given debt beta, how to calculate unlevered beta?

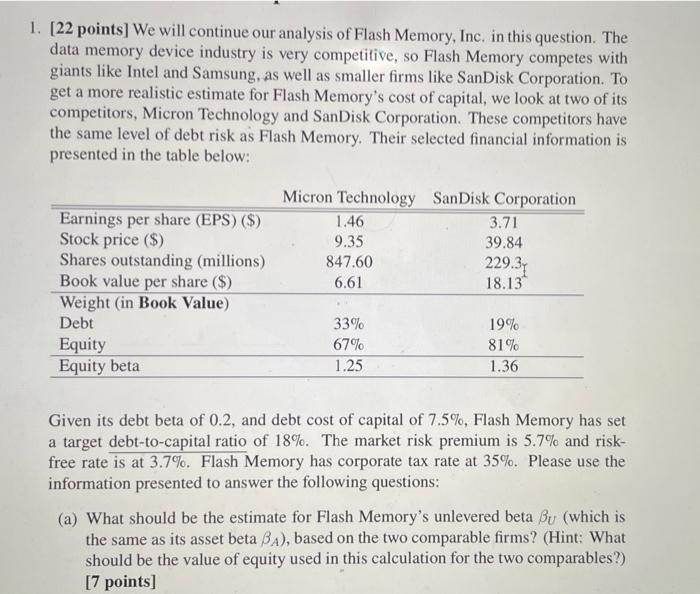

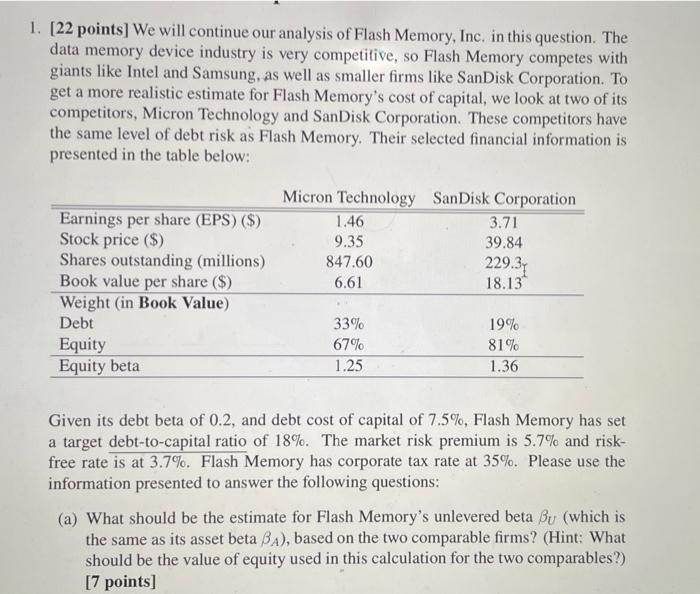

1. [22 points] We will continue our analysis of Flash Memory, Inc. in this question. The data memory device industry is very competitive, so Flash Memory competes with giants like Intel and Samsung, as well as smaller firms like SanDisk Corporation. To get a more realistic estimate for Flash Memory's cost of capital, we look at two of its competitors, Micron Technology and SanDisk Corporation. These competitors have the same level of debt risk as Flash Memory. Their selected financial information is presented in the table below: Micron Technology SanDisk Corporation 1.46 3.71 Earnings per share (EPS) ($) Stock price ($) 9.35 39.84 Shares outstanding (millions) 847.60 229.3 Book value per share ($) 6.61 18.13 Weight (in Book Value) Debt 33% 19% Equity 67% 81% Equity beta 1.25 1.36 Given its debt beta of 0.2, and debt cost of capital of 7.5%, Flash Memory has set a target debt-to-capital ratio of 18%. The market risk premium is 5.7% and risk- free rate is at 3.7%. Flash Memory has corporate tax rate at 35%. Please use the information presented to answer the following questions: (a) What should be the estimate for Flash Memory's unlevered beta Bu (which is the same as its asset beta BA), based on the two comparable firms? (Hint: What should be the value of equity used in this calculation for the two comparables?) [7 points] 1. [22 points] We will continue our analysis of Flash Memory, Inc. in this question. The data memory device industry is very competitive, so Flash Memory competes with giants like Intel and Samsung, as well as smaller firms like SanDisk Corporation. To get a more realistic estimate for Flash Memory's cost of capital, we look at two of its competitors, Micron Technology and SanDisk Corporation. These competitors have the same level of debt risk as Flash Memory. Their selected financial information is presented in the table below: Micron Technology SanDisk Corporation 1.46 3.71 Earnings per share (EPS) ($) Stock price ($) 9.35 39.84 Shares outstanding (millions) 847.60 229.3 Book value per share ($) 6.61 18.13 Weight (in Book Value) Debt 33% 19% Equity 67% 81% Equity beta 1.25 1.36 Given its debt beta of 0.2, and debt cost of capital of 7.5%, Flash Memory has set a target debt-to-capital ratio of 18%. The market risk premium is 5.7% and risk- free rate is at 3.7%. Flash Memory has corporate tax rate at 35%. Please use the information presented to answer the following questions: (a) What should be the estimate for Flash Memory's unlevered beta Bu (which is the same as its asset beta BA), based on the two comparable firms? (Hint: What should be the value of equity used in this calculation for the two comparables?) [7 points]