Answered step by step

Verified Expert Solution

Question

1 Approved Answer

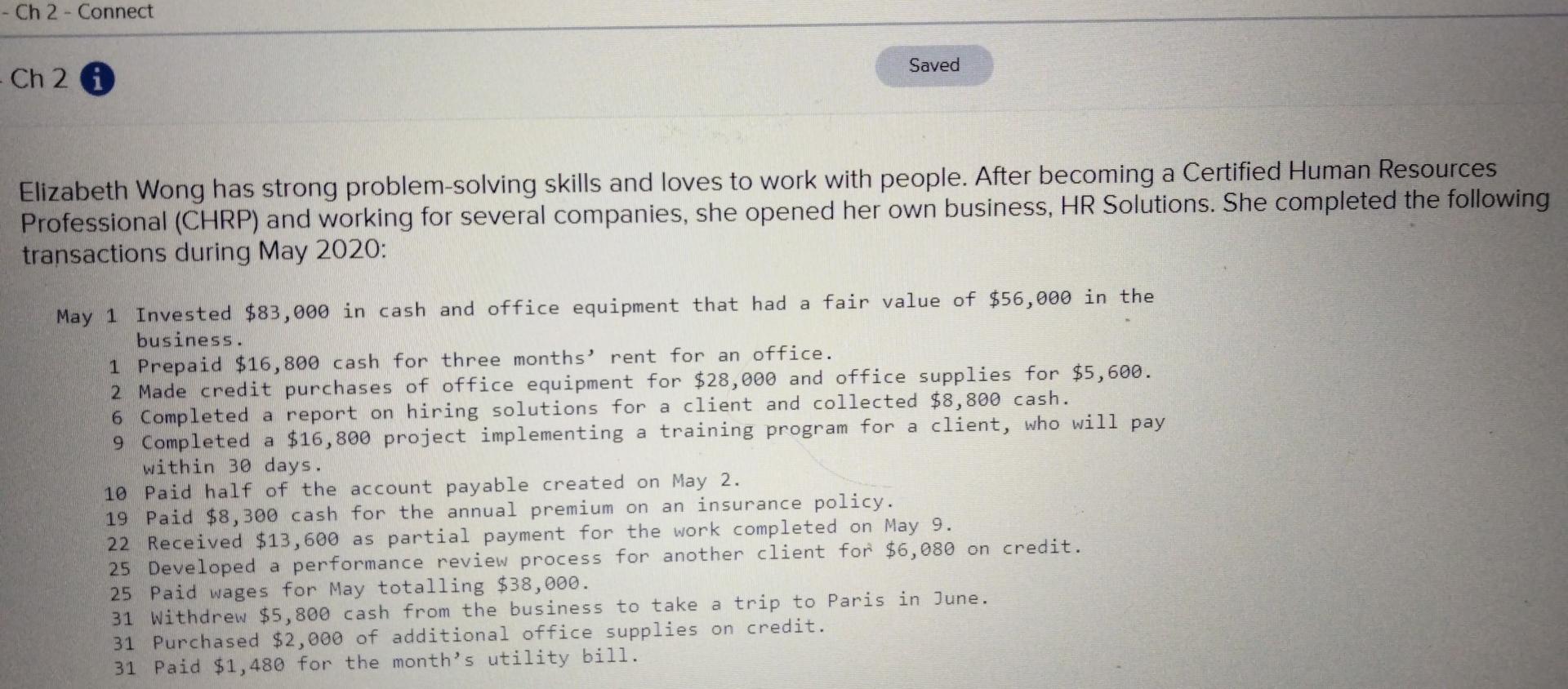

give whole question answer step by step please don't miss anything Ch 2 - Connect Saved -Ch 2 Elizabeth Wong has strong problem-solving skills and

