Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given table Below answer the questions. Table 1.2 2020 Federal Tax Rates for Individual and Joint Taxpayers Income brackets Income Tax Rate Individual Taxpayers Joint

Given table Below answer the questions.

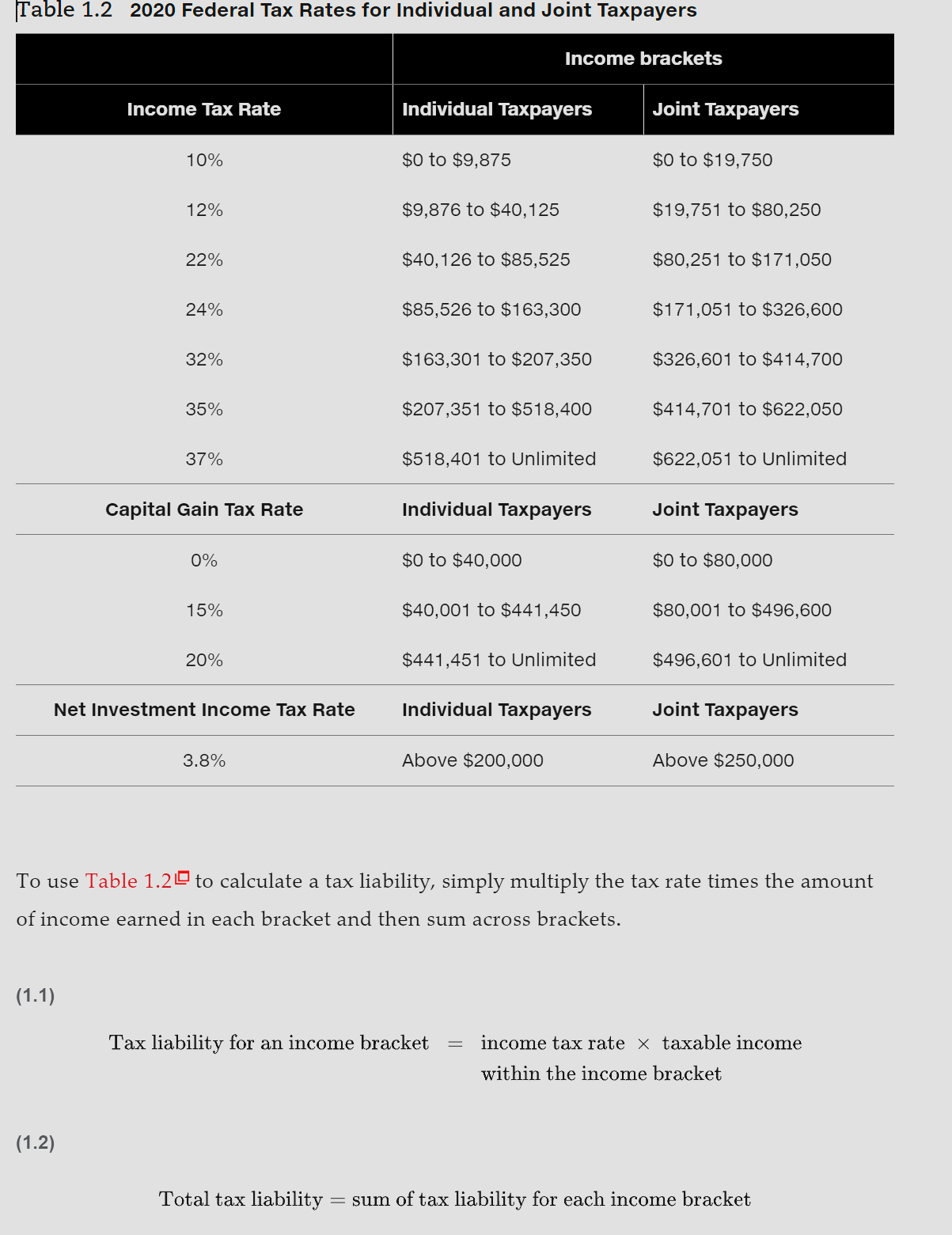

Table 1.2 2020 Federal Tax Rates for Individual and Joint Taxpayers Income brackets Income Tax Rate Individual Taxpayers Joint Taxpayers 10% $0 to $9,875 12% $9,876 to $40,125 $0 to $19,750 $19,751 to $80,250 22% $40,126 to $85,525 $80,251 to $171,050 24% $85,526 to $163,300 $171,051 to $326,600 32% $163,301 to $207,350 $326,601 to $414,700 35% $207,351 to $518,400 $414,701 to $622,050 37% $518,401 to Unlimited $622,051 to Unlimited Capital Gain Tax Rate Individual Taxpayers Joint Taxpayers 0% $0 to $40,000 15% $40,001 to $441,450 $0 to $80,000 $80,001 to $496,600 20% $441,451 to Unlimited $496,601 to Unlimited Net Investment Income Tax Rate Individual Taxpayers Joint Taxpayers 3.8% Above $200,000 Above $250,000 To use Table 1.2 to calculate a tax liability, simply multiply the tax rate times the amount of income earned in each bracket and then sum across brackets. (1.1) Tax liability for an income bracket income tax rate taxable income within the income bracket (1.2) Total tax liability = sum of tax liability for each income bracket

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started