Question

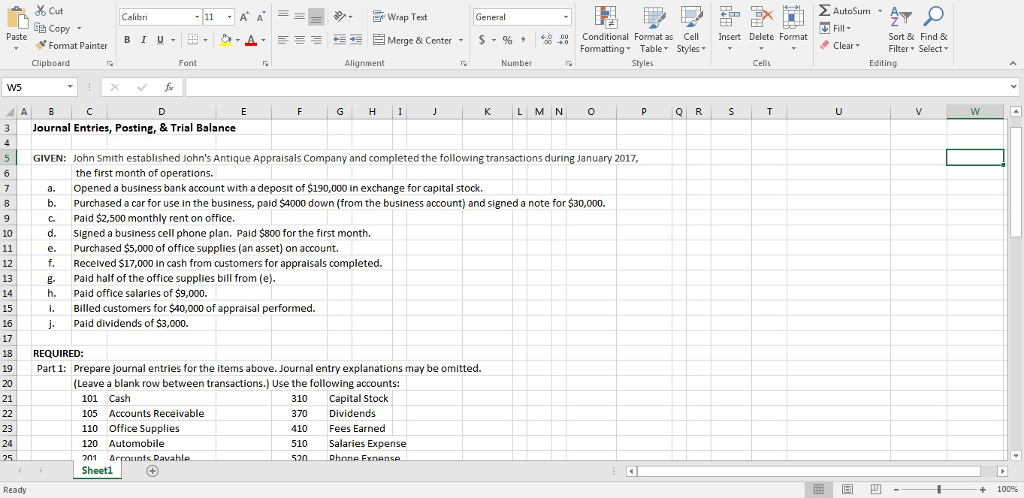

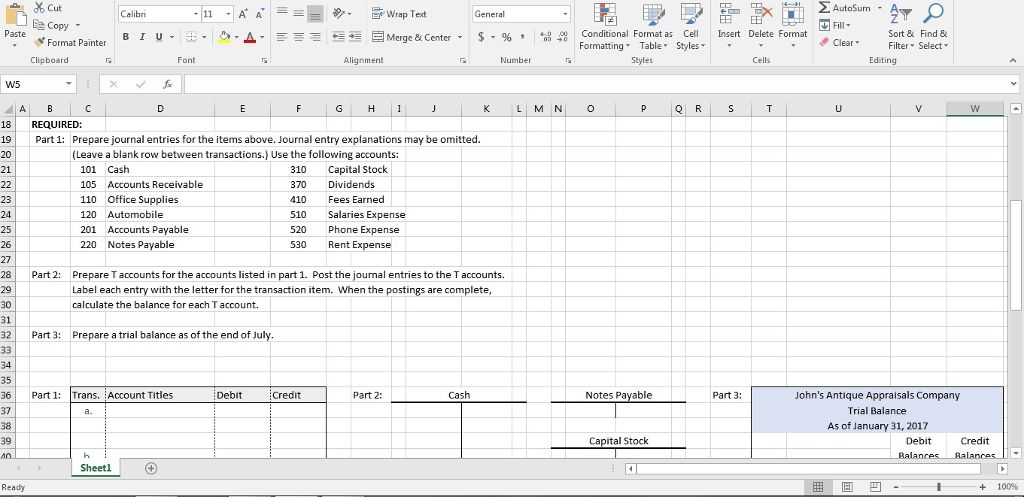

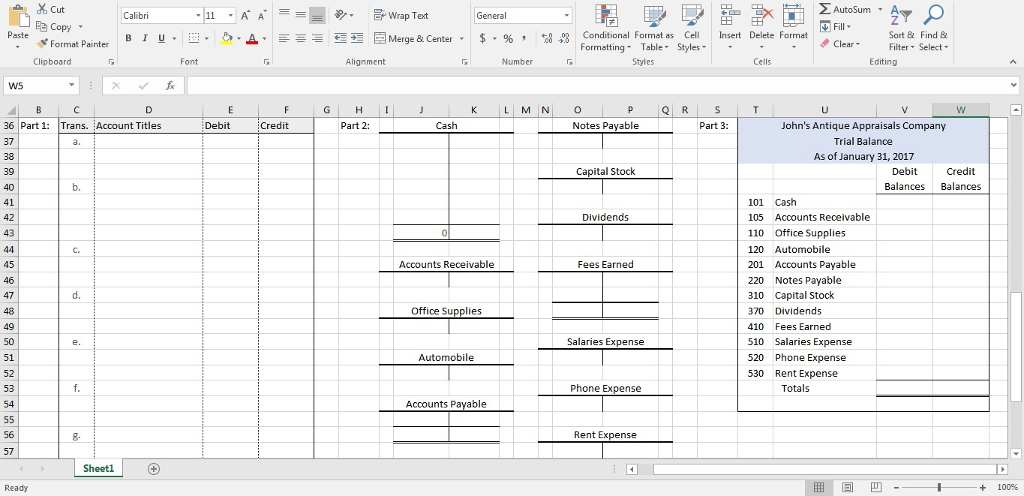

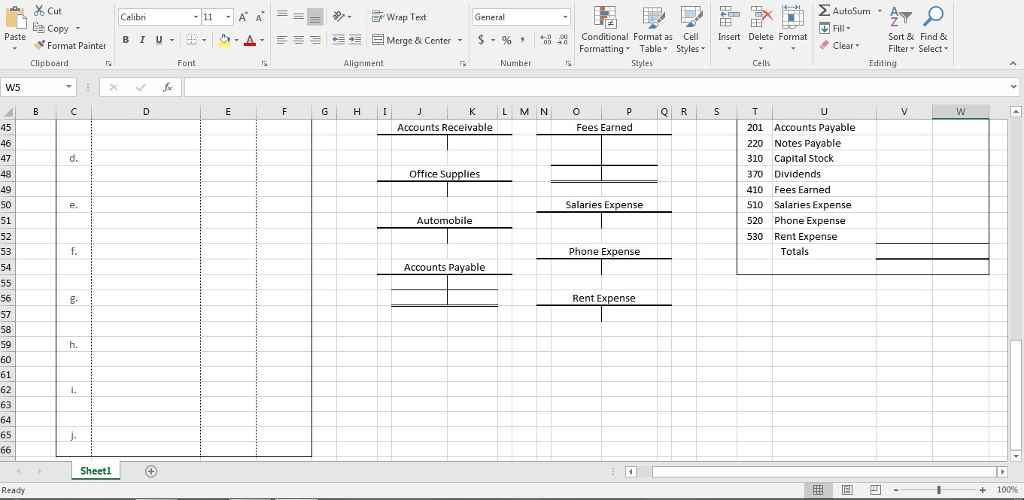

GIVEN: John Smith established John's Antique Appraisals Company and completed the following transactions during January 2017, the first month of operations. a. Opened a business

GIVEN: John Smith established John's Antique Appraisals Company and completed the following transactions during January 2017, the first month of operations.

a. Opened a business bank account with a deposit of $190,000 in exchange for capital stock.

b. Purchased a car for use in the business, paid $4000 down (from the business account) and signed a note for $30,000.

c. Paid $2,500 monthly rent on office.

d. Signed a business cell phone plan. Paid $800 for the first month.

e. Purchased $5,000 of office supplies (an asset) on account.

f. Received $17,000 in cash from customers for appraisals completed.

g. Paid half of the office supplies bill from (e).

h. Paid office salaries of $9,000.

i. Billed customers for $40,000 of appraisal performed.

j. Paid dividends of $3,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started