give whole question answer step by step please don't miss anything

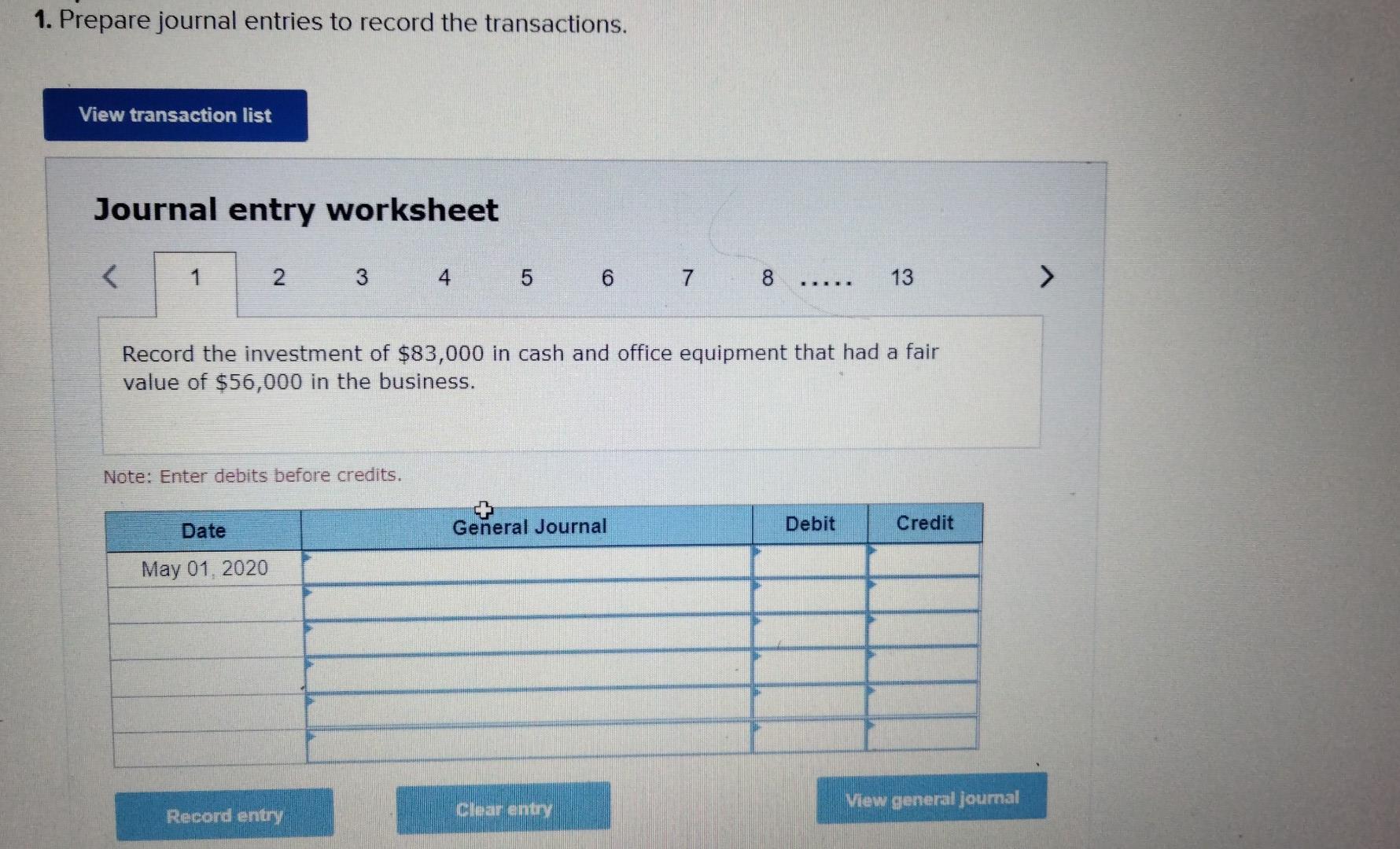

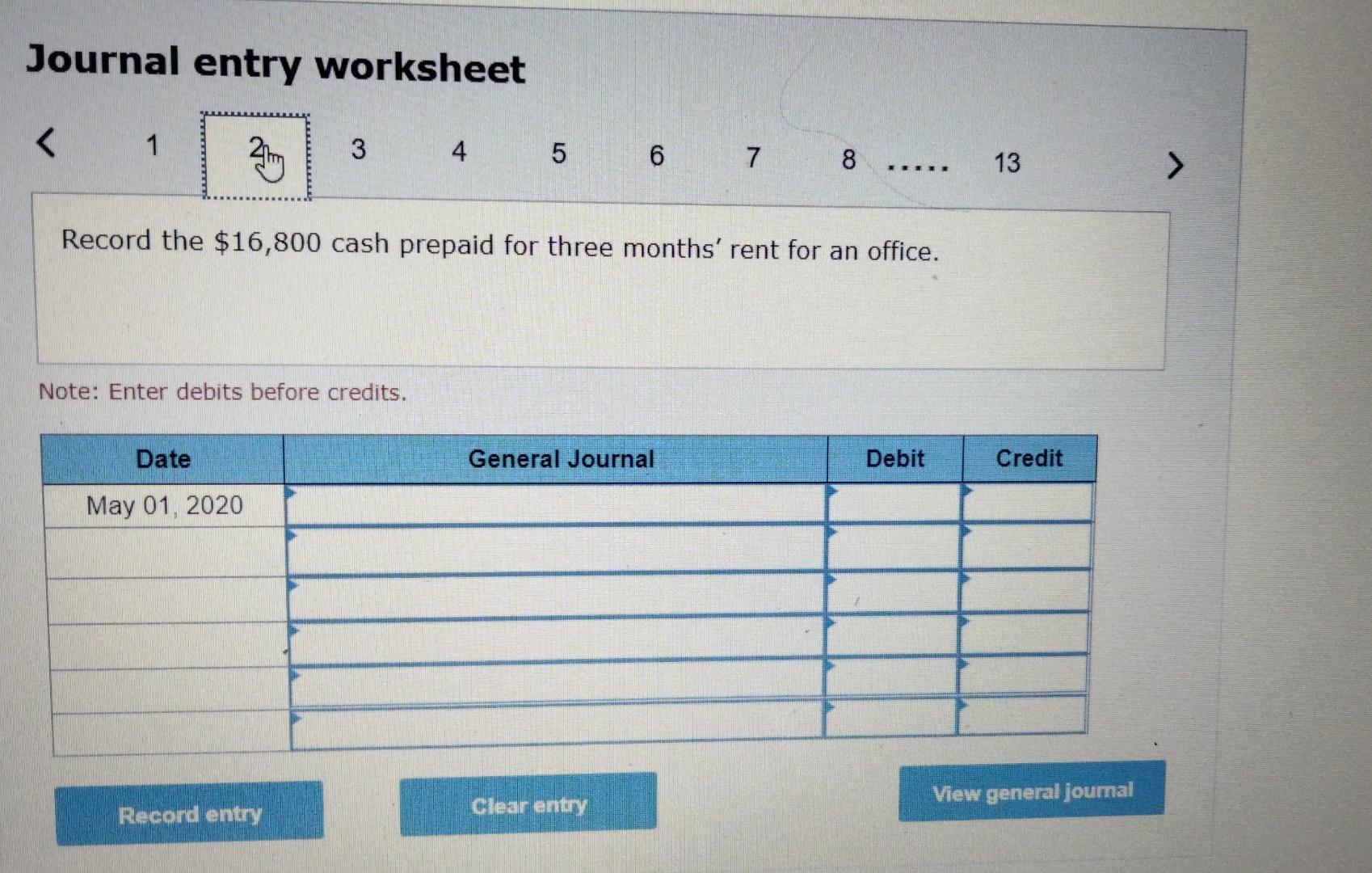

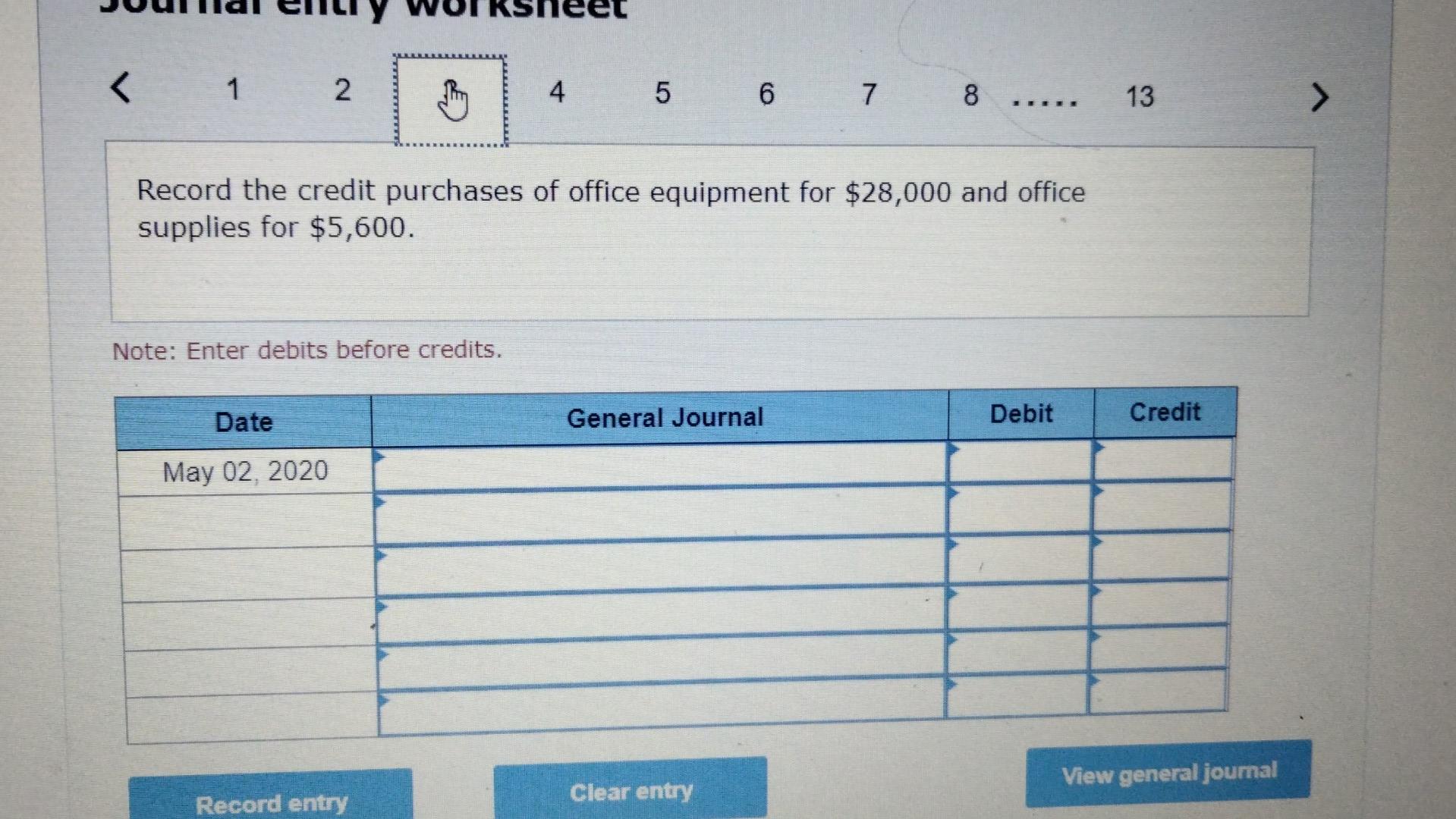

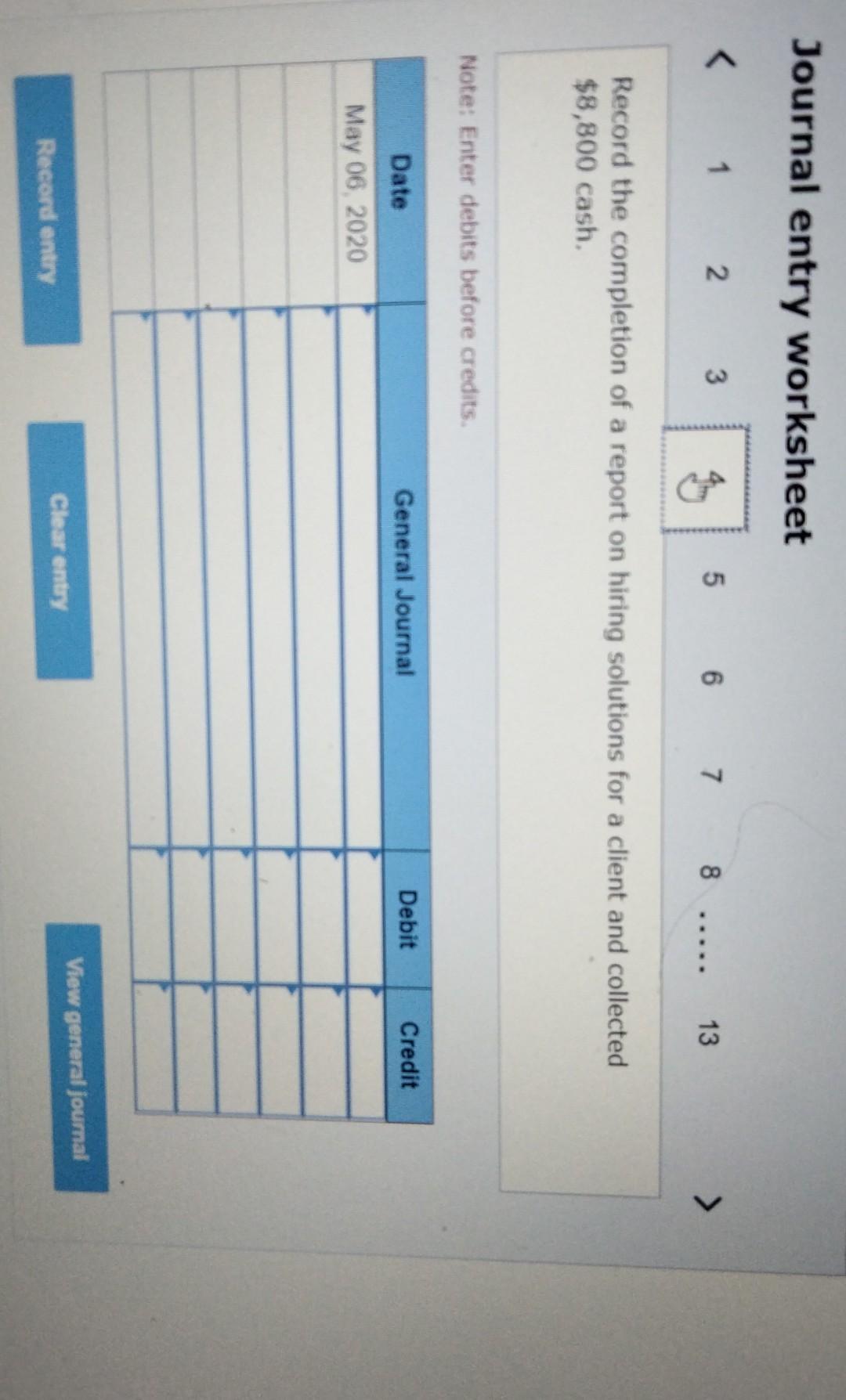

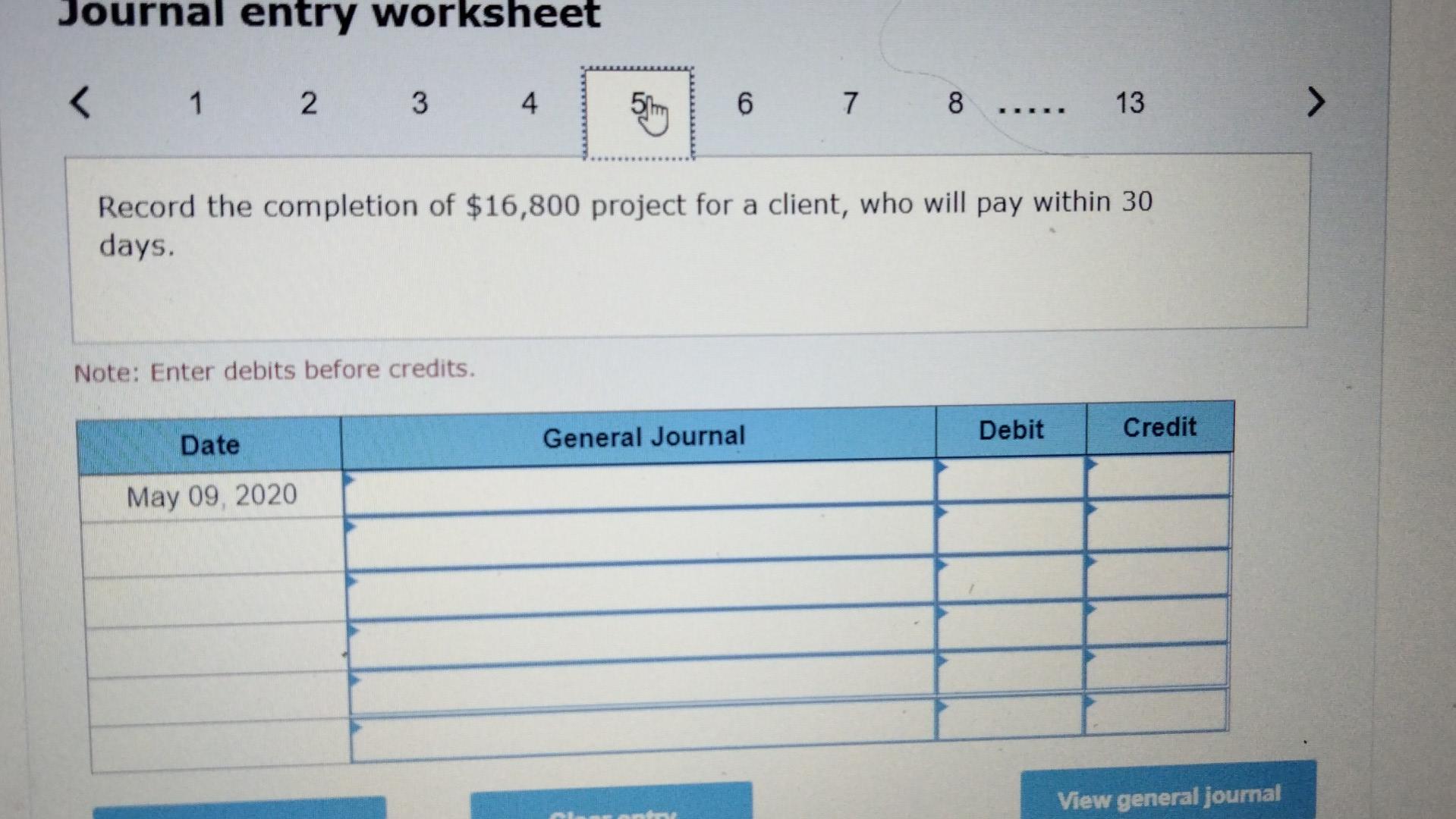

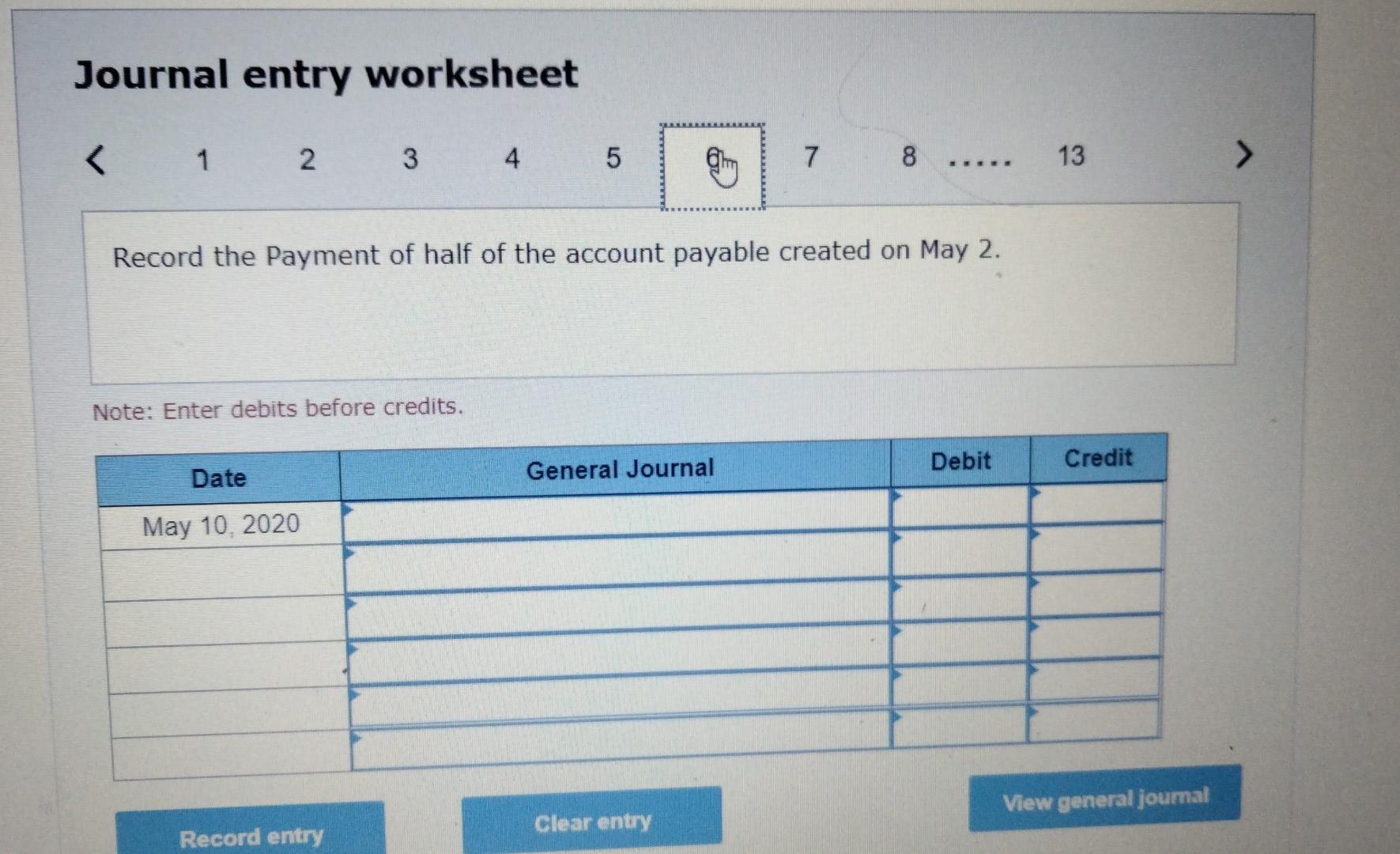

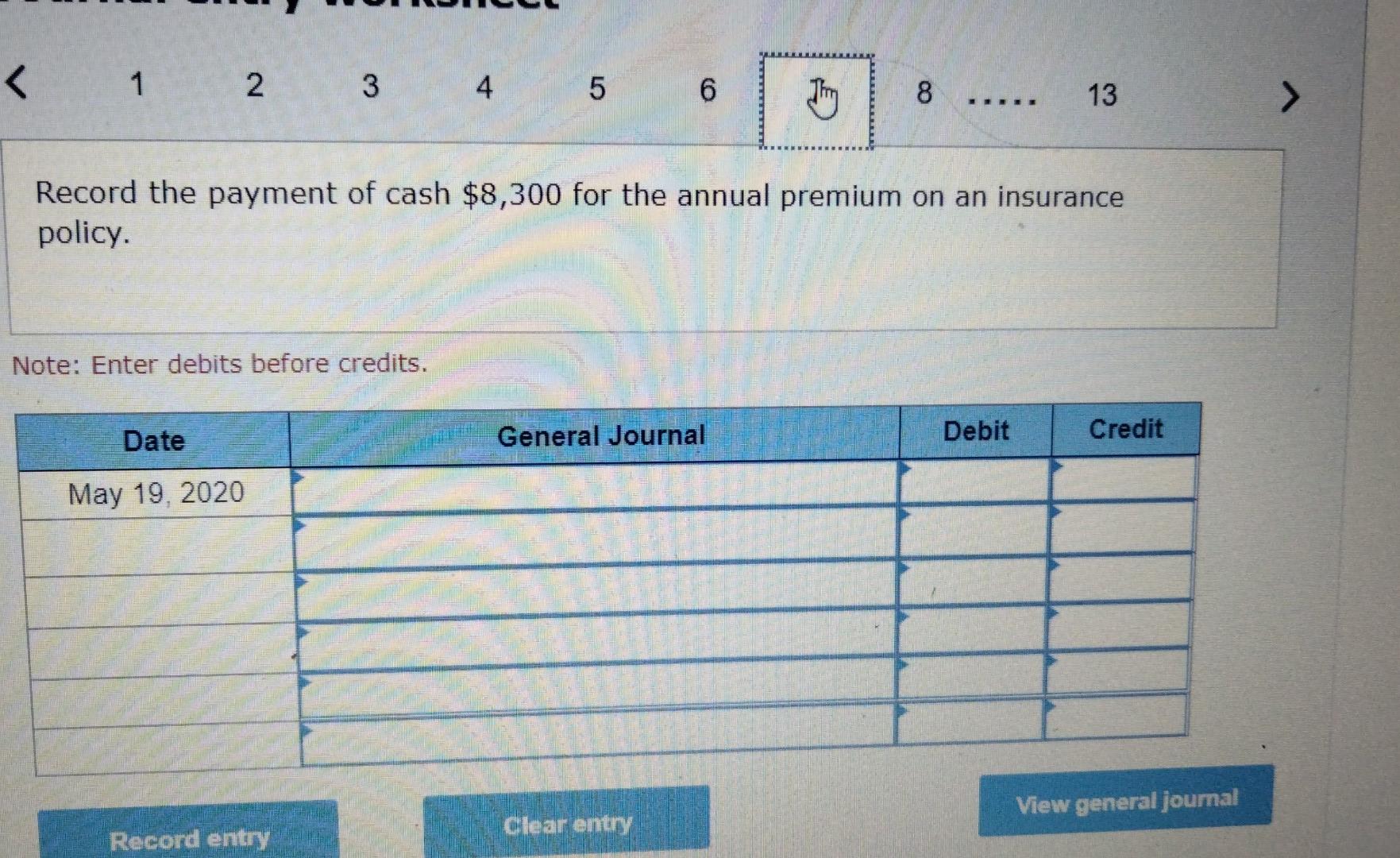

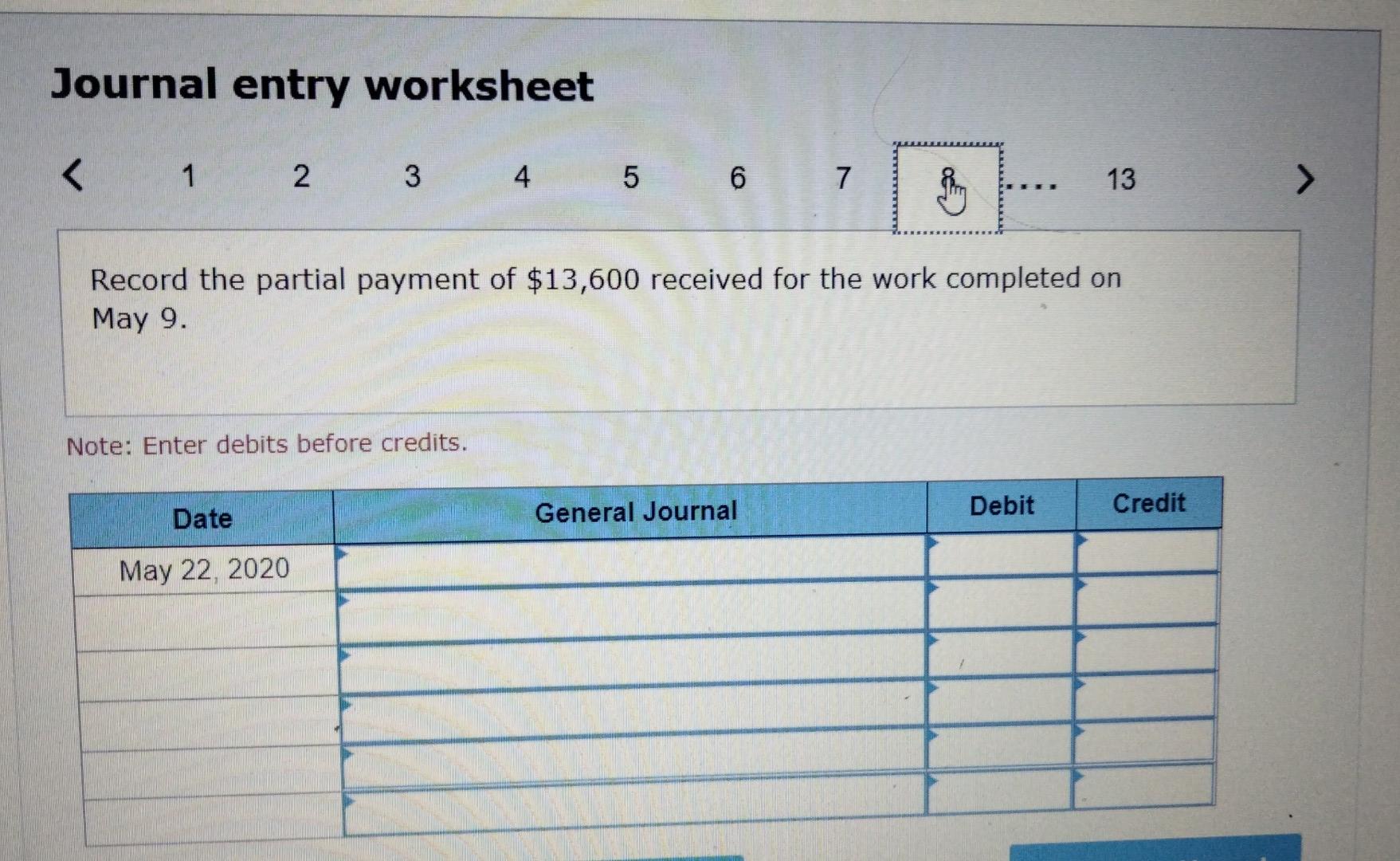

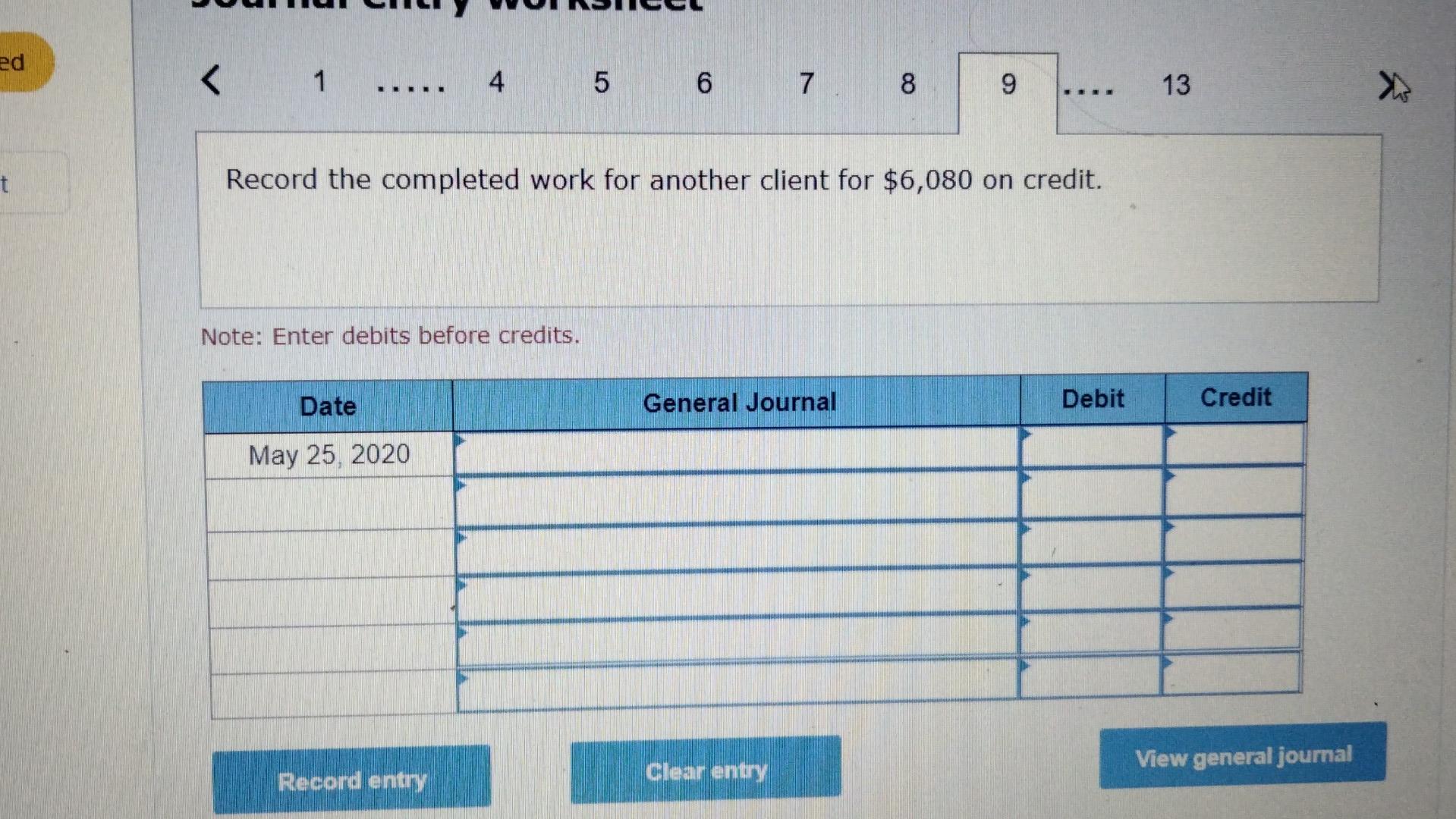

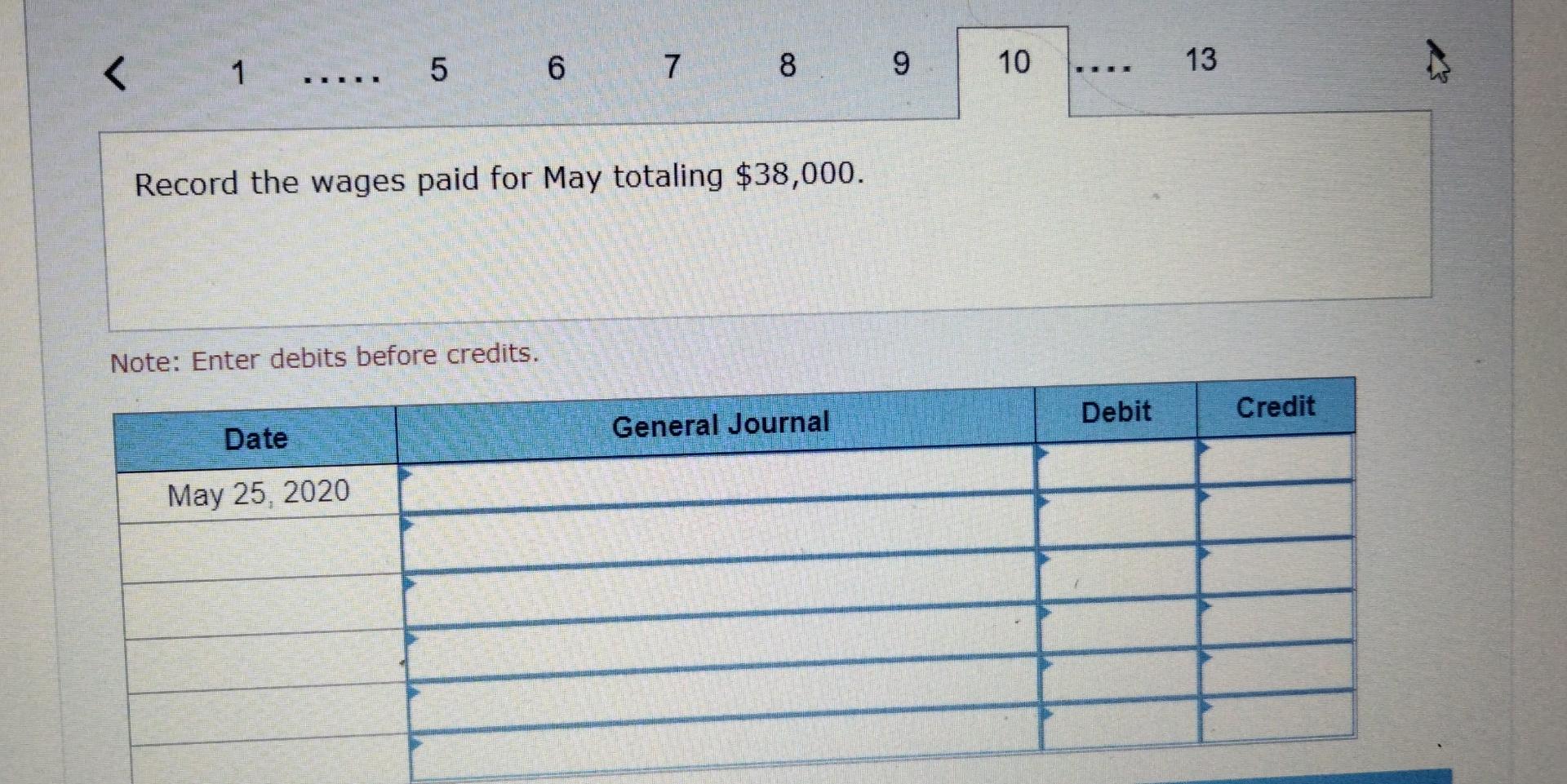

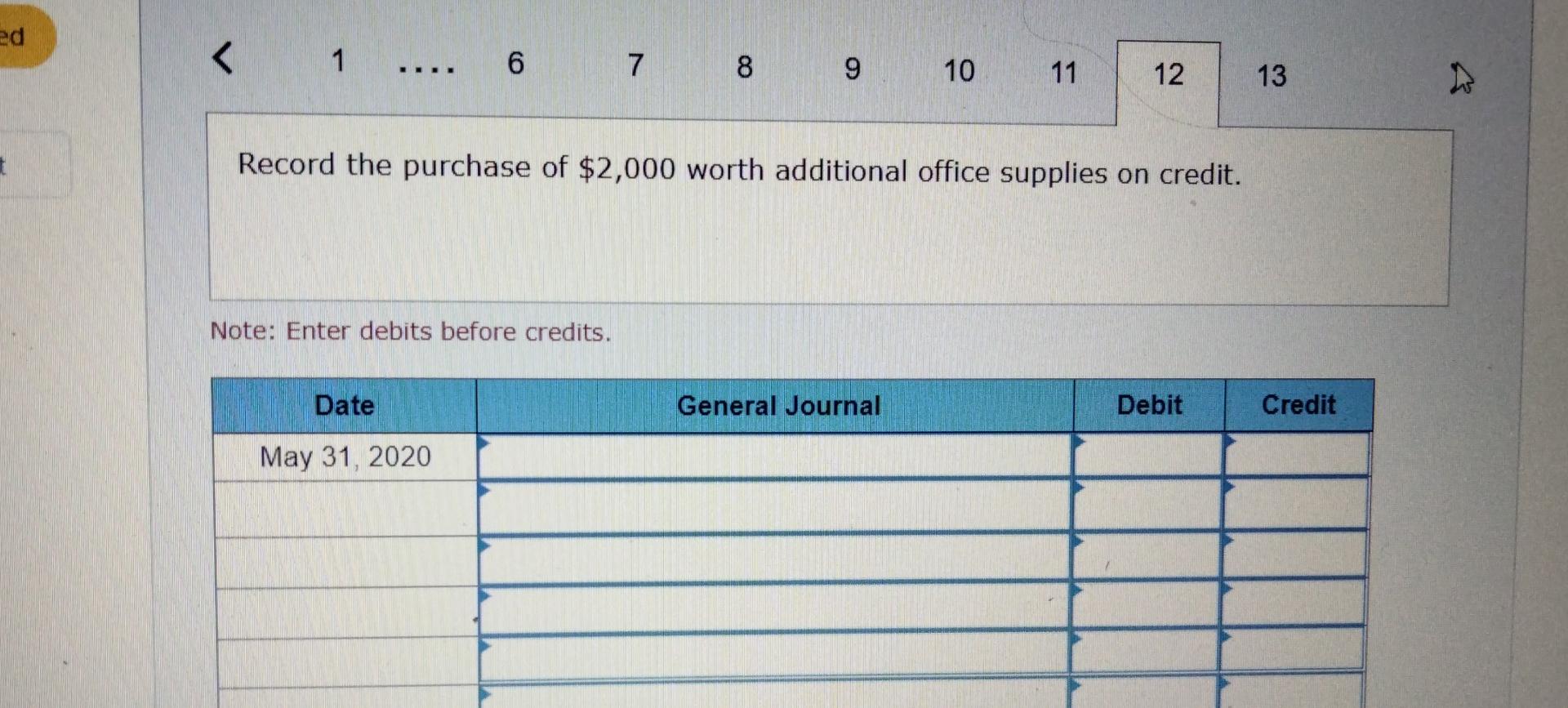

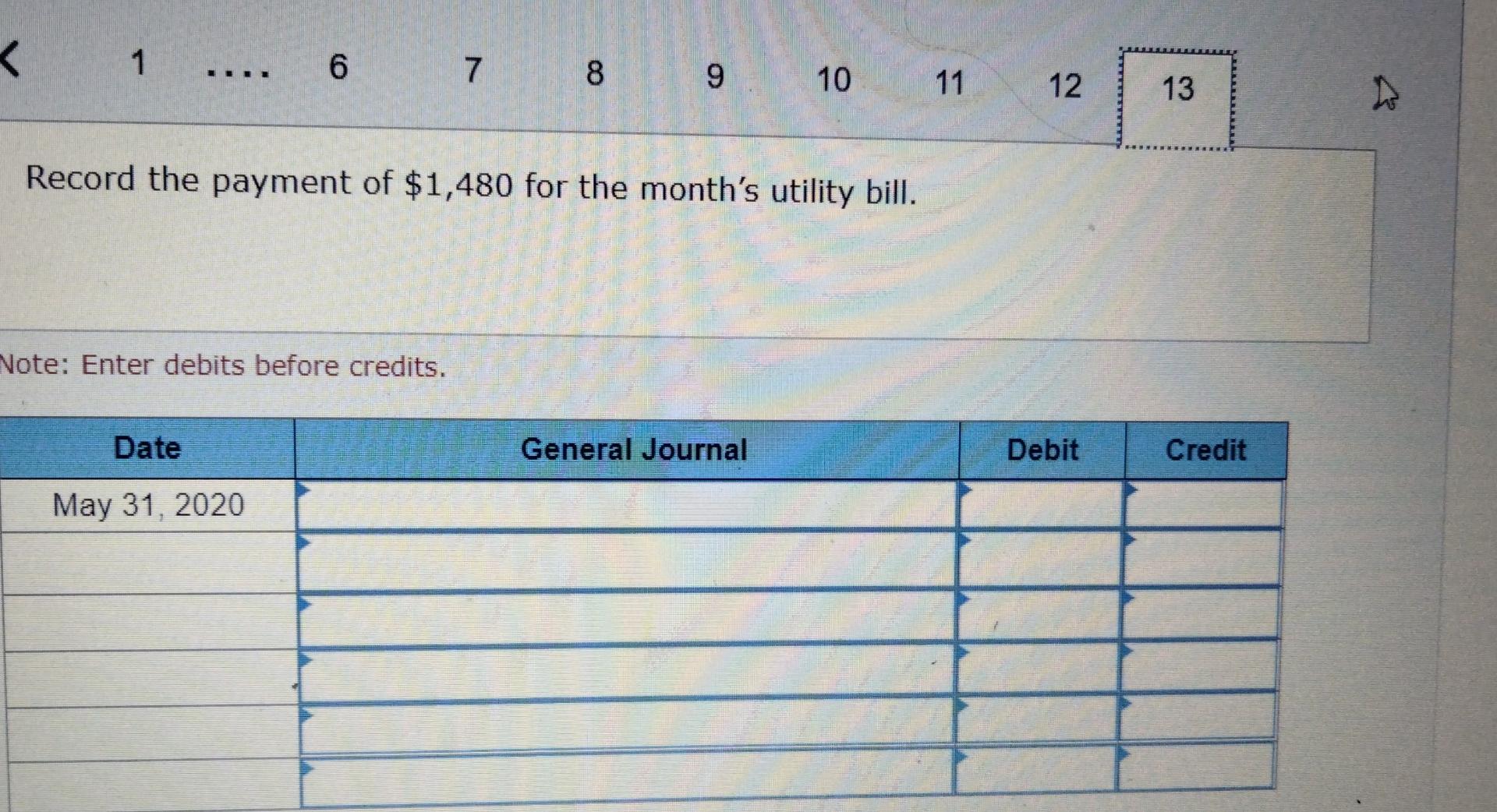

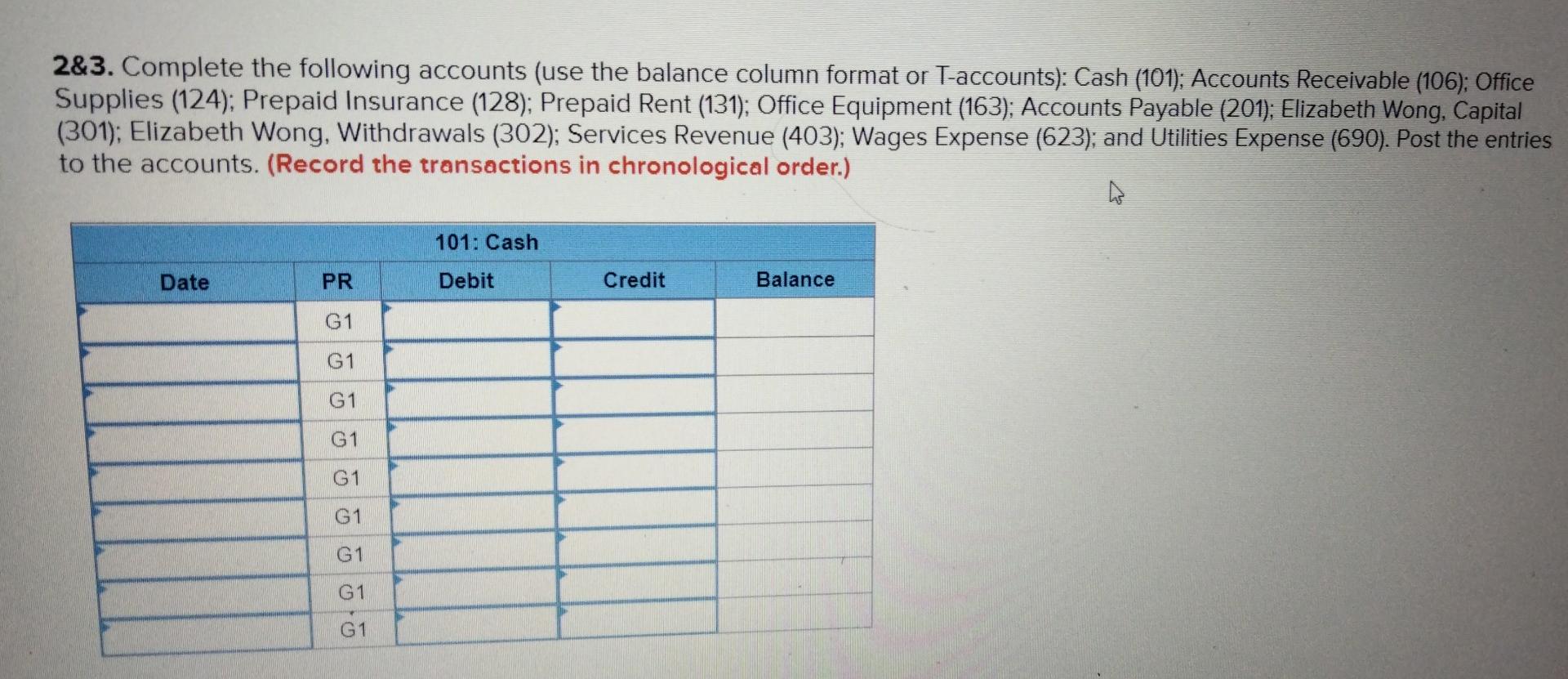

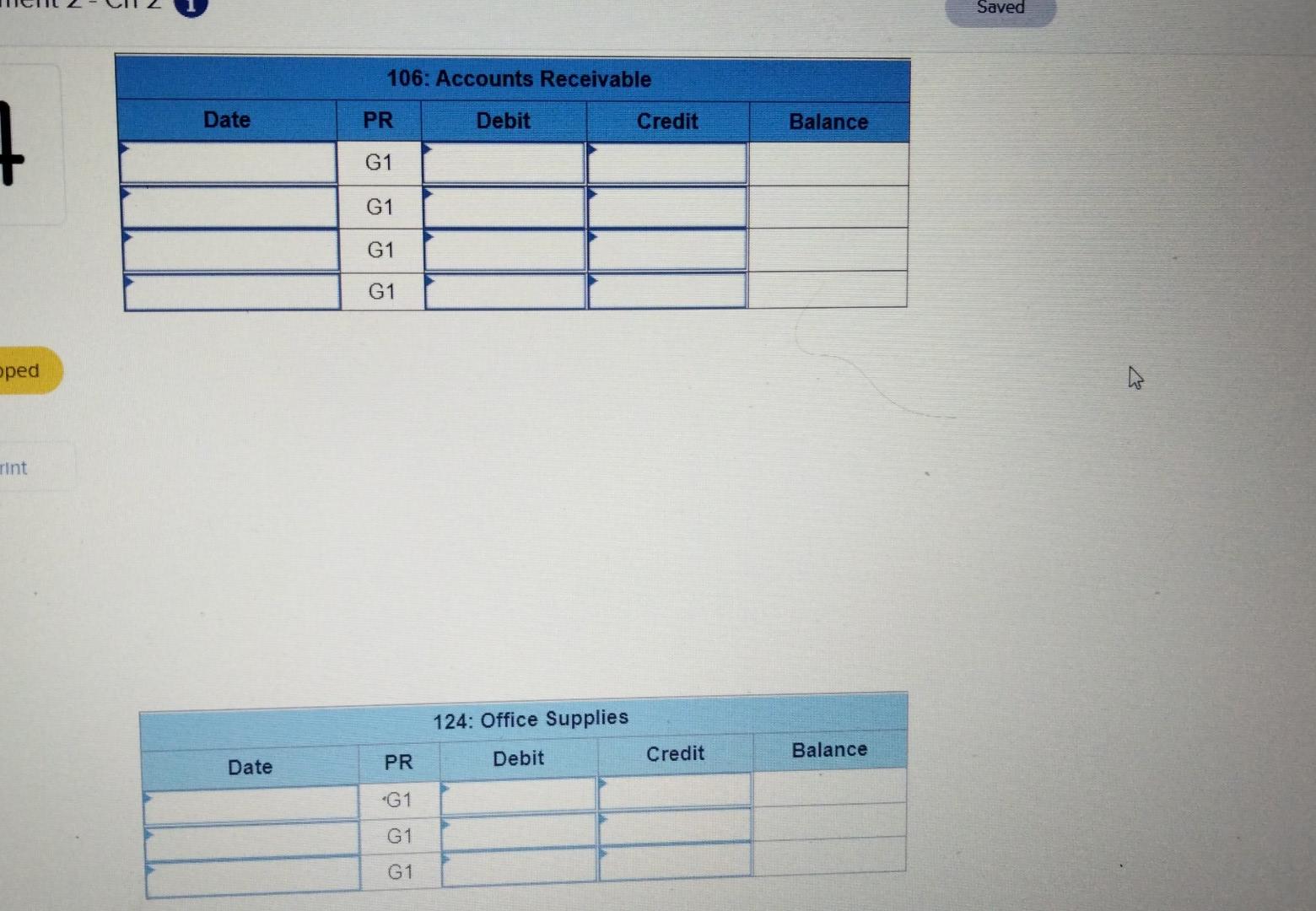

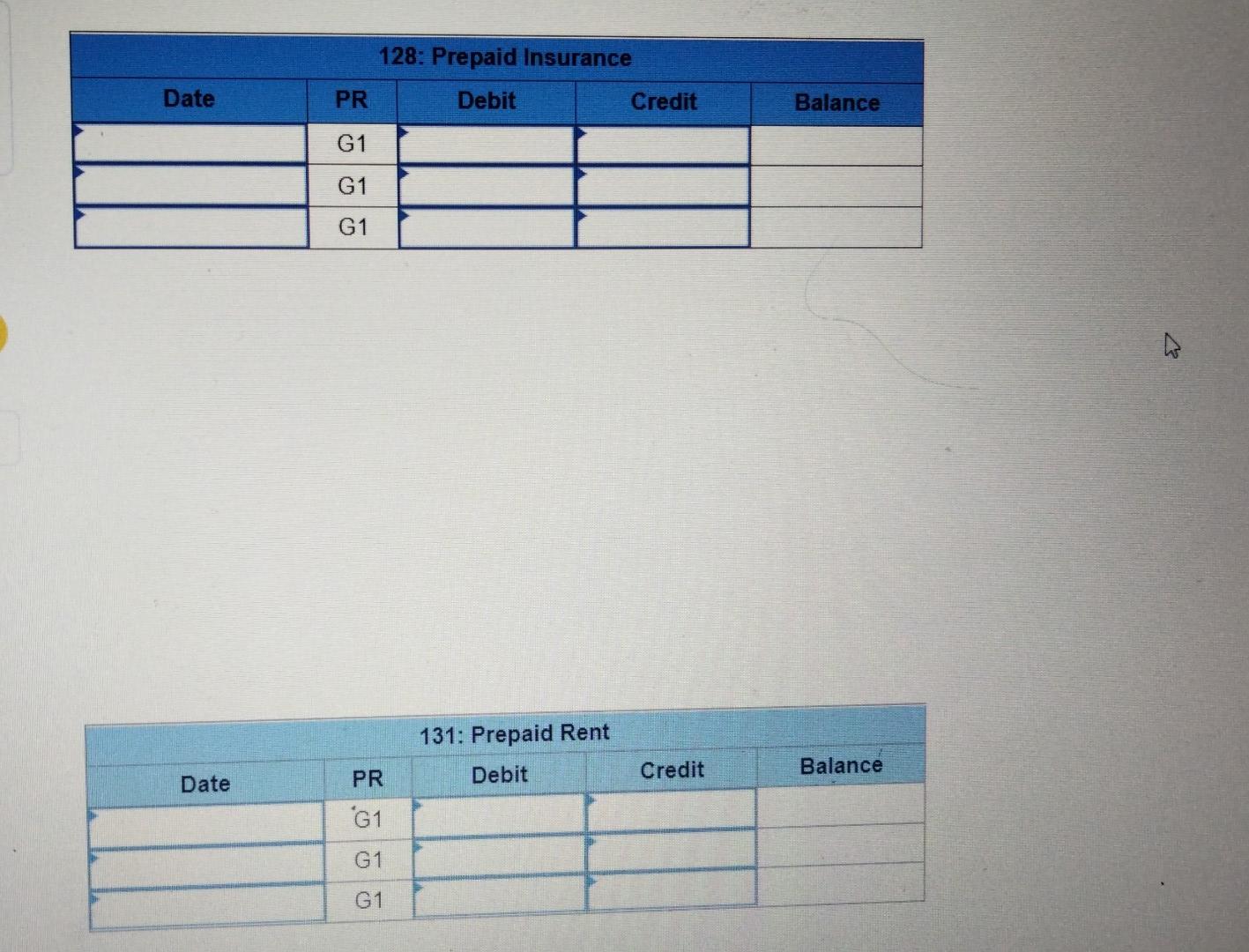

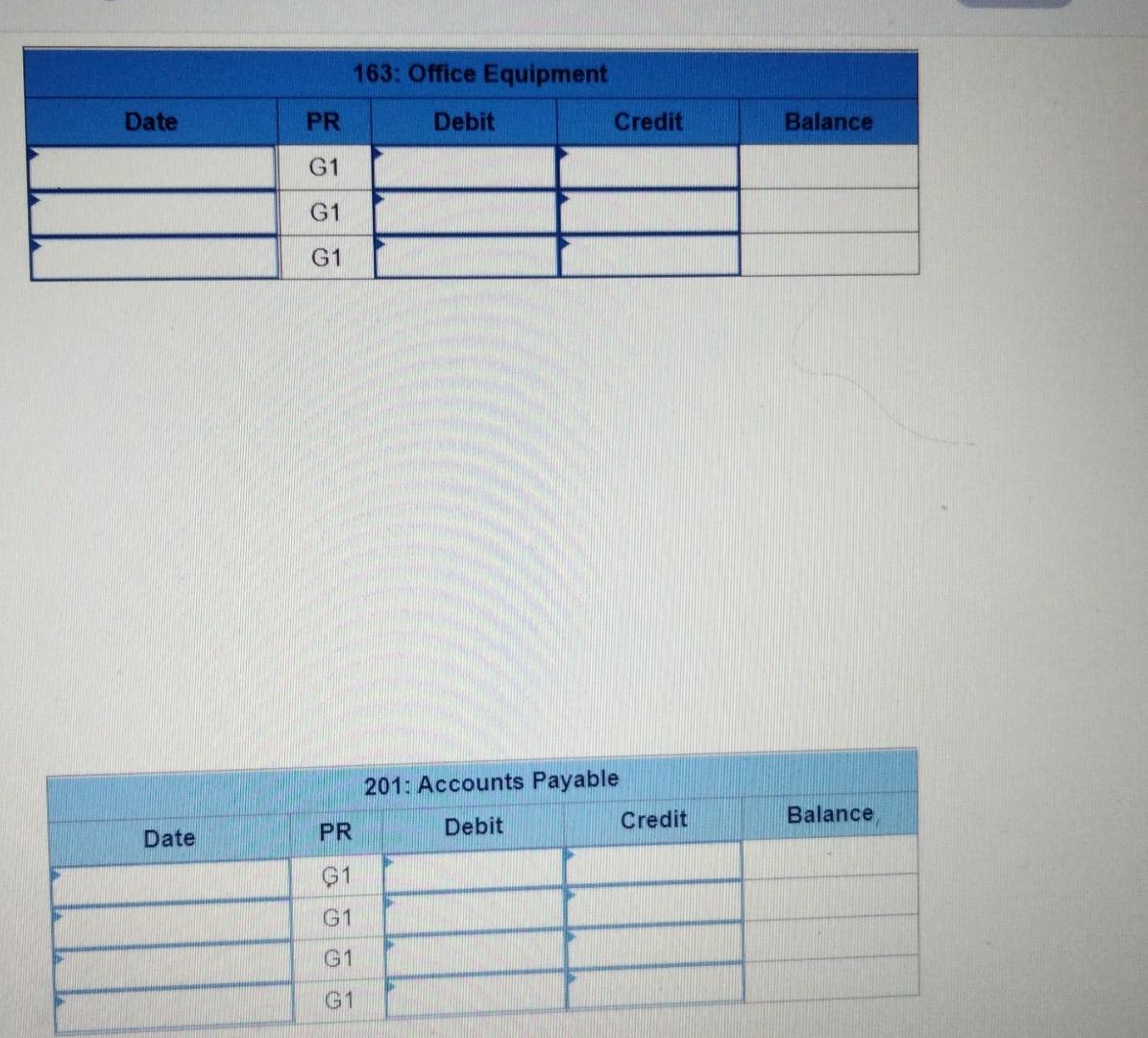

