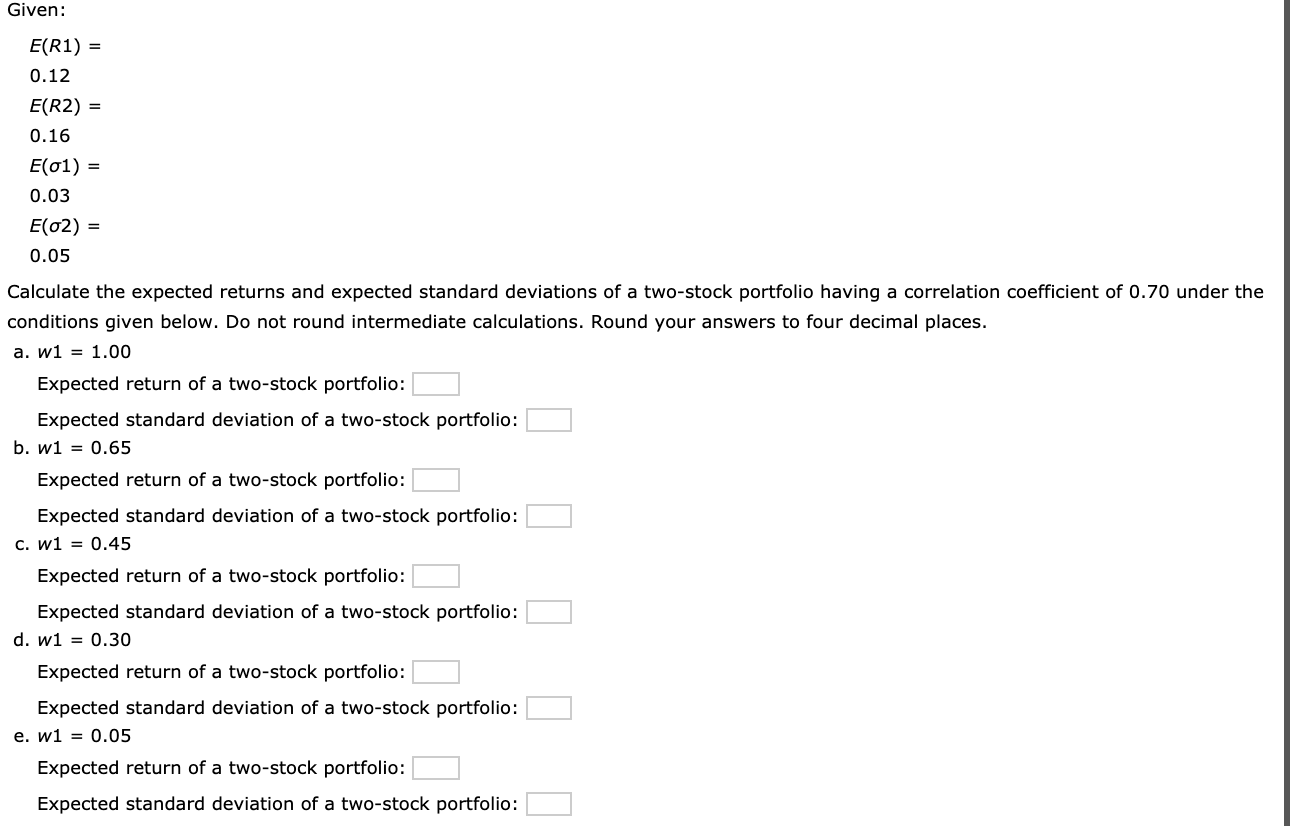

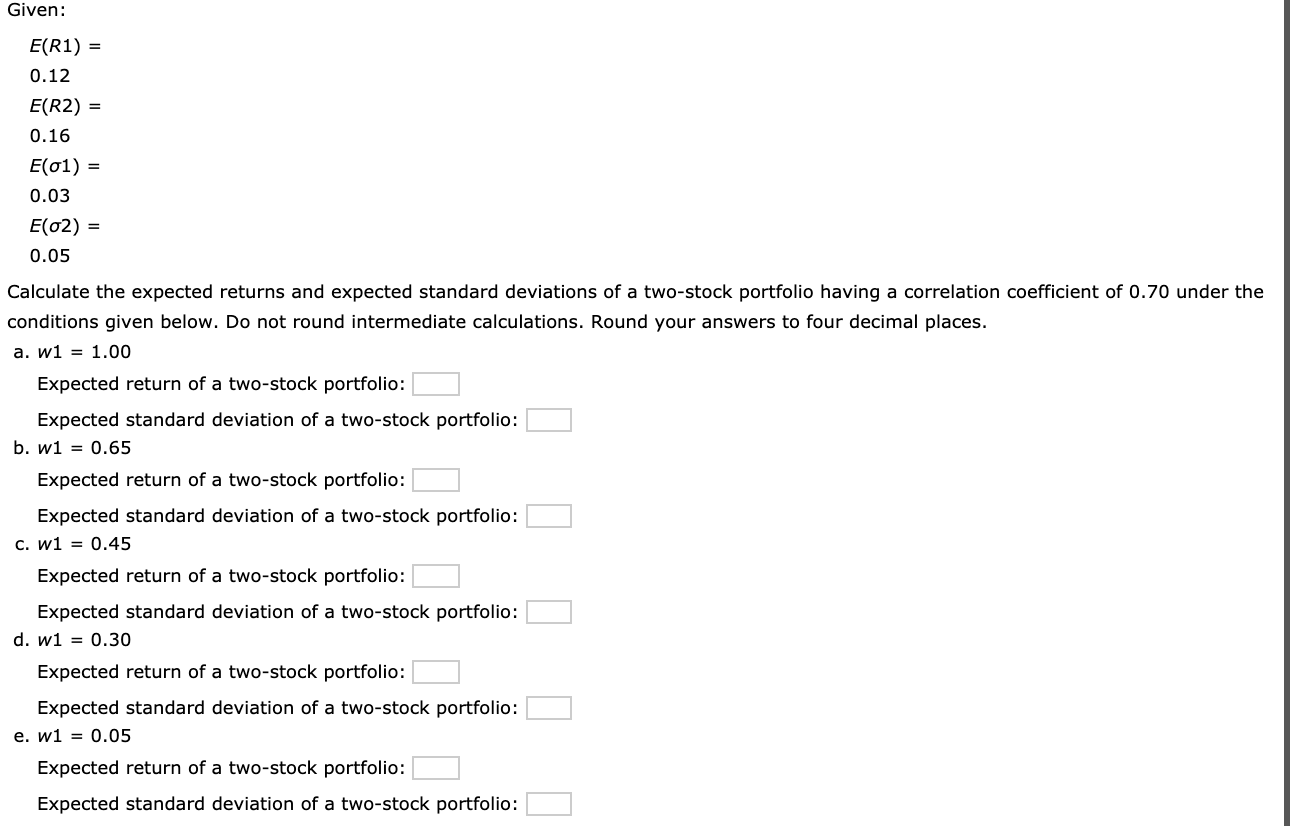

Given: E(R1) = 0.12 E(R2) = 0.16 E(01) = 0.03 E(02) = 0.05 Calculate the expected returns and expected standard deviations of a two-stock portfolio having a correlation coefficient of 0.70 under the conditions given below. Do not round intermediate calculations. Round your answers to four decimal places. a. w1 = 1.00 Expected return of a two-stock portfolio: Expected standard deviation of a two-stock portfolio: b. w1 = 0.65 Expected return of a two-stock portfolio: Expected standard deviation of a two-stock portfolio: C. W1 = 0.45 Expected return of a two-stock portfolio: Expected standard deviation of a two-stock portfolio: d. w1 = 0.30 Expected return of a two-stock portfolio: Expected standard deviation of a two-stock portfolio: e. w1 = 0.05 Expected return of a two-stock portfolio: Expected standard deviation of a two-stock portfolio: Choose the correct risk-return graph for weights from parts (a) through (e) when rij = -0.70; 0.00; 0.70. The correct graph is -Select- : . A. 0:10 .0.01. D.P29.03.29.04.0.5 p. 297,4.98... tandard Deviation of Return 12-0.70 2-0.00 -0.70 B. 1.4.1.02202.004. 22. 