Answered step by step

Verified Expert Solution

Question

1 Approved Answer

give me the answer please Marbell Data Technology Inc. had sales of $330 million last year. The business has a steady net profit margin of

give me the answer please

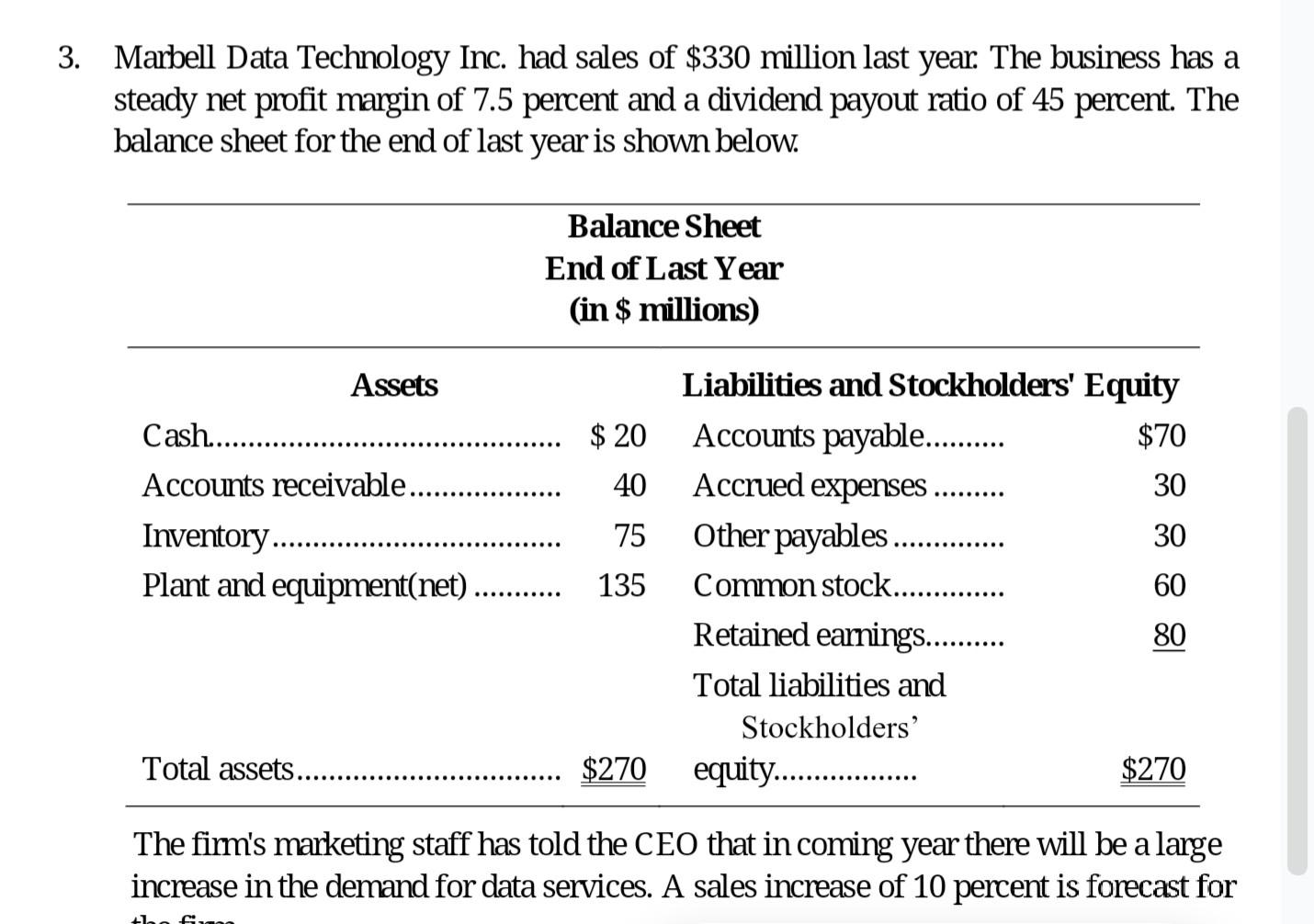

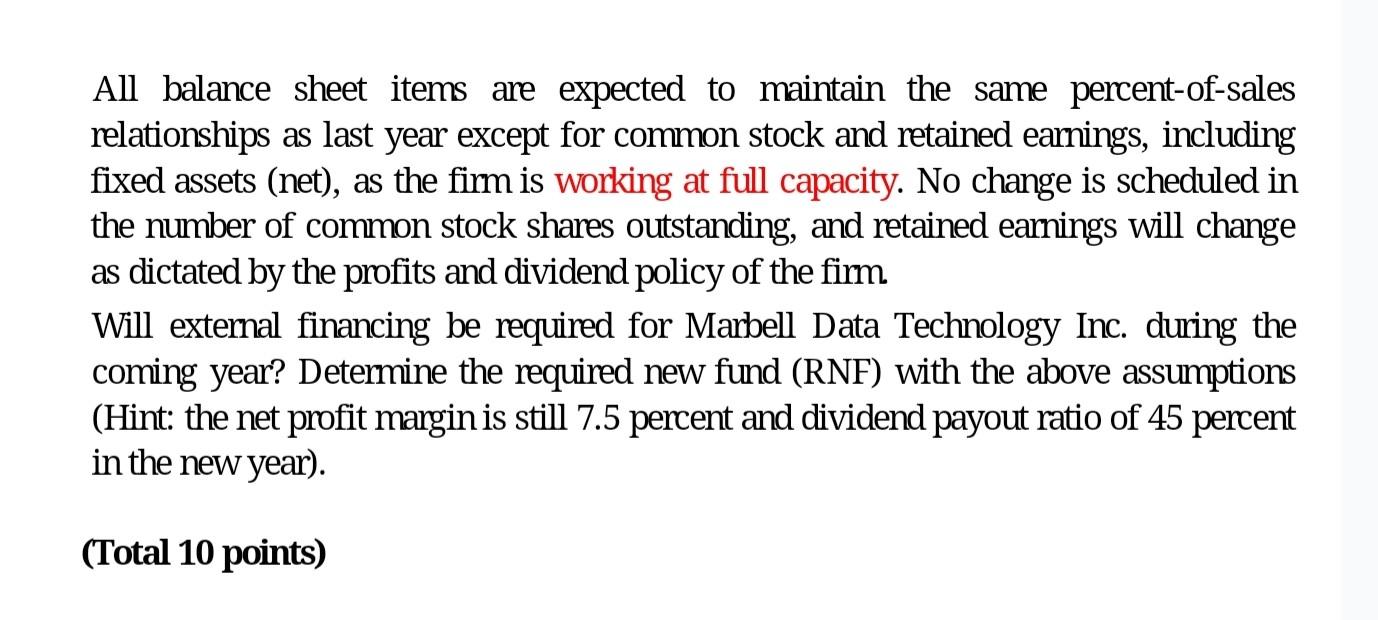

Marbell Data Technology Inc. had sales of $330 million last year. The business has a steady net profit margin of 7.5 percent and a dividend payout ratio of 45 percent. The balance sheet for the end of last year is shown below. The firm's marketing staff has told the CEO that in coming year there will be a large increase in the demand for data services. A sales increase of 10 percent is forecast for All balance sheet items are expected to maintain the same percent-of-sales relationships as last year except for common stock and retained earnings, including fixed assets (net), as the firm is working at full capacity. No change is scheduled in the number of common stock shares outstanding, and retained earnings will change as dictated by the profits and dividend policy of the firm Will external financing be required for Marbell Data Technology Inc. during the coming year? Determine the required new fund (RNF) with the above assumptions (Hint: the net profit margin is still 7.5 percent and dividend payout ratio of 45 percent in the new year). (Total 10 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started