Question

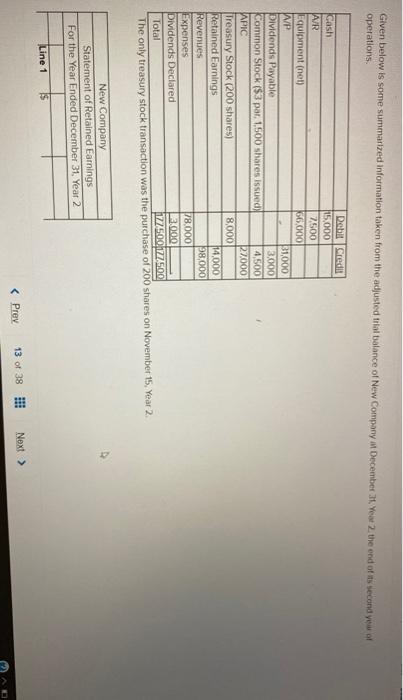

Given below is some summarized information taken from the adjusted trial balance of New Company at December 31, Year 2, the end of its second

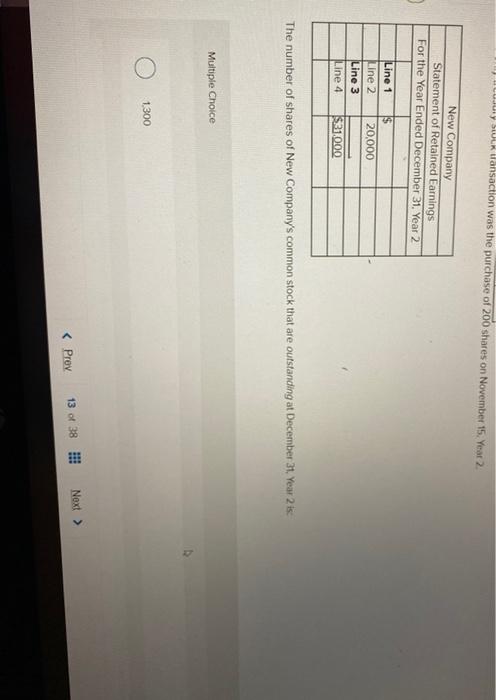

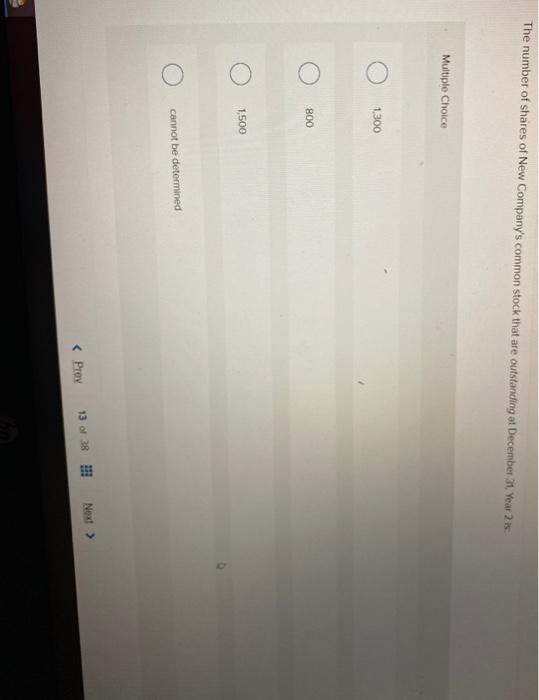

Given below is some summarized information taken from the adjusted trial balance of New Company at December 31, Year 2, the end of its second year of operations. Debit Credit Cash A/R Equipment (net) WP Dividends Payable Common Stock ($3 par, 1,500 shares issued) APIC Treasury Stock (200 shares) Retained Earnings Revenues Expenses 15,000 7,500 66,000 31,000 3,000 4,500] 27,000 8,000 14,000 98,000 78,000 3.000 177500177,500 Dividends Declared Total The only treasury stock transaction was the purchase of 200 shares on November 15, Year 2. New Company Statement of Retained Earnings For the Year Ended December 31, Year 2 Line 1 $ Ty SULK transaction was the purchase of 200 shares on November 15, Year 2. New Company Statement of Retained Earnings For the Year Ended December 31, Year 2 Line 1 $ Line 2 20,000 Line 3 Line 4 $31.000 The number of shares of New Company's common stock that are outstanding at December 31, Year 2 is: Multiple Choice 1.300 The number of shares of New Company's common stock that are outstanding at December 31, Year 2 is: Multiple Choice 1,300 O 800 1,500 cannot be determined >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started