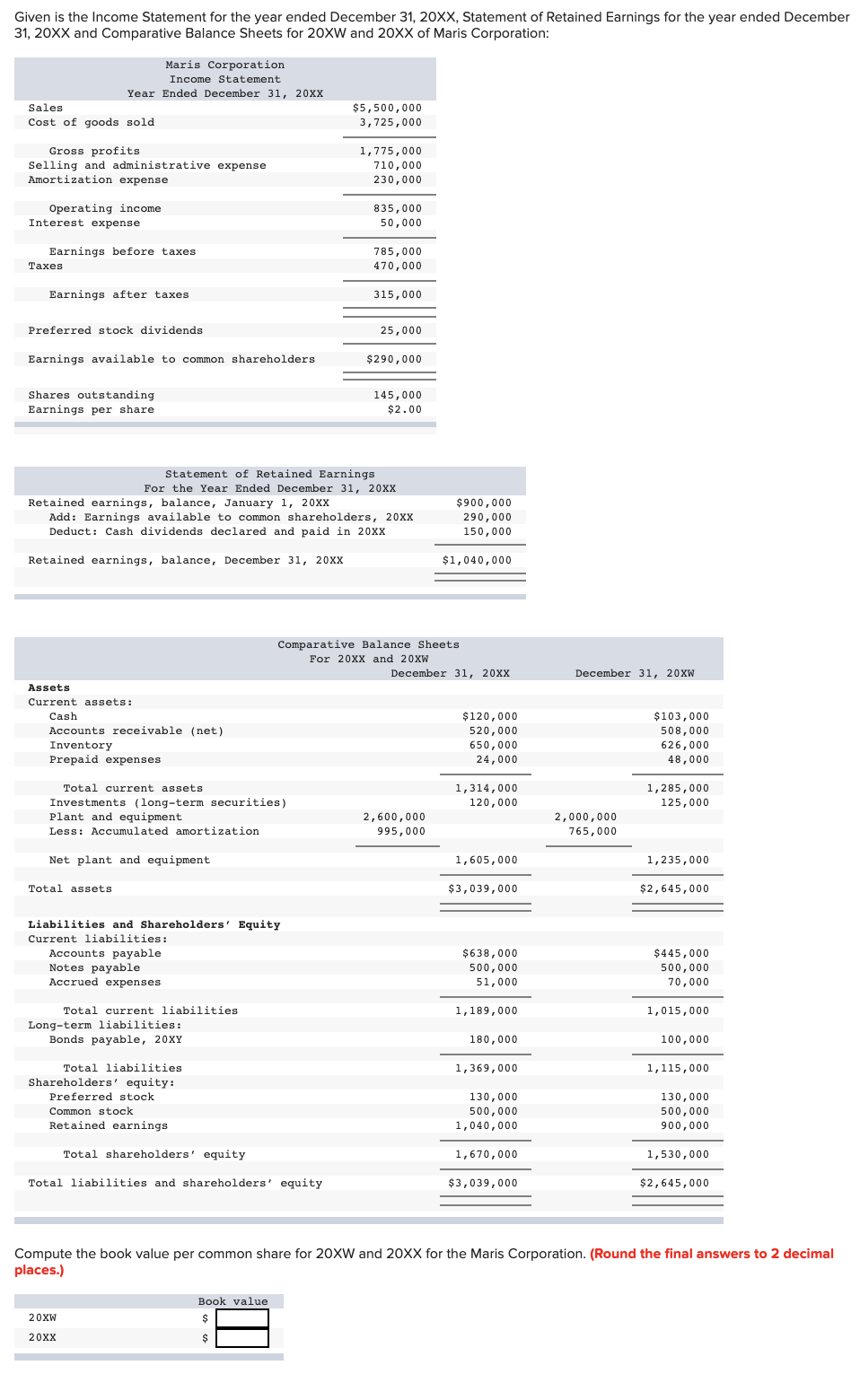

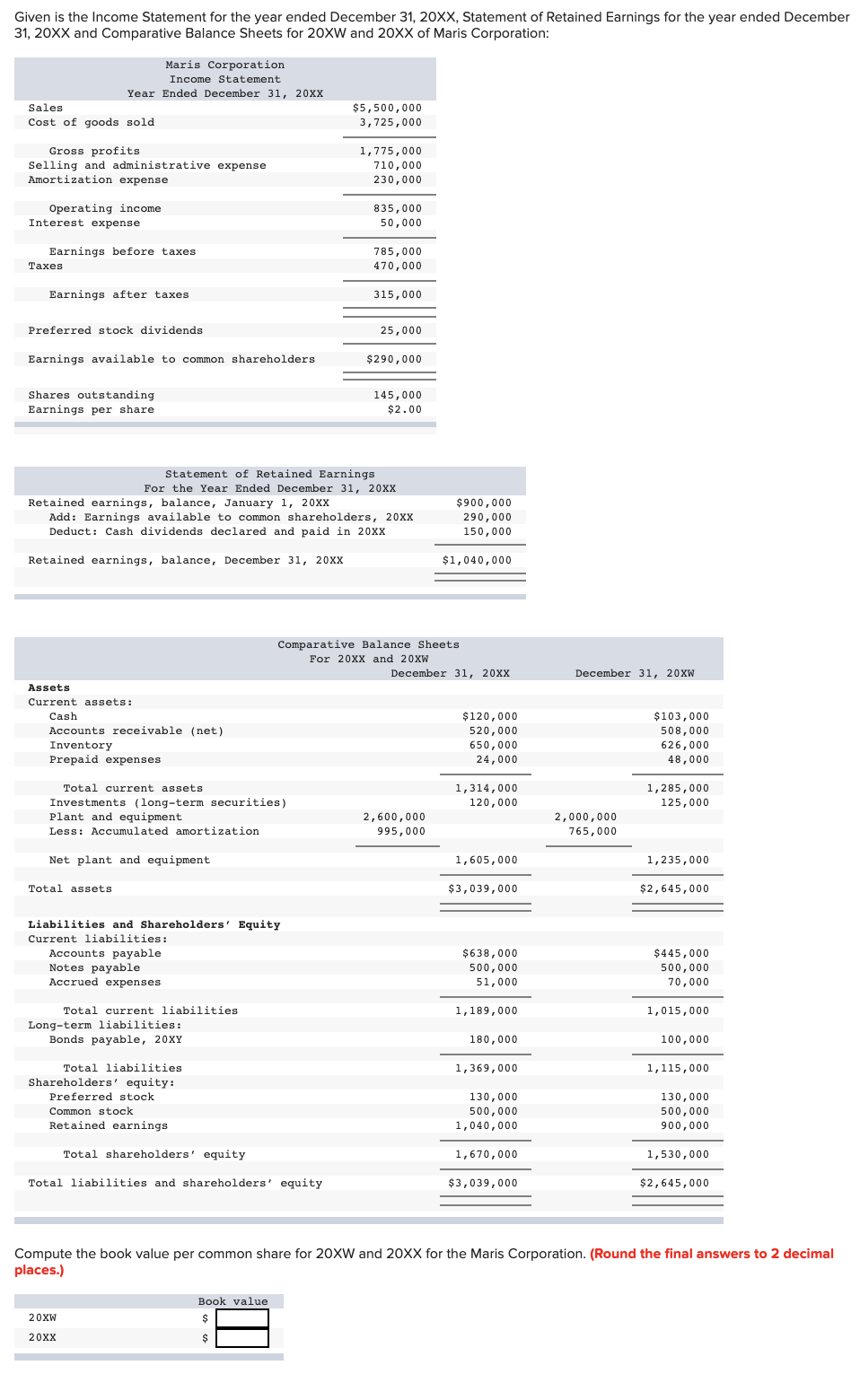

Given is the Income Statement for the year ended December 31, 20XX, Statement of Retained Earnings for the year ended December 31, 20XX and Comparative Balance Sheets for 20XW and 20XX of Maris Corporation: Maris Corporation Income Statement Year Ended December 31, 20xx Sales Cost of goods sold $5,500,000 3,725,000 Gross profits Selling and administrative expense Amortization expense 1,775,000 710,000 230,000 Operating income Interest expense 835,000 50,000 Earnings before taxes Taxes 785,000 470,000 Earnings after taxes 315,000 Preferred stock dividends 25,000 Earnings available to common shareholders $290,000 Shares outstanding Earnings per share 145,000 $2.00 Statement of Retained Earnings For the Year Ended December 31, 20XX Retained earnings, balance, January 1, 20XX Add: Earnings available to common shareholders, 20XX Deduct: Cash dividends declared and paid in 20XX $900,000 290,000 150,000 Retained earnings, balance, December 31, 20xx $1,040,000 Comparative Balance Sheets For 20xx and 20xw December 31, 20xx December 31, 20XW Assets Current assets: Cash Accounts receivable (net) Inventory Prepaid expenses $120,000 520,000 650,000 24,000 $103,000 508,000 626,000 48,000 1,314,000 120,000 1,285,000 125,000 Total current assets Investments (long-term securities) Plant and equipment Less: Accumulated amortization 2,600,000 995,000 2,000,000 765,000 Net plant and equipment 1,605,000 1,235,000 Total assets $3,039,000 $2,645,000 Liabilities and shareholders' Equity Current liabilities: Accounts payable Notes payable Accrued expenses $638,000 500,000 51,000 $445,000 500,000 70,000 1,189,000 1,015,000 Total current liabilities Long-term liabilities: Bonds payable, 20XY 180,000 100,000 1,369,000 1,115,000 Total liabilities Shareholders' equity: Preferred stock Common stock Retained earnings 130,000 500,000 1,040,000 130,000 500,000 900,000 Total shareholders' equity 1,670,000 1,530,000 Total liabilities and shareholders' equity $3,039,000 $2,645,000 Compute the book value per common share for 20XW and 20XX for the Maris Corporation. (Round the final answers to 2 decimal places.) Book value $ 20xw 20xx $