Given:

(1) Suppose bid-ask price for 6-month Euro FRA one year from now is 4-4.5%

(2) Bid-ask price for 6-month Euro-dollar FRA one year from now is 5-5.5%

(3) one year forward rate is $1.3-1.305/euro

(4) 18-month forward rate today is $1.3100-1.3205/Euro

Are they are arbitrage opportunities out there in the quotes? Show all work.

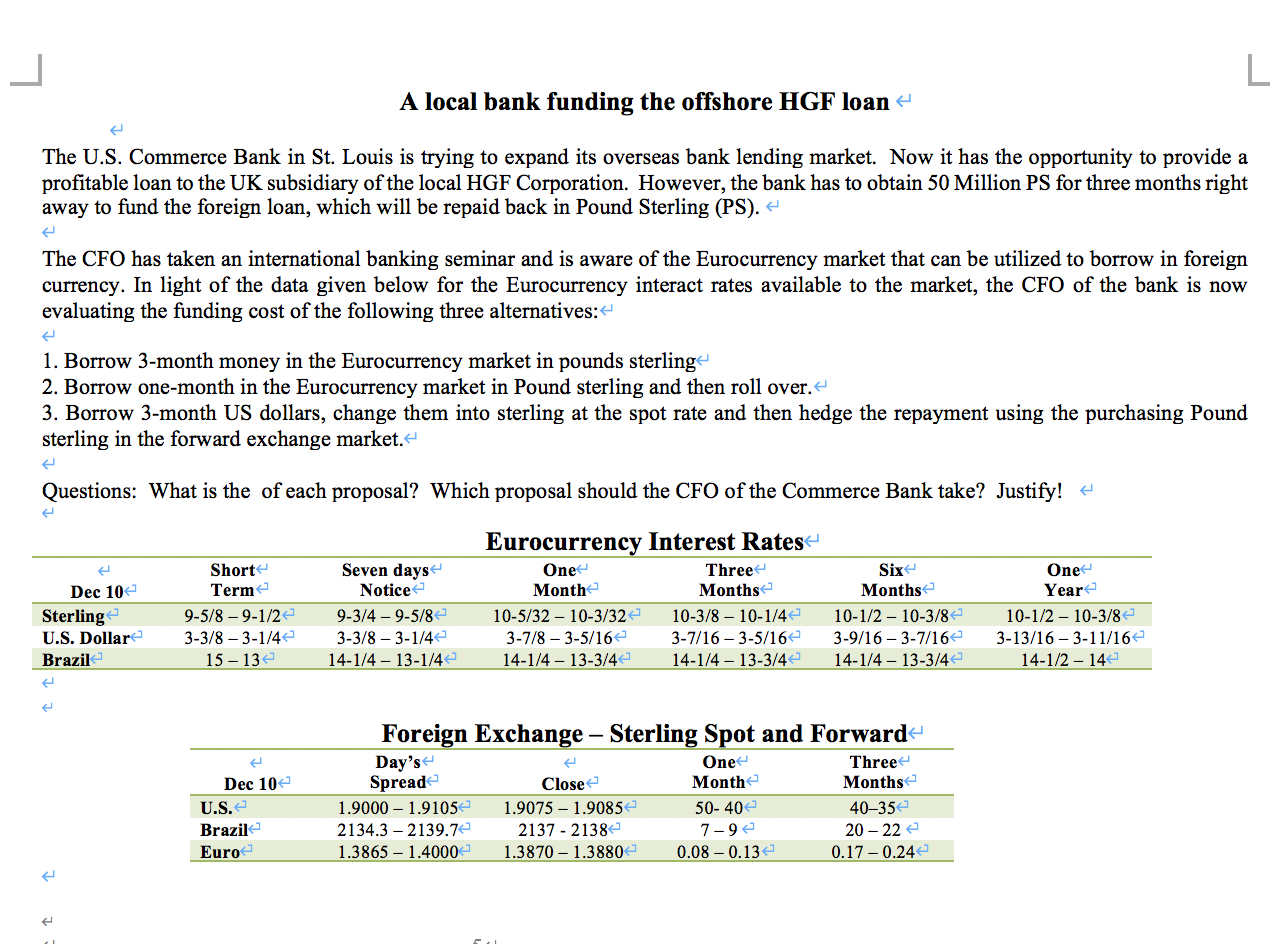

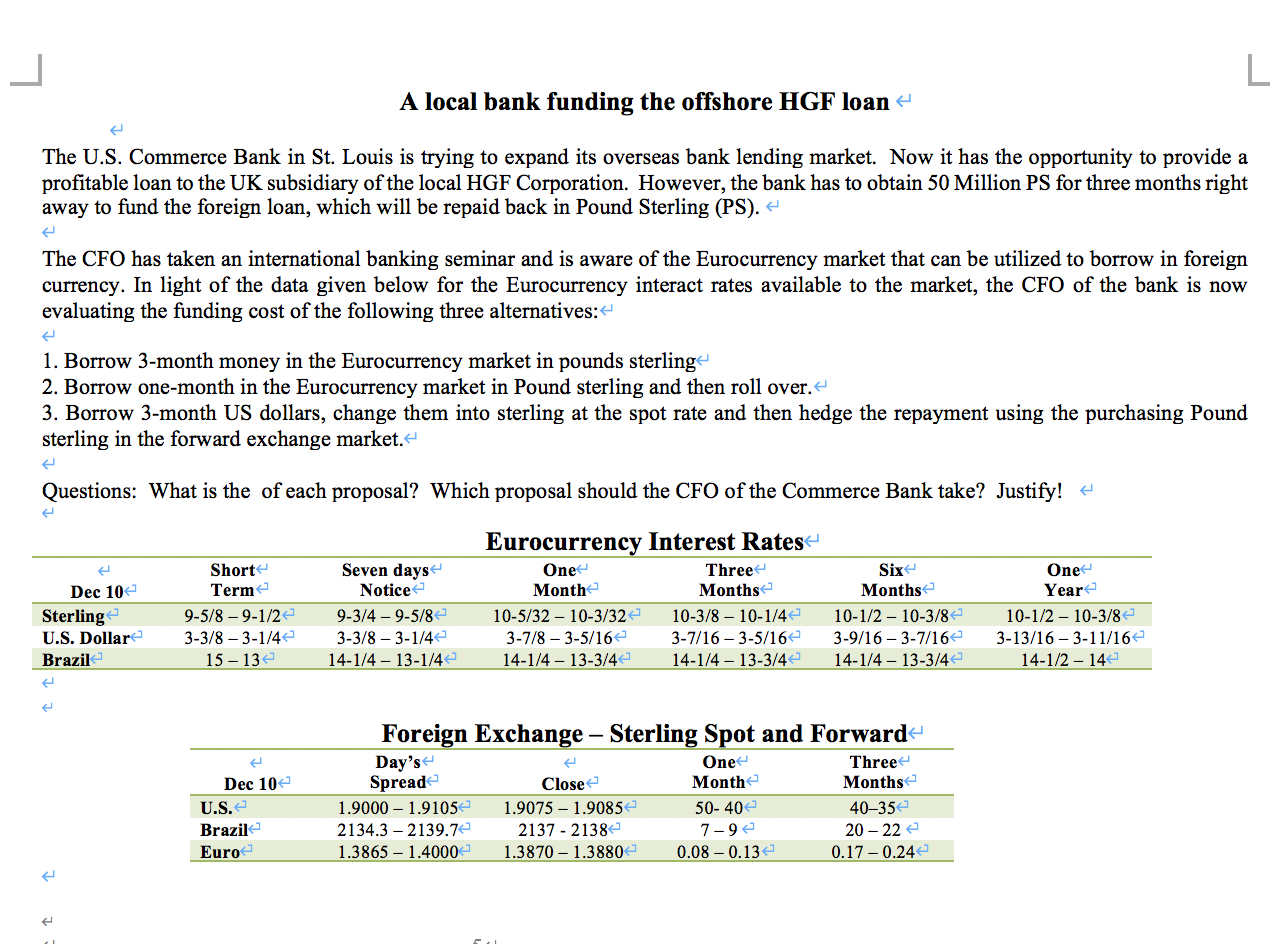

A local bank funding the offshore HGF loan The U.S. Commerce Bank in St. Louis is trying to expand its overseas bank lending market. Now it has the opportunity to provide a profitable loan to the UK subsidiary of the local HGF Corporation. However, the bank has to obtain 50 Million PS for three months right away to fund the foreign loan, which will be repaid back in Pound Sterling (PS). 4 The CFO has taken an international banking seminar and is aware of the Eurocurrency market that can be utilized to borrow in foreign currency. In light of the data given below for the Eurocurrency interact rates available to the market, the CFO of the bank is now evaluating the funding cost of the following three alternatives: 1. Borrow 3-month money in the Eurocurrency market in pounds sterling 2. Borrow one-month in the Eurocurrency market in Pound sterling and then roll over. 3. Borrow 3-month US dollars, change them