Answered step by step

Verified Expert Solution

Question

1 Approved Answer

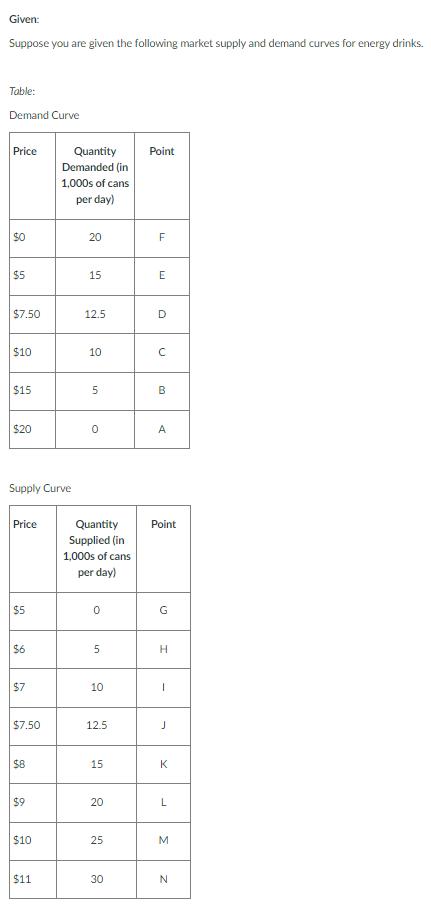

Given: Suppose you are given the following market supply and demand curves for energy drinks. Table: Demand Curve Price Quantity Demanded (in 1,000s of

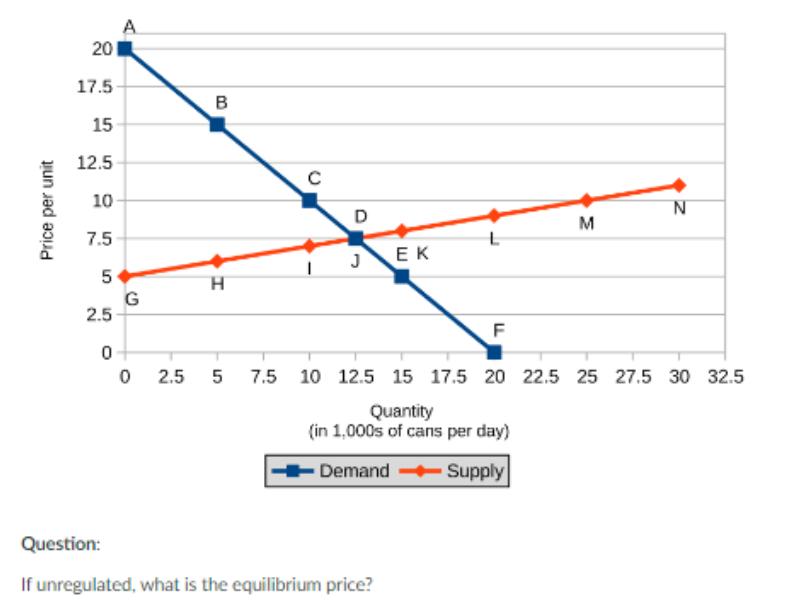

Given: Suppose you are given the following market supply and demand curves for energy drinks. Table: Demand Curve Price Quantity Demanded (in 1,000s of cans per day) 90 $0 20 Point LL F $5 15 E $7.50 12.5 D $10 10 C $15 5 B $20 0 A Supply Curve Price Quantity Supplied (in 1,000s of cans per day) Point $5 0 G $6 5 H $7 10 $7.50 $8 $9 12.5 J 15 45 20 20 K L $10 25 M $11 30 90 N Price per unit 201 17.5- 15 12.5 10- 7.5 A B 5 H G 2.5 0 0 2.5 5 7.5 C D JEK N M F 10 12.5 15 17.5 20 22.5 25 27.5 30 32.5 Quantity (in 1,000s of cans per day) Demand Supply Question: If unregulated, what is the equilibrium price? If unregulated, what is the equilibrium quantity? If unregulated, what is consumer surplus? If unregulated, what is producer surplus? Now suppose a $3 per unit tax is imposted. Assume the statutory burden specifies that firms will pay the tax. With the tax in place, what price is charged to consumers? Now suppose a $3 per unit tax is imposted. Assume the statutory burden specifies that firms will pay the tax. With the tax in place, what price do sellers receive net of the tax? Now suppose a $3 per unit tax is imposted. Assume the statutory burden specifies that firms will pay the tax. With the tax in place, how much of total tax revenue originates from the price increase experience by consumers? Now suppose a $3 per unit tax is imposted. Assume the statutory burden specifies that firms will pay the tax. With the tax in place, how much of total tax revenue originates from the price decrease experience by sellers?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started