings of $3,564.00. Employee: Paul Newman Earnings to Date: $64,800.00 Current Earnings: $3,564.00 OASDI Withholding: 220.97 Give It A Try Note: Round to the nearest cent. Matt Damon has earned to date $122,600 and has current earnings of $6,743. Employee: Matt Damon Earnings to Date: $122,600.00 Current Earnings: $6,743.00 OASDI Withholding: $ 7,542.73 X Give It A Try Complete the following: 1. Another name for the Hospital Insurance trust fund is Medicare. 2. The employer HI rate is in decimal form 0.145 X or in percentage 3. The Supplemental HI rate is in decimal form 0.009 or in percentage 4. The HI wages cap is $200,000 X.. 1.45 %. 0.9 Corre: Compute the following. Note: Round each to the nearest cent and if an amount is zero, enter "0". a. Angelina's current earnings are $3,564.00. Year to date she has earned $64,800. Angelina's 2018 HI withholding, for this pay period, is: $ 51.68 b. Faye's current earnings are $6,743. Year to date she has earned $122,600. Faye's 2018 HI withholding, for this pay period, is: $ 97.77 C. Sophia's current earnings are $14,475. Year to date she has earned $193,000. Sophia's 2018 HI withholding, for this pay period, is: $ 209.89 And her supplemental withholding, for this pay period, is: $ 67.28 SECA uses an individual's self-employment income as the basis for levying taxes and for determining the amount of income to credit toward OASDI insurance benefits or HI coverage. Self-employment income generally consists of the net earnings derived by individuals from a business or profession carried on as a sole proprietorship or as a partnership. Self-employed persons determine their net earnings by finding the sum of the following: a. Gross income b. Distributive share Using the information provided here and in your text, complete the following: 1. Gross income is defined as income derived from any business or profession carried on by the individual, less allowable deductions. 2. Whether or not distributed , the distributive share is the ordinary net income or loss from any business or profession carried on by a partnership 3. The self-employed OASDI tax rate for 2018 is 12.4 In decimal formator 12.4 % 4. The self-employed HI tax rate for 2018 is 2.9 in decimal format or 2.9 % 5. Self-employment income is subject to the supplemental tax at a rate of 15.3 percent additional Hf tax on earned Income in excess of $200,000 6. True or False: If the individual is also an employee of another company, the wages received will not reduce the amount of self-employment income that is taxed for OASDI False 7. Earnings of less than $ 400 from self-employment are ignored. Practice, Practice, Practice For the current pay period, compute the following for the employees of Rodeo. Note: Round each to the nearest cent and if an amount is zero, enter "0". 1. Robert has cumulative earnings of $52,200. His current earnings are $2,871.00. 178.00 Robert's 2018 OASDI withholding is: $ And his 2018 HI withholding is: $ 41.63 2. Joan's current earnings total a gross amount of $6,798.00. Year to date she has earnings of $123,600. 421.48 X Joan's 2018 OASDI withholding is: $ And her 2018 HI withholding is: $ 98.57 3. Ellen's current earnings total a gross amount of $18,480. Year to date earnings are $336,000. 0 Ellen's 2018 OASDI withholding is: $ And her 2018 total HI withholding is: $ 349,780.0 X Regarding Ellen's supplemental withholding for the current period, select the correct response. All her current earnings are subject to the tax Compute the total annual tax for the following individuals. Compute the total annual tax for the following individuals. Note: Round each to the nearest cent. 1. Joaquin has self-employment earnings of $53,800. Joaquin's 2018 total self-employment withholding is: $ 7,601.70 x 2. Vivien has self-employment earnings of $132,000. Vivien's 2018 total self-employment withholding is: $ 18,651.01 X 3. Maggie has self-employment earnings of $305,000. Maggie's 2018 total self-employment withholding is: $ 43,095.13 X Compute the following for Olivia who is both an employee and self-employed. Note: Round each to the nearest cent. Olivia worked for Rodeo, earning for the year $100,000. In addition, during her free time, she Olivia's 2018 self-employment FICA withholding is: $ 18,360 x Feedback