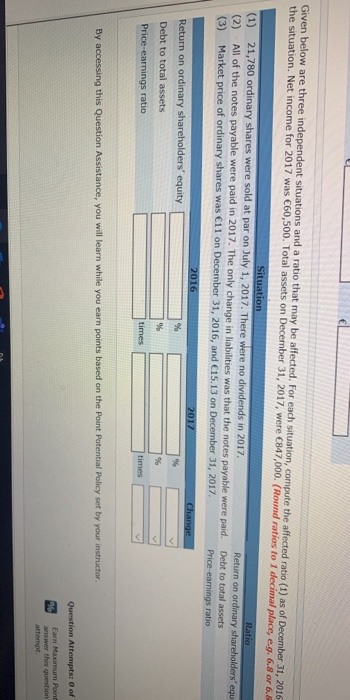

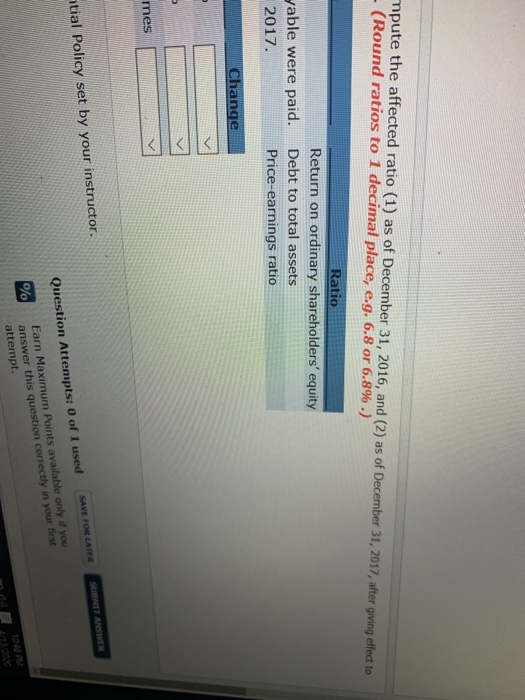

Given below are three independent situations and a ratio that may be affected. For each situation, compute the affected ratio (1) as of December 31, 2016 the situation. Net income for 2017 was 60,500. Total assets on December 31, 2017, were 847,000. (Round ratios to I decimal place, e.g. 6.8 or 6.8 (1) (2) (3) Situation 21,780 ordinary shares were sold at par on July 1, 2017. There were no dividends in 2017 All of the notes payable were paid in 2017. The only change in liabilities was that the notes payable were paid Market price of ordinary shares was 11 on December 31, 2016, and 15.13 on December 31, 2017 Ratio Return on ordinary shareholders' equ Debt to total assets Price-earnings ratio 2016 Change Return on ordinary shareholders' equity Debt to total assets % Price-earnings ratio By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. Question Attempts: 0 of Earn Maximum Point answer this question mpute the affected ratio (1) as of December 31, 2016, and (2) as of December 31, 2017, after giving effect to - (Round ratios to 1 decimal place, e.g. 6.8 or 6,8%.) Ratio Return on ordinary shareholders' equity Debt to total assets Price-earnings ratio yable were paid. 2017. Change mes SUBMIT ANSWER SAVE FOR LATER tial Policy set by your instructor. Question Attempts: 0 of 1 used Earn Maximum Points available only if you answer this question correctly in your first attempt. 2013/2020 Given below are three independent situations and a ratio that may be affected. For each situation, compute the affected ratio (1) as of December 31, 2016 the situation. Net income for 2017 was 60,500. Total assets on December 31, 2017, were 847,000. (Round ratios to I decimal place, e.g. 6.8 or 6.8 (1) (2) (3) Situation 21,780 ordinary shares were sold at par on July 1, 2017. There were no dividends in 2017 All of the notes payable were paid in 2017. The only change in liabilities was that the notes payable were paid Market price of ordinary shares was 11 on December 31, 2016, and 15.13 on December 31, 2017 Ratio Return on ordinary shareholders' equ Debt to total assets Price-earnings ratio 2016 Change Return on ordinary shareholders' equity Debt to total assets % Price-earnings ratio By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. Question Attempts: 0 of Earn Maximum Point answer this question mpute the affected ratio (1) as of December 31, 2016, and (2) as of December 31, 2017, after giving effect to - (Round ratios to 1 decimal place, e.g. 6.8 or 6,8%.) Ratio Return on ordinary shareholders' equity Debt to total assets Price-earnings ratio yable were paid. 2017. Change mes SUBMIT ANSWER SAVE FOR LATER tial Policy set by your instructor. Question Attempts: 0 of 1 used Earn Maximum Points available only if you answer this question correctly in your first attempt. 2013/2020