Question

Given that the annual risk-free interest rate on the margin account is 3% continuously compounded. For each futures contract, you will need to generate your

Given that the annual risk-free interest rate on the margin account is 3% continuously compounded. For each futures contract, you will need to generate your future prices, and you may refer to the instructions in the boxes above for the respective future contracts.

You need to verify whether you will receive a margin call after each of the settlements. Besides, you need to calculate the total amount needed to be deposit into the margin account if there is a margin call. This is because any margin call received will need to deposit an extra amount to achieve the minimum value of the maintenance level.

You need to calculate the remaining balances in the margin account after the last settlement.

Determine which of the position you want to enter based on the calculation you had done.

You need to calculate the subsequent settlement future price to receive for margin call after settlement for your chosen position.

Show ALL the workings in your answer script. (Including the calculation, the excel function generates and presents your answer in a table form).

Remarks: If you are using the random function in the excel files, the values will be changing from time to time. You need to fix the value once you obtained your futures contract prices. (You may use Snipping tools to cut the table from the Microsoft Excel and paste it in the Microsoft Word file.)

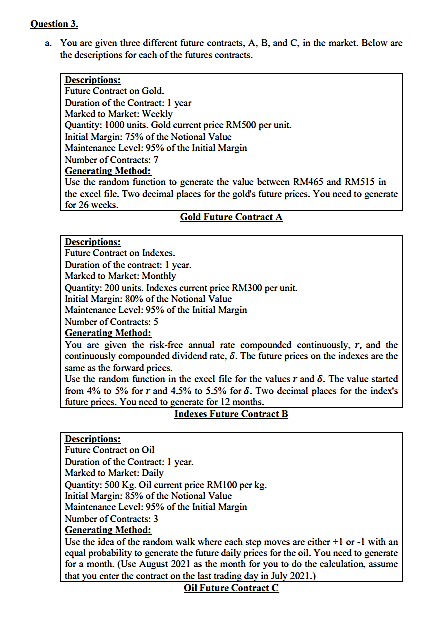

Question 3. a. You are given three different future contracts, A, B, and C, in the market. Below are the descriptions for each of the futures contracts. Descriptions: Future Contract on Gold. Duration of the Contract: 1 year Marked to Market: Weekly Quantity: 1000 units. Gold current price RM500 per unit. Initial Margin: 75% of the Notional Value Maintenance Level: 95% of the Initial Margin Number of Contracts: 7 Generating Method: Use the random function to generate the value between RM465 and RM515 in the excel file. Two decimal places for the gold's future prices. You need to generate for 26 weeks. Gold Future Contract A Descriptions: Future Contract on Indexes. Duration of the contract: 1 year. Marked to Market: Monthly Quantity: 200 units. Indexes current price RM300 per unit. Initial Margin: 80% of the Notional Value Maintenance Level: 95% of the Initial Margin Number of Contracts: 5 Generating Method: You are given the risk-free annual rate compounded continuously, r, and the continuously compounded dividend rate, 8. The future prices on the indexes are the same as the forward prices. Use the random function in the excel file for the values r and 8. The value started from 4% to 5% for r and 4.5% to 5.5% for S. Two decimal places for the index's future prices. You need to generate for 12 months. Indexes Future Contract B Descriptions: Future Contract on Oil Duration of the Contract: 1 year. Marked to Market: Daily Quantity: 500 Kg. Oil current price RM100 per kg. Initial Margin: 85% of the Notional Value Maintenance Level: 95% of the Initial Margin Number of Contracts: 3 Generating Method: Use the idea of the random walk where cach step moves are cither + or -1 with an equal probability to generate the future daily prices for the oil. You need to generate for a month. (Use August 2021 ss the month for you to do the calculation, assume that you enter the contract on the last trading day in July 2021.) Oil Future Contract c Question 3. a. You are given three different future contracts, A, B, and C, in the market. Below are the descriptions for each of the futures contracts. Descriptions: Future Contract on Gold. Duration of the Contract: 1 year Marked to Market: Weekly Quantity: 1000 units. Gold current price RM500 per unit. Initial Margin: 75% of the Notional Value Maintenance Level: 95% of the Initial Margin Number of Contracts: 7 Generating Method: Use the random function to generate the value between RM465 and RM515 in the excel file. Two decimal places for the gold's future prices. You need to generate for 26 weeks. Gold Future Contract A Descriptions: Future Contract on Indexes. Duration of the contract: 1 year. Marked to Market: Monthly Quantity: 200 units. Indexes current price RM300 per unit. Initial Margin: 80% of the Notional Value Maintenance Level: 95% of the Initial Margin Number of Contracts: 5 Generating Method: You are given the risk-free annual rate compounded continuously, r, and the continuously compounded dividend rate, 8. The future prices on the indexes are the same as the forward prices. Use the random function in the excel file for the values r and 8. The value started from 4% to 5% for r and 4.5% to 5.5% for S. Two decimal places for the index's future prices. You need to generate for 12 months. Indexes Future Contract B Descriptions: Future Contract on Oil Duration of the Contract: 1 year. Marked to Market: Daily Quantity: 500 Kg. Oil current price RM100 per kg. Initial Margin: 85% of the Notional Value Maintenance Level: 95% of the Initial Margin Number of Contracts: 3 Generating Method: Use the idea of the random walk where cach step moves are cither + or -1 with an equal probability to generate the future daily prices for the oil. You need to generate for a month. (Use August 2021 ss the month for you to do the calculation, assume that you enter the contract on the last trading day in July 2021.) Oil Future Contract cStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started