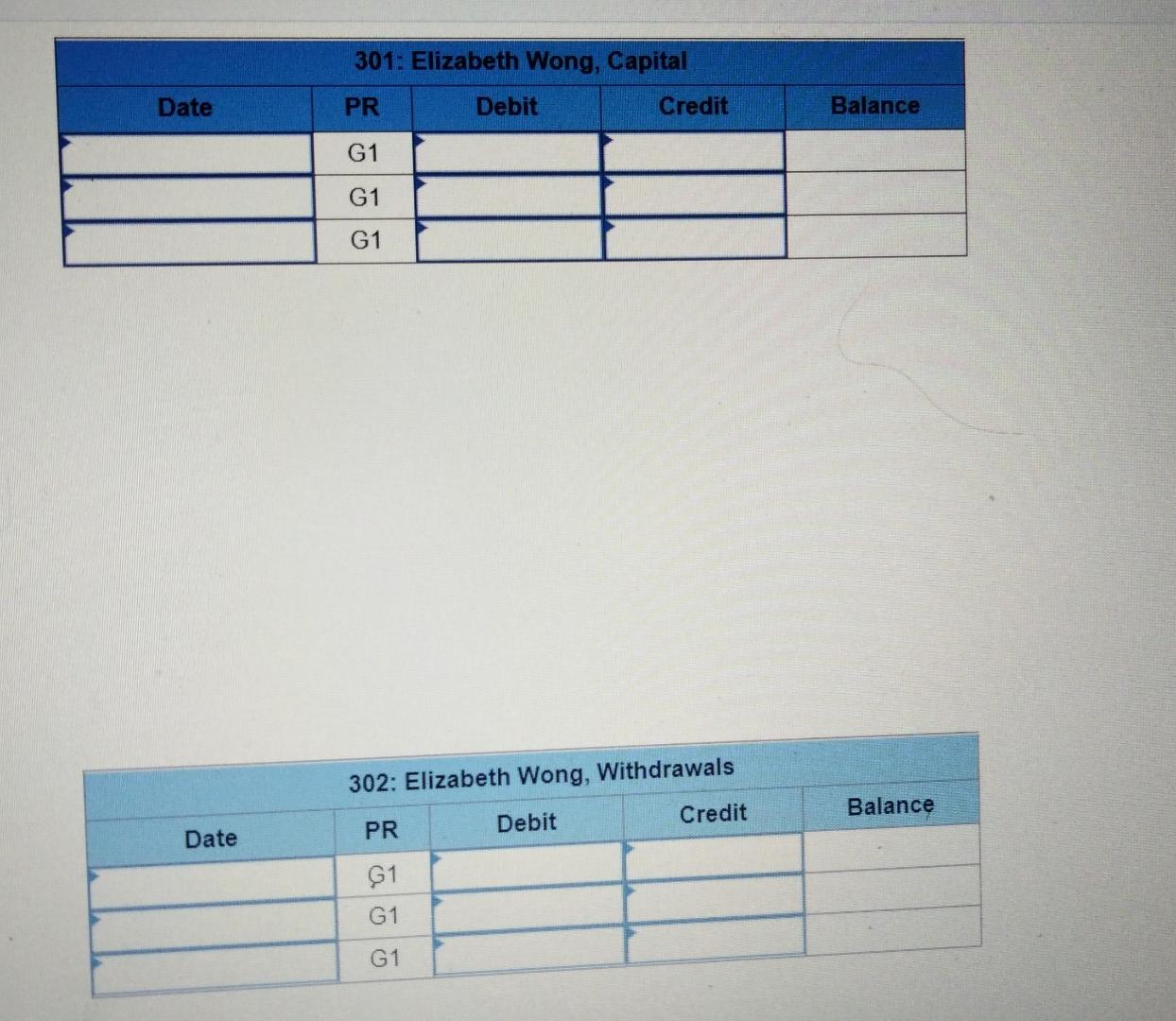

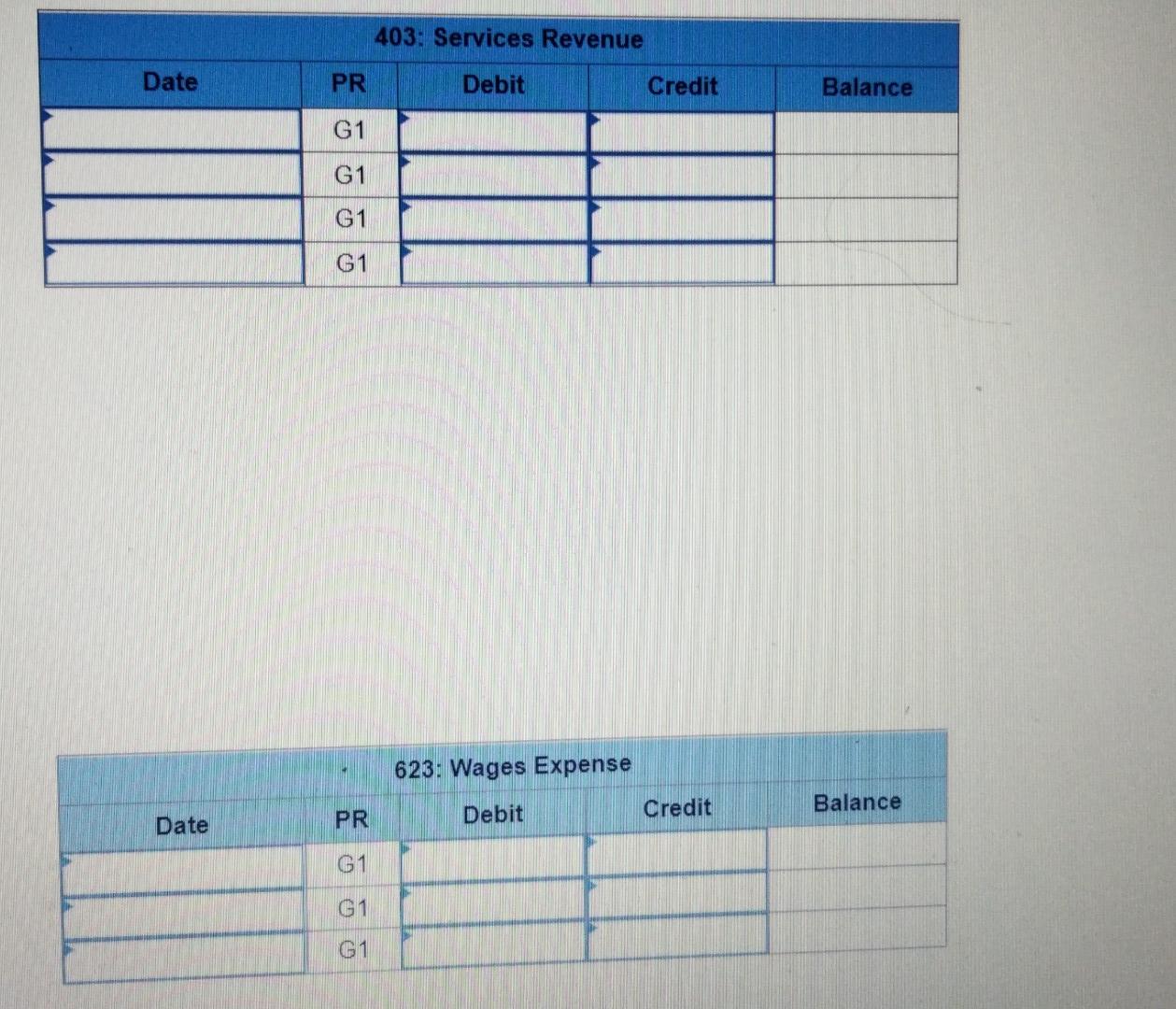

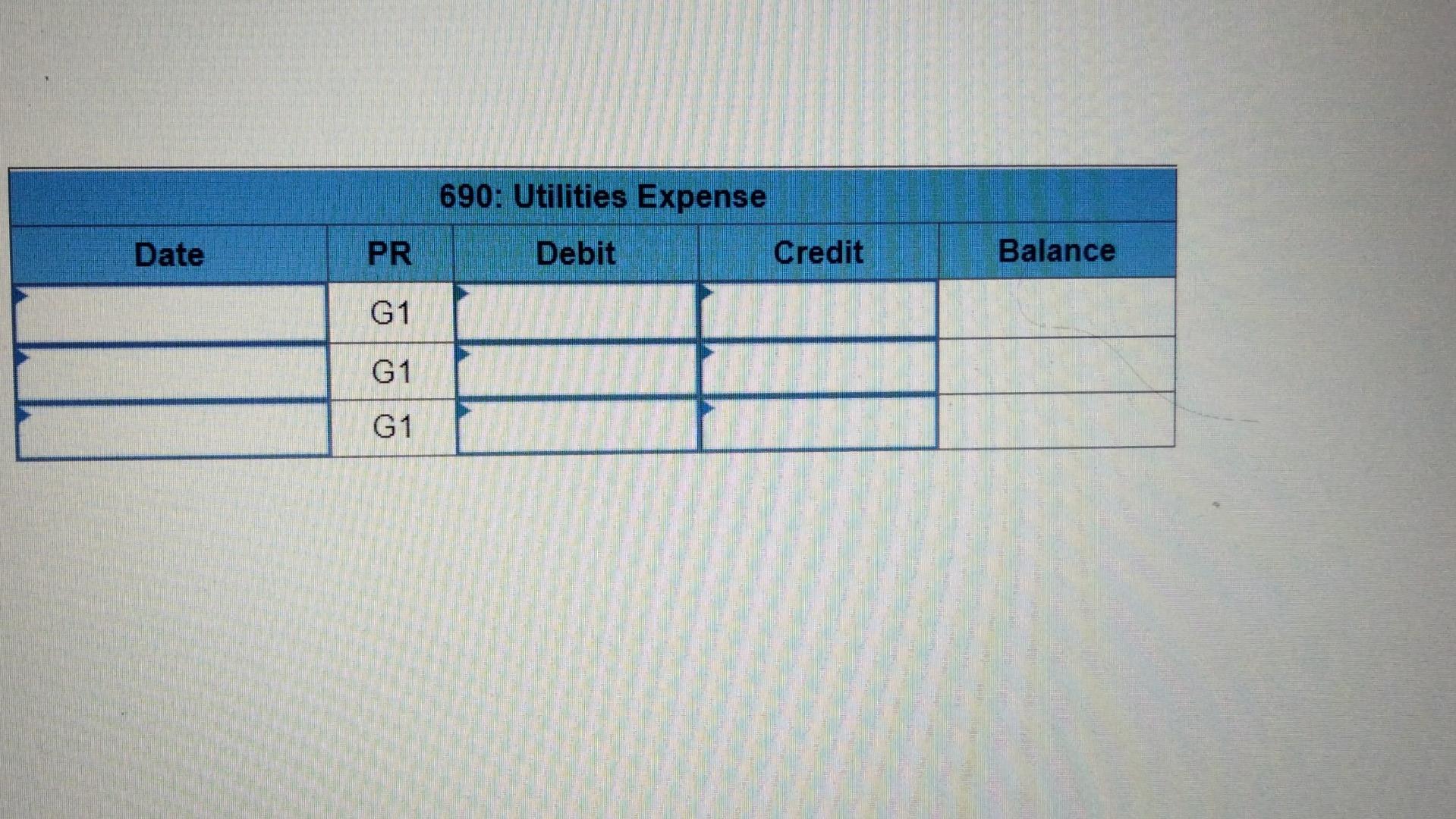

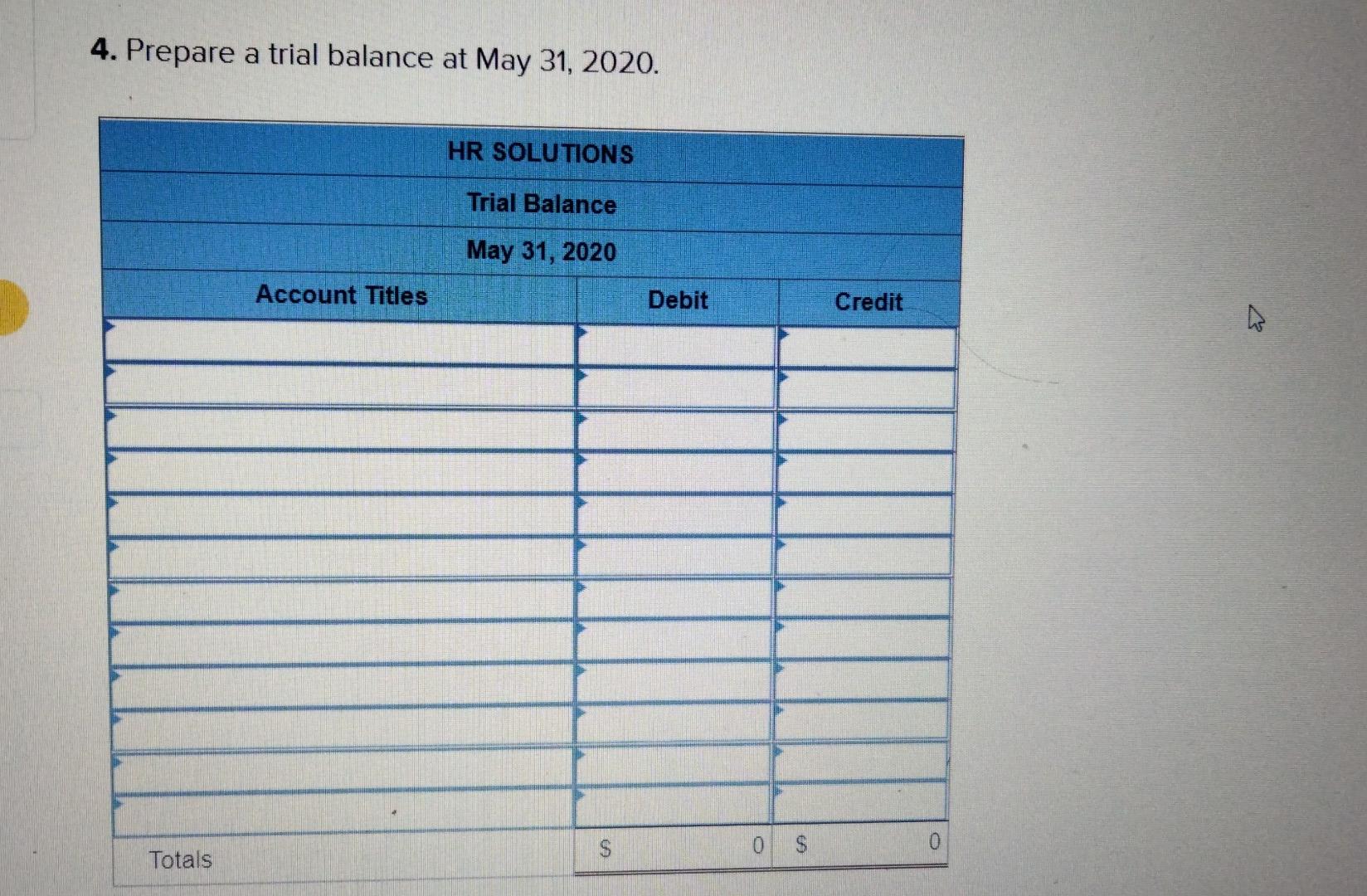

Ch 2 - Connect Saved -Ch 2 Elizabeth Wong has strong problem-solving skills and loves to work with people. After becoming a Certified Human Resources Professional (CHRP) and working for several companies, she opened her own business, HR Solutions. She completed the following transactions during May 2020: May 1 Invested $83,000 in cash and office equipment that had a fair value of $56,000 in the business. 1 Prepaid $16,800 cash for three months' rent for an office. 2 Made credit purchases of office equipment for $28,000 and office supplies for $5,600. 