Question

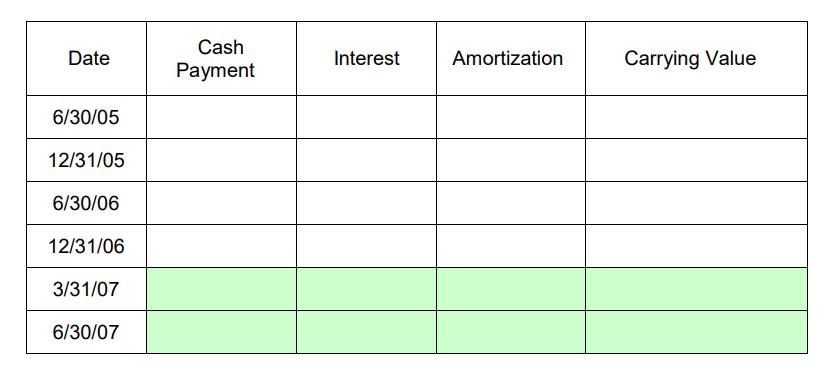

Given below is a blank amortization table for the Jolie bonds. Fill in the first four columns of the table up through 12/31/06 (ie. for

Given below is a blank amortization table for the Jolie bonds. Fill in the first four columns of the table up through 12/31/06 (ie. for the first four rows). The remaining three columns and bottom two rows are included for your convenience. Round all values to the nearest dollar for your calculations. Use the effective interest rate rounded to the nearest hundredth of a percent.

2. Write Jolie’s journal entry to record the initial sale of the bonds on 6/30/05.

3. Write Jolie’s 12/31/05 journal entry relating to this bond issue.

4.Write the 3/31/07 journal entry Jolie makes to record the repurchase of the bonds via the call option.

5.Was this bond repurchase economically a good idea for Jolie? How much of an economic (not accounting) gain or loss did they make on the repurchase? Was this economic gain or loss reflected in the journal entry in #5? If not, why not?

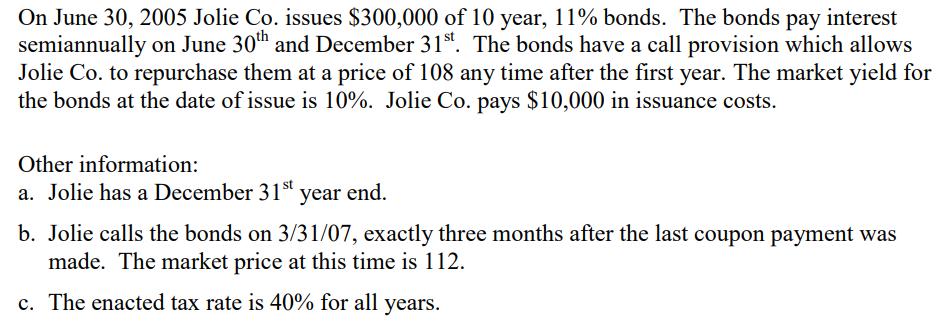

On June 30, 2005 Jolie Co. issues $300,000 of 10 year, 11% bonds. The bonds pay interest semiannually on June 30th and December 31st. The bonds have a call provision which allows Jolie Co. to repurchase them at a price of 108 any time after the first year. The market yield for the bonds at the date of issue is 10%. Jolie Co. pays $10,000 in issuance costs. Other information: a. Jolie has a December 31st year year end. b. Jolie calls the bonds on 3/31/07, exactly three months after the last coupon payment was made. The market price at this time is 112. c. The enacted tax rate is 40% for all years.

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Lets tackle each part of your question step by step 1 Amortization Table Well calculate the c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started