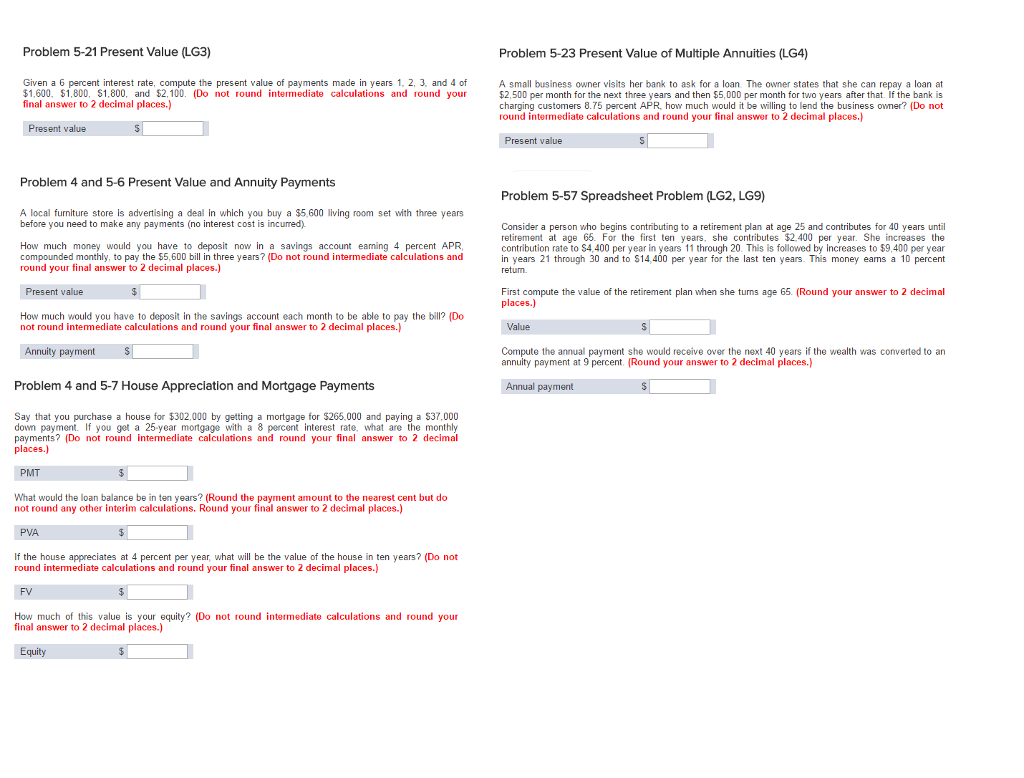

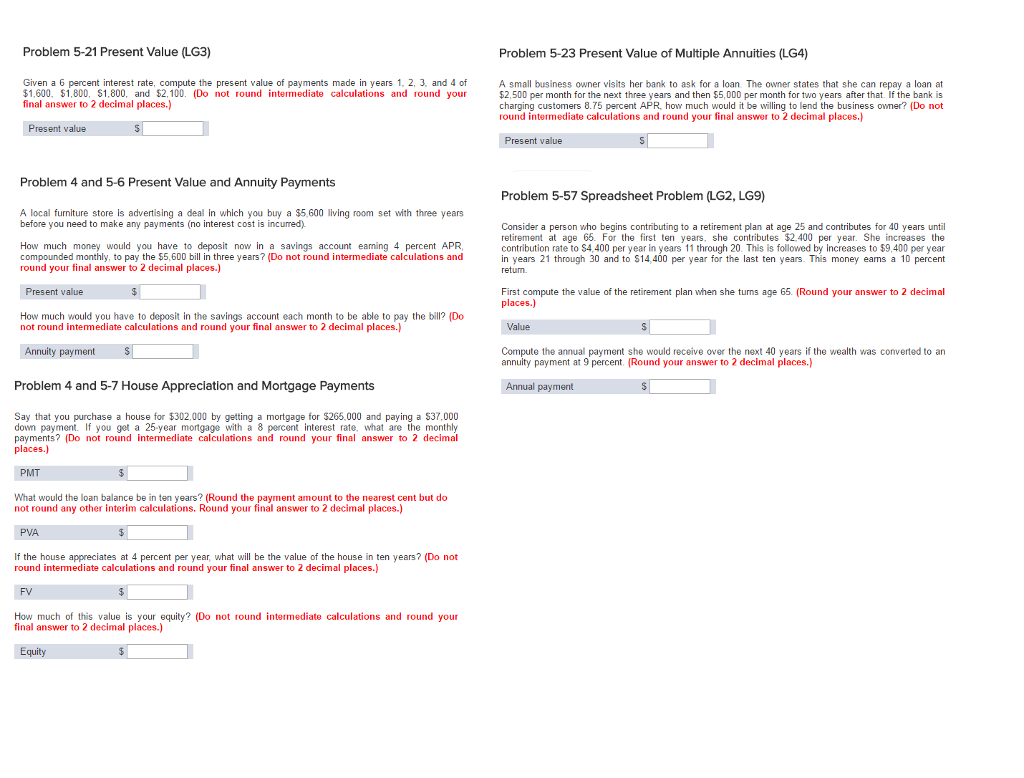

Given a 6 percent interest rate, compute the present value of payments made in years 1. 2. 3. and 4 of $1, 600. $1, 800, S1.800. and $2, 100. (Do not round intermediate calculations and round your final answer to 2 decimal places.) A local furniture store Is advertising a deal in which you buy a $5 600 living room set with three years before you need to make any payments (no interest cost is incurred). How much money would you have to deposit now in a savings account earning 4 percent APR compounded monthly, to pay the $5, 600 bill in three years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) A small business owner visits her bank to ask for a loan the owner states that she can repay a loan at $2 500 per month for the next three years and then $5.000 per month for two years after that If the bank is charging customers 8.75 percent APR. how much would it be willing to lend the business owner? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Consider a person who begins contributing to a retirement plan at age 25 and contributes for 40 years until retirement at age 66. For the first ten years, she contributes $2, 400 per year She increases the contribution rate to S4.400 per year in years 11 through 20 This is followed by increases to $9, 400 per year in years 21 through 30 and to $14.400 per year for the last ten years This money earns a 10 percent return First compute the value of the retirement plan when she turns age 65 (Round your answer to 2 decimal places.) How much would you have to deposit in the savings account each month to be able to pay the bill? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Compute the annual payment she would receive over the next 40 years if the wealth was converted to an annuity payment at 9 percent (Round your answer to 2 decimal places.) Say that you purchase a house for $302,000 by getting a mortgage for 5266.000 and paying a S37.000 down payment If you get a 25-year mortgage with a 8 percent interest rate, what are the monthly payments? (Do not round intermediate calculations and round your final answer to 2 decimal places.) What would the loan balance be in ten years? (Round the payment amount to the nearest cent but do not round any other interim calculations. Round your final answer to 2 decimal places.) If the house appreciates at 4 percent per year what will be the value of the house in ten years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) How much of this value is your equity? (Do not round intermediate calculations and round your final answer to 2 decimal places.)