Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given that equities carry more risk but also offer potentially unlimited returns, how would you use the concepts of Modern Portfolio Theory and the Efficient

Given that equities carry more risk but also offer potentially

unlimited returns, how would you use the concepts of

Modern Portfolio Theory and the Efficient Frontier to

optimize your investment strategy?

O Focus more on bonds, as they provide a safety net against potential bankruptcy.

Diversify your portfolio, including both equities and bonds, to balance risk and

return, and aim for an investment allocation that lies on the Efficient Frontier.

Focus solely on the few highest growth stocks in the equities market due to their

high return potential and ignore any risk factors.

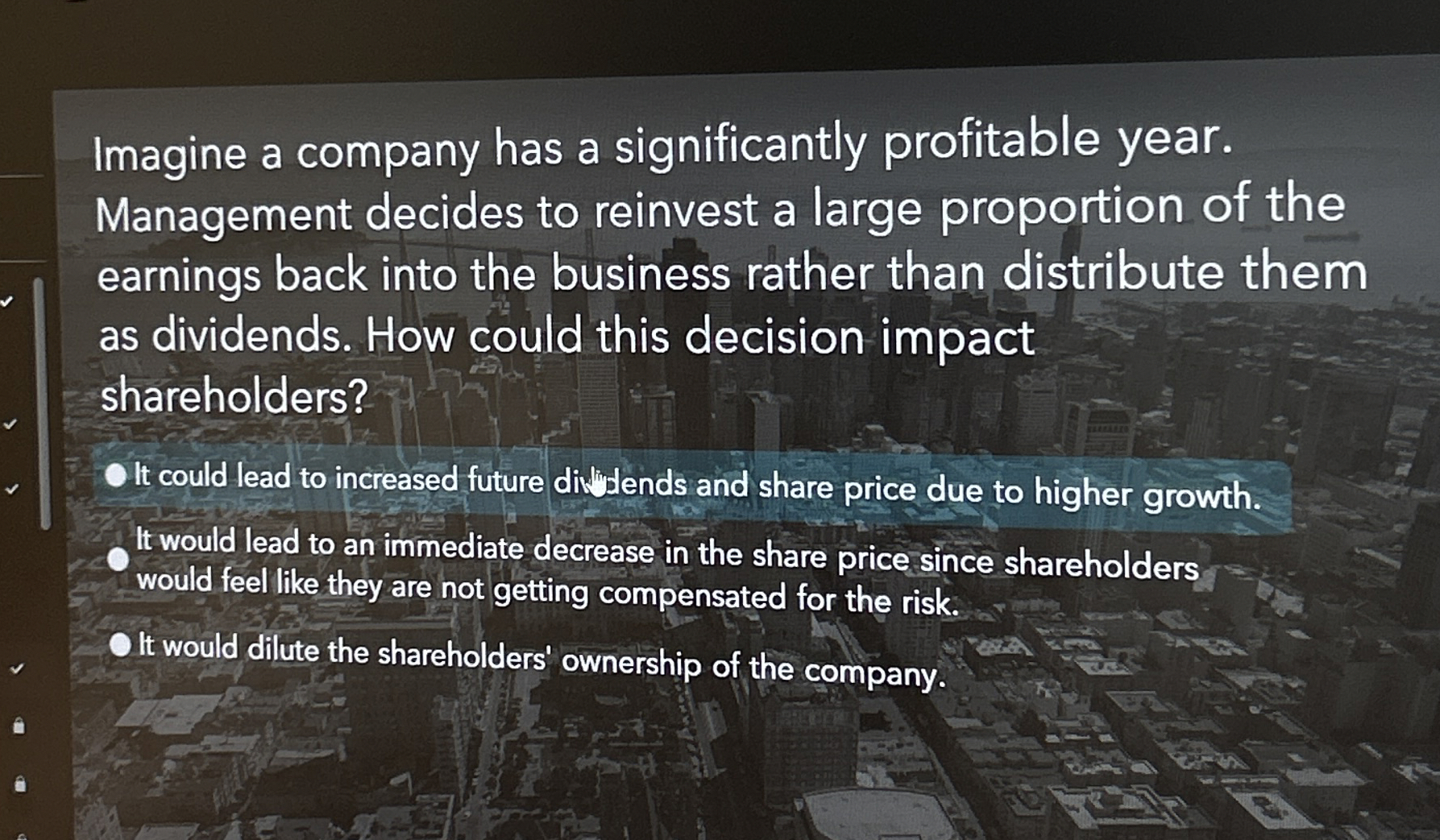

Imagine a company has a significantly profitable year.

Management decides to reinvest a large proportion of the

earnings back into the business rather than distribute them

as dividends. How could this decision impact

shareholders?

Olt could lead to increased future diflydends and share price due to higher growth.

It would lead to an inmediate decrease in the share price since shareholders

would feel like they are not getting compensated for the risk.

O It would dilute the shareholders' ownership of the company.

Imagine a company has a significantly profitable year.

Management decides to reinvest a large proportion of the

earnings back into the business rather than distribute them

as dividends. How could this decision impact

shareholders?

Olt could lead to increased future diflydends and share price due to higher growth.

It would lead to an inmediate decrease in the share price since shareholders

would feel like they are not getting compensated for the risk.

O It would dilute the shareholders' ownership of the company.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started