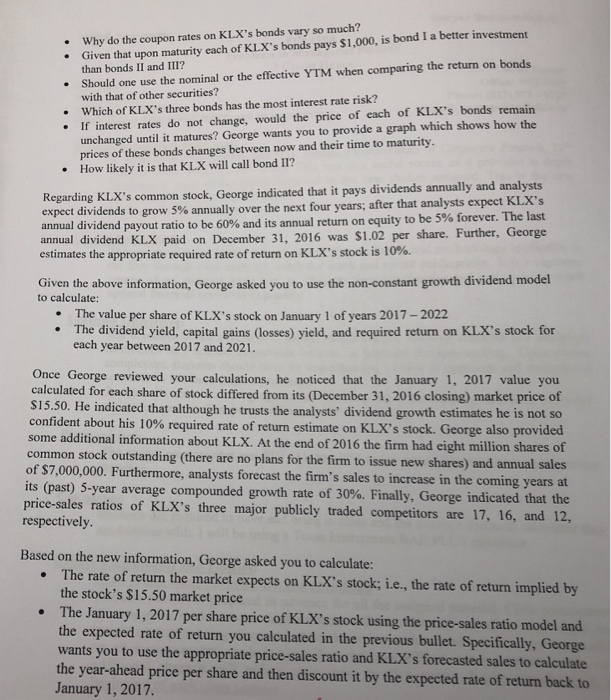

Given that upon maturity each of KLX's bonds pays S1,000, is bond I a better investment than bonds II and III? Why do the coupon rates on KLX's bonds vary so much? . .Should one use the nominal or the effective YTM when comparing the return on bonds with that of other securities? Which of KLX's three bonds has the most interest rate risk? unchanged until it matures? George wants you to provide a graph which shows how the prices of these bonds changes between now and their time to maturity. . If interest rates do not change, would the price of each of KLX's bonds remain How likely it is that KLX will call bond 11? Regarding KLX's common stock, George indicated that it pays dividends annually and analysts expect dividends to grow 5% annually over the next four years after that analysts expect KLX's o be 5% forever. The last annual dividend payout ratio to be 60% and its annual return on equity t annual dividend KLX paid on December 31, 2016 was $1.02 per share. Further, George estimates the appropriate required rate of return on KLX's stock is 10% Given the above information, George asked you to use the non-constant growth dividend model to calculate The value per share of KLX's stock on January 1 of years 2017-2022 . The dividend yield, capital gains (losses) yield, and required return on KLX's stock for each year between 2017 and 2021 * Once George reviewed your calculations, he noticed that the January 1, 2017 value you calculated for each share of stock differed from its (December 31, 2016 closing) market price o some additional information about KLX. At the end of 2016 the firm had eight million shares of of $7,000,000. Furthermore, analysts forecast the firm's sales to increase in the coming years at S15.50. He indicated that although he trusts the analysts' dividend growth estimat es he is not so KLX's stock. George also provided confident about his 10% required rate of return estimate on common stock outstanding (there are no plans for the firm to issue new shares) and price-sales ratios of KLX's three major publicly traded competitors are 17, 16, and annual sales its (past) 5-year average compounded growth rate of 30%. Finally, George indicated that the respectively 12, Based on the new information, George asked you to calculate The rate of return the market expects on KLX's stock; ie., the rate of return implied by the stock's $15.50 market price The January 1, 2017 per share price of KLX's stock using the price-sales ratio model and the expected rate of return you calculated in the previous bullet. Specifically, George wants you to use the appropriate price-sales ratio and KLX's forecasted sales to calculate the year-ahead price per share and then discount it by the expected rate of return back to January 1, 2017