6 Completed a report on hiring solutions for a client and collected $8,800 cash. 9 Completed a $16,800 project implementing a training program for a client, who will pay within 30 days. 10 Paid half of the account payable created on May 2. 19 Paid $8,300 cash for the annual premium on an insurance policy. 22 Received $13,600 as partial payment for the work completed on May 9. 25 Developed a performance review process for another client for $6,080 on credit. 25 Paid wages for May totalling $38,000. 31 Withdrew $5,800 cash from the business to take a trip to Paris in June. 31 Purchased $2,000 of additional office supplies on credit. 31 Paid $1,480 for the month's utility bill. 1. Prepare journal entries to record the transactions. View transaction list Journal entry worksheet Record the $16,800 cash prepaid for three months' rent for an office. Note: Enter debits before credits. Date General Journal Debit Credit May 01, 2020 View general journal Record entry Clear entry Record the credit purchases of office equipment for $28,000 and office supplies for $5,600. Note: Enter debits before credits. Date General Journal Debit Credit May 02, 2020 View general journal Clear entry Record entry Journal entry worksheet Record the completion of $16,800 project for a client, who will pay within 30 days. Note: Enter debits before credits. Debit General Journal Date Credit May 09, 2020 View general journal Journal entry worksheet Record the Payment of half of the account payable created on May 2. Note: Enter debits before credits. Debit Credit Date General Journal May 10, 2020 View general journal Clear entry Record entry Record the payment of cash $8,300 for the annual premium on an insurance policy. Note: Enter debits before credits. Date General Journal Debit Credit May 19, 2020 View general journal Clear entry Record entry Journal entry worksheet Record the partial payment of $13,600 received for the work completed on May 9. Note: Enter debits before credits. Debit General Journal Date Credit May 22, 2020 ed Record the payment of $1,480 for the month's utility bill. Note: Enter debits before credits. Date General Journal