Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given Days Inventory (365 x Average inventory / Cost of sales) Sales/Store ($ million) = Transactions/Store (Thousands) x Sales/Transactions ($) Sales/Store ($ million) =

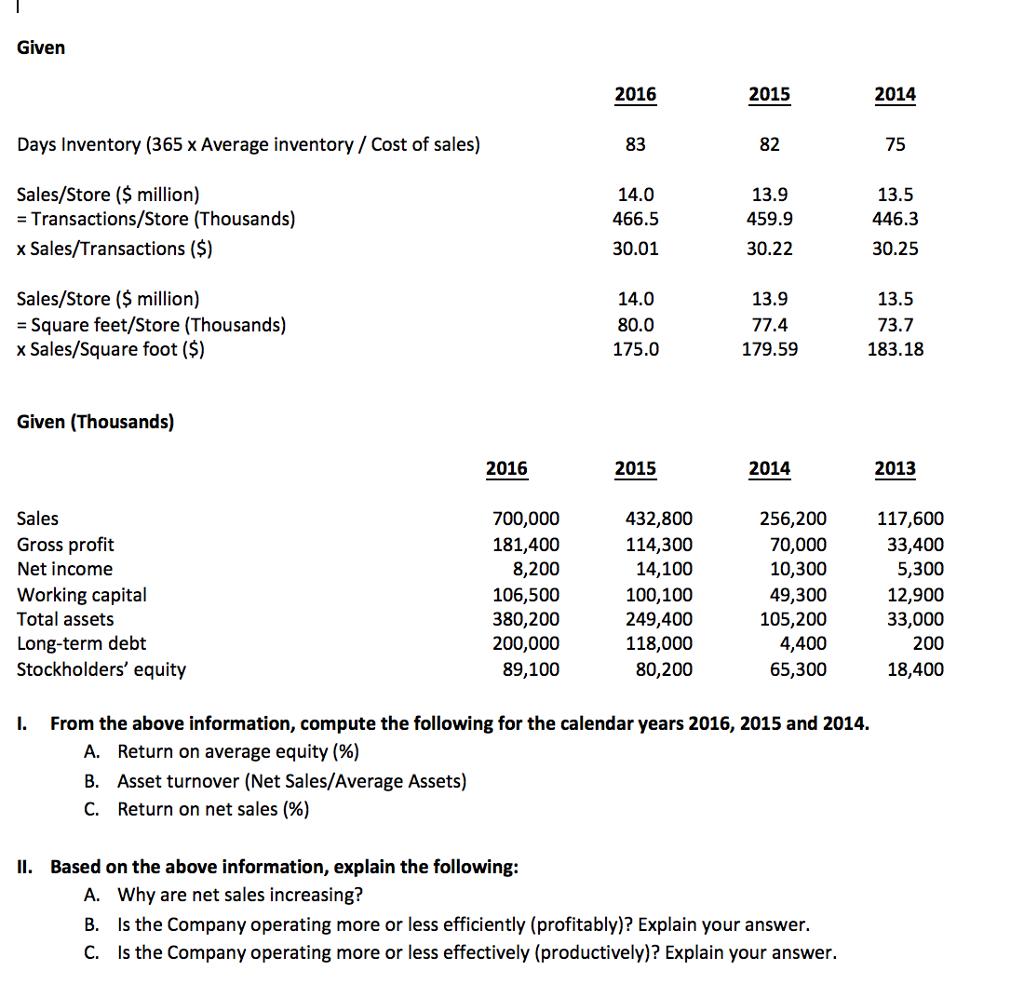

Given Days Inventory (365 x Average inventory / Cost of sales) Sales/Store ($ million) = Transactions/Store (Thousands) x Sales/Transactions ($) Sales/Store ($ million) = Square feet/Store (Thousands) x Sales/Square foot ($) Given (Thousands) Sales Gross profit Net income Working capital Total assets Long-term debt Stockholders' equity 1. 2016 700,000 181,400 8,200 106,500 380,200 200,000 89,100 2016 83 14.0 466.5 30.01 14.0 80.0 175.0 2015 432,800 114,300 14,100 100,100 249,400 118,000 80,200 2015 82 13.9 459.9 30.22 13.9 77.4 179.59 2014 256,200 70,000 10,300 49,300 105,200 4,400 65,300 From the above information, compute the following for the calendar years 2016, 2015 and 2014. A. Return on average equity (%) B. Asset turnover (Net Sales/Average Assets) C. Return on net sales (%) II. Based on the above information, explain the following: A. Why are net sales increasing? B. Is the Company operating more or less efficiently (profitably)? Explain your answer. C. Is the Company operating more or less effectively (productively)? Explain your answer. 2014 75 13.5 446.3 30.25 13.5 73.7 183.18 2013 117,600 33,400 5,300 12,900 33,000 200 18,400

Step by Step Solution

★★★★★

3.56 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Question IXA Return of average equity x Particulars Net Income Average equity Returns ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started