Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the assumptions below, make a value calculation for DH Hospital as it considers this merger (Clinic Acquisition). Will it increase revenue of their primary

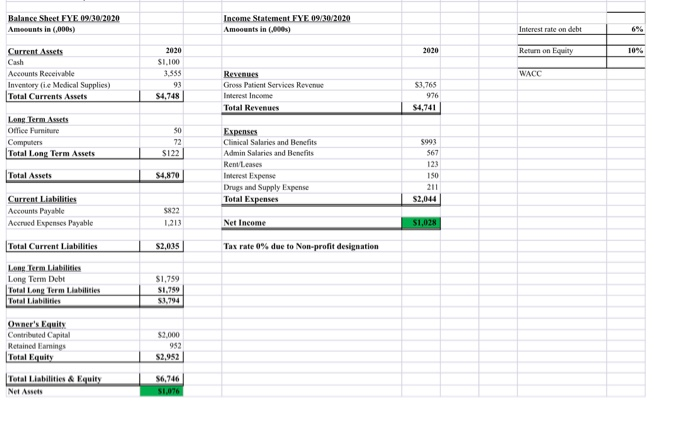

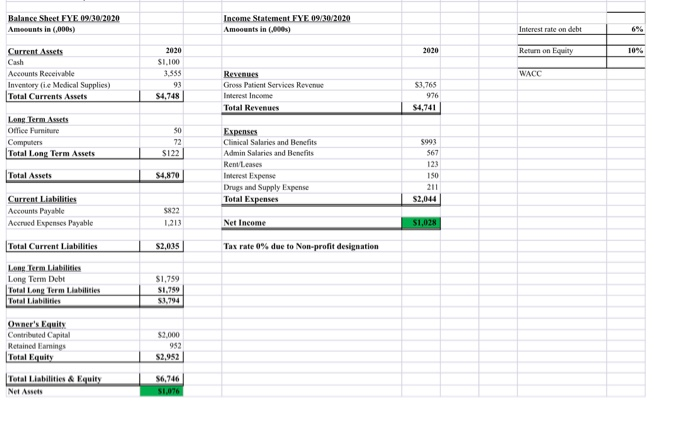

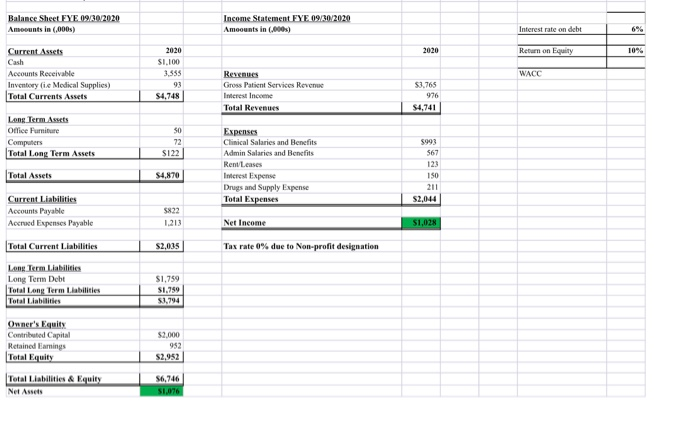