Debit Credit May 31, 2020 1 2&3. Complete the following accounts (use the balance column format or T-accounts): Cash (101); Accounts Receivable (106); Office Supplies (124); Prepaid Insurance (128); Prepaid Rent (131); Office Equipment (163); Accounts Payable (201); Elizabeth Wong, Capital (301); Elizabeth Wong, Withdrawals (302); Services Revenue (403); Wages Expense (623); and Utilities Expense (690). Post the entries to the accounts. (Record the transactions in chronological order.) 101: Cash Date PR Debit Credit Balance G1 G1 G1 G1 G1 G1 G1 G1 G1 Saved 106. Accounts Receivable Date PR Debit Credit Balance G1 G1 G1 G1 oped rint 124: Office Supplies Credit Date Debit Balance PR -G1 G1 G1 128: Prepaid Insurance Date PR Debit Credit Balance G1 G1 G1 131: Prepaid Rent Debit PR Credit Balance Date G1 G1 G1 163: Office Equipment Date PR Debit Credit Balance G1 G1 G1 201: Accounts Payable PR Debit Credit Balance Date G1 G1 G1 G1 301: Elizabeth Wong, Capital Date PR Debit Credit Balance G1 G1 G1 302: Elizabeth Wong, Withdrawals Credit Balance Debit Date PR G1 G1 G1 403: Services Revenue Date PR Debit Credit Balance G1 G1 G1 G1 623: Wages Expense Balance Date PR Credit Debit G1 G1 0 G1 690. Utilities Expense Date PR Debit Credit Balance G1 G1 G1 4. Prepare a trial balance at May 31, 2020. HR SOLUTIONS Trial Balance May 31, 2020 Account Titles Debit Credit S 0 $ 0 TotalsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started