Answered step by step

Verified Expert Solution

Question

1 Approved Answer

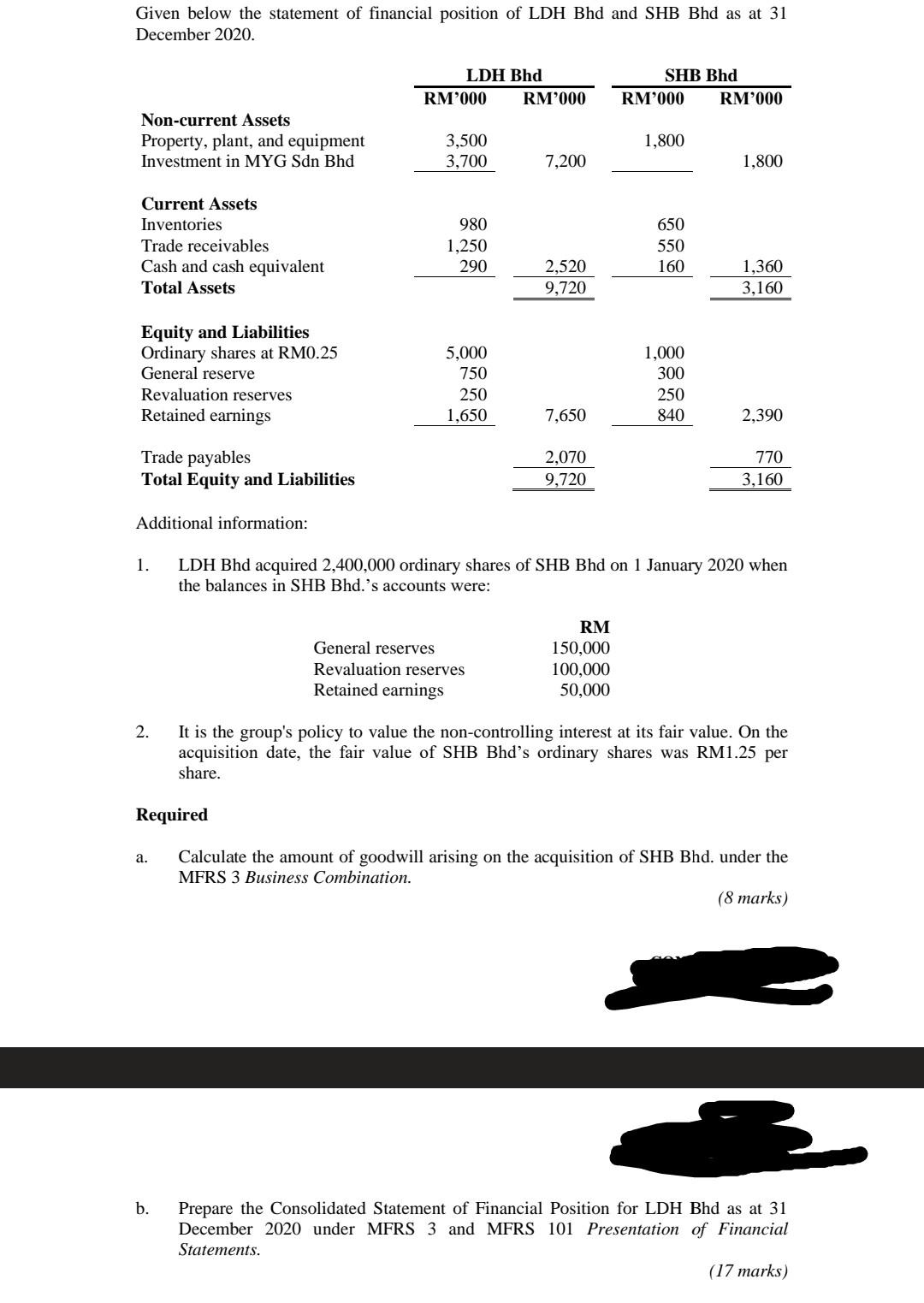

Given below the statement of financial position of LDH Bhd and SHB Bhd as at 31 December 2020. LDH Bhd RM000 RM'000 SHB Bhd RM'000

Given below the statement of financial position of LDH Bhd and SHB Bhd as at 31 December 2020. LDH Bhd RM000 RM'000 SHB Bhd RM'000 RM'000 Non-current Assets Property, plant, and equipment Investment in MYG Sdn Bhd 1,800 3,500 3,700 7,200 1,800 Current Assets Inventories Trade receivables Cash and cash equivalent Total Assets 980 1.250 290 650 550 160 2,520 9,720 1,360 3,160 Equity and Liabilities Ordinary shares at RM0.25 General reserve Revaluation reserves Retained earnings 5,000 750 250 1,650 1,000 300 250 840 7,650 2,390 Trade payables Total Equity and Liabilities 2,070 9,720 770 3,160 Additional information: 1. LDH Bhd acquired 2,400,000 ordinary shares of SHB Bhd on 1 January 2020 when the balances in SHB Bhd.'s accounts were: General reserves Revaluation reserves Retained earnings RM 150,000 100,000 50,000 2. It is the group's policy to value the non-controlling interest at its fair value. On the acquisition date, the fair value of SHB Bhd's ordinary shares was RM1.25 per share. Required a. Calculate the amount of goodwill arising on the acquisition of SHB Bhd. under the MFRS 3 Business Combination. (8 marks) b. Prepare the Consolidated Statement of Financial Position for LDH Bhd as at 31 December 2020 under MFRS 3 and MFRS 101 Presentation of Financial Statements. (17 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started