Answered step by step

Verified Expert Solution

Question

1 Approved Answer

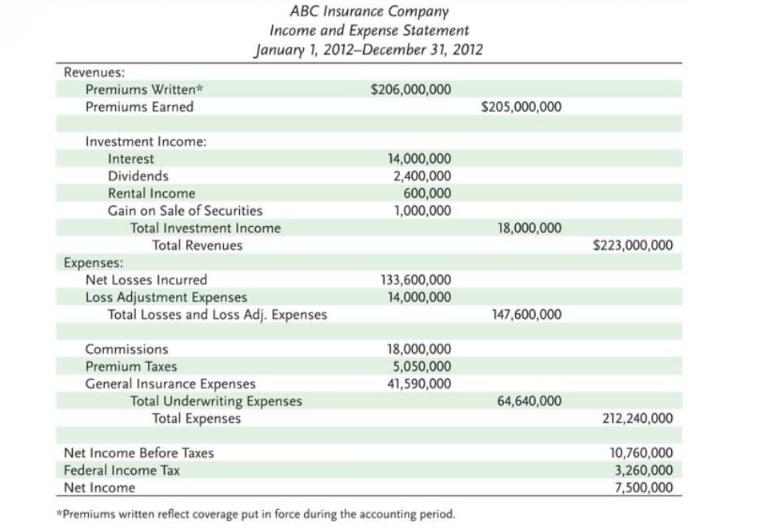

Given that ABC insurance company has the income and expense statement as provided in figure 6. 4 below Figure 6. 4 ABC Insurance Company

Given that ABC insurance company has the income and expense statement as provided in figure 6. 4 below Figure 6. 4 ABC Insurance Company Revenues: Premiums Written* Premiums Earned Investment Income: Interest Dividends Rental Income Gain on Sale of Securities Expenses: ABC Insurance Company Income and Expense Statement January 1, 2012-December 31, 2012 Total Investment Income Total Revenues Net Losses Incurred Loss Adjustment Expenses Total Losses and Loss Adj. Expenses Commissions Premium Taxes General Insurance Expenses Total Underwriting Expenses Total Expenses $206,000,000 14,000,000 2,400,000 600,000 1,000,000 133,600,000 14,000,000 18,000,000 5,050,000 41,590,000 Net Income Before Taxes Federal Income Tax Net Income *Premiums written reflect coverage put in force during the accounting period. $205,000,000 18,000,000 147,600,000 64,640,000 $223,000,000 212,240,000 10,760,000 3,260,000 7,500,000 Required: Calculate the following ratios for insurance company ABC indicating your opinion in this company Loss ratio 2- Expense ratio 3- Combined ratio_4--1 Overall operating ratio And comment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ABC INSURANCE COMPANY Name Institution Professor Course Date Calculating Loss Expense Combined and O...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started