400 12-0.70 -0.000 2-0.70 Standard Deviation of Return 12-0.70 12-0.00 -0.70 ...091.03.202.224_022 2 2-0.70 ,2-0.00 2-0.70 Given: E(R1) = 0.12 E(R2) = 0.16 E(01) = 0.03 E(02) = 0.05 Calculate the expected returns and expected standard deviations of a two-stock portfolio having a correlation coefficient of 0.70 under the conditions given below. Do not round intermediate calculations. Round your answers to four decimal places. a. w1 = 1.00 Expected return of a two-stock portfolio: Expected standard deviation of a two-stock portfolio: b. w1 = 0.65 Expected return of a two-stock portfolio: Expected standard deviation of a two-stock portfolio: C. W1 = 0.45 Expected return of a two-stock portfolio: Expected standard deviation of a two-stock portfolio: d. w1 = 0.30 Expected return of a two-stock portfolio: Expected standard deviation of a two-stock portfolio: e. w1 = 0.05 Expected return of a two-stock portfolio: Expected standard deviation of a two-stock portfolio: Choose the correct risk-return graph for weights from parts (a) through (e) when rij = -0.70; 0.00; 0.70. The correct graph is -Select- : . A. 0:10 .0.01. D.P29.03.29.04.0.5 p. 297,4.98... tandard Deviation of Return 12-0.70 2-0.00 -0.70 B. 1.4.1.02202.004. 22. 400 12-0.70 -0.000 2-0.70 Standard Deviation of Return 12-0.70 12-0.00 -0.70 ...091.03.202.224_022 2 2-0.70 ,2-0.00 2-0.70