Question

Give the general journal entry to record each of the following transactions for Davidson Company: 1. Issued a 6-month. 8 percent note for $73,000

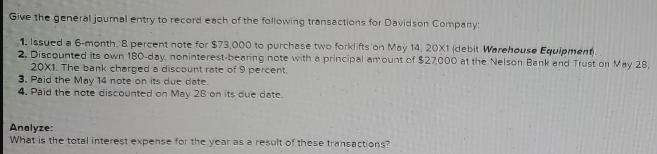

Give the general journal entry to record each of the following transactions for Davidson Company: 1. Issued a 6-month. 8 percent note for $73,000 to purchase two forklifts on May 14, 20X1 (debit Warehouse Equipment 2. Discounted its own 180-day, noninterest-bearing note with a principal amount of $27,000 at the Nelson Bank and Trust on May 28, 20X1. The bank charged a discount rate of 9 percent. 3. Paid the May 14 note on its due date. 4. Paid the note discounted on May 28 on its due date. Analyze: What is the total interest expense for the year as a result of these transactions?

Step by Step Solution

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The transactions are journalized below Date Account Title Debit Credit May14 War...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting Chapters 1-30

Authors: John Price, M. David Haddock, Michael Farina

15th edition

1259994975, 125999497X, 1259631117, 978-1259631115

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App