into sterling at the spot rate and then hedge the repayment using the purchasing Pound sterling in the forward exchange market. Questions: What is the of each proposal? Which proposal should the CFO of the Commerce Bank take? Justify! Dec 10 Sterling U.S. Dollar Brazil Short Term 9-5/8-9-1/2 3-3/8 - 3-1/42 15 -13 Seven days Notice 9-3/4 - 9-5/8 3-3/8 - 3-1/4 14-1/4 13-1/42 Eurocurrency Interest Rates One Three Month Months 10-5/32 10-3/32 1 0-3/8 10-1/4 3-7/8-3-5/16 3-7/16 - 3-5/16 14-1/4 13-3/4 14-1/4 13-3/ 4 Six Months 10-1/2 - 10-3/8 3-9/16-3-7/162 1 4-1/4 - 13-3/4 One Year 10-1/2 - 10-3/8 3-13/16-3-11/16 14-1/2 - 14- tt Dec 102 U.S. Brazil Euro Foreign Exchange - Sterling Spot and Forward Day's One Three Spread Close Month Months 1.9000 - 1.91052 1.9075 - 1.90852 50-40 40352 2134.3 - 2139.72 2137 - 21384 7-9 20 - 22 1.3865 1.4000 1.3870 - 1.3880 0.08 -0.132 0.17 0.24 - A local bank funding the offshore HGF loan The U.S. Commerce Bank in St. Louis is trying to expand its overseas bank lending market. Now it has the opportunity to provide a profitable loan to the UK subsidiary of the local HGF Corporation. However, the bank has to obtain 50 Million PS for three months right away to fund the foreign loan, which will be repaid back in Pound Sterling (PS). 