Answered step by step

Verified Expert Solution

Question

1 Approved Answer

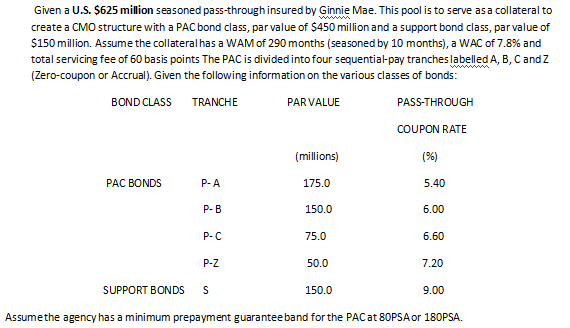

Given a U.S. $625 million seasoned pass-through insured by Ginnie Mae. This pool is to serve as a collateral to create a CMO structure

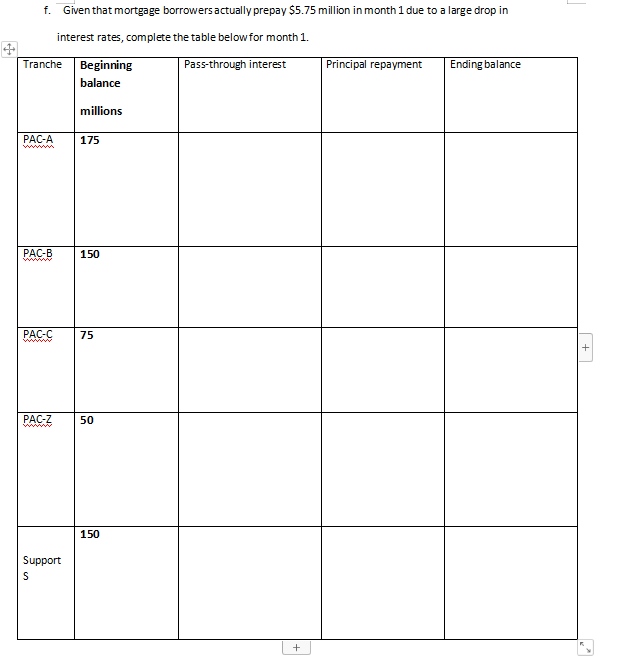

Given a U.S. $625 million seasoned pass-through insured by Ginnie Mae. This pool is to serve as a collateral to create a CMO structure with a PAC bond class, par value of $450 million and a support bond class, par value of $150 million. Assume the collateral has a WAM of 290 months (seasoned by 10 months), a WAC of 7.8% and total servicing fee of 60 basis points The PAC is divided into four sequential-pay tranches labelled A, B, C and Z (Zero-coupon or Accrual). Given the following information on the various classes of bonds: BOND CLASS TRANCHE PAR VALUE PASS-THROUGH PAC BONDS P-A P-B P-C P-Z (millions) 175.0 150.0 75.0 50.0 150.0 COUPON RATE (%) 5.40 6.00 6.60 7.20 SUPPORT BONDS S Assume the agency has a minimum prepayment guarantee band for the PAC at 80PSA or 180PSA. 9.00 f. Given that mortgage borrowers actually prepay $5.75 million in month 1 due to a large drop in interest rates, complete the table below for month 1. Pass-through interest Tranche PAC-A 175 PAC-B www PAC-C wwwwww PAC-Z Beginning balance millions Support S 150 75 50 150 + Principal repayment Ending balance +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To complete the table for month 1 we need to calculate the passthrough interest principal repayment and ending balance for each tranche Here are the c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started