4 The CFO has taken an international banking seminar and is aware of the Eurocurrency market that can be utilized to borrow in foreign currency. In light of the data given below for the Eurocurrency interact rates available to the market, the CFO of the bank is now evaluating the funding cost of the following three alternatives: 1. Borrow 3-month money in the Eurocurrency market in pounds sterling 2. Borrow one-month in the Eurocurrency market in Pound sterling and then roll over. 3. Borrow 3-month US dollars, change them into sterling at the spot rate and then hedge the repayment using the purchasing Pound sterling in the forward exchange market. Questions: What is the of each proposal? Which proposal should the CFO of the Commerce Bank take? Justify! Dec 10 Sterling U.S. Dollar Brazil Short Term 9-5/8-9-1/2 3-3/8 - 3-1/42 15 -13 Seven days Notice 9-3/4 - 9-5/8 3-3/8 - 3-1/4 14-1/4 13-1/42 Eurocurrency Interest Rates One Three Month Months 10-5/32 10-3/32 1 0-3/8 10-1/4 3-7/8-3-5/16 3-7/16 - 3-5/16 14-1/4 13-3/4 14-1/4 13-3/ 4 Six Months 10-1/2 - 10-3/8 3-9/16-3-7/162 1 4-1/4 - 13-3/4 One Year 10-1/2 - 10-3/8 3-13/16-3-11/16 14-1/2 - 14- tt Dec 102 U.S. Brazil Euro Foreign Exchange - Sterling Spot and Forward Day's One Three Spread Close Month Months 1.9000 - 1.91052 1.9075 - 1.90852 50-40 40352 2134.3 - 2139.72 2137 - 21384 7-9 20 - 22 1.3865 1.4000 1.3870 - 1.3880 0.08 -0.132 0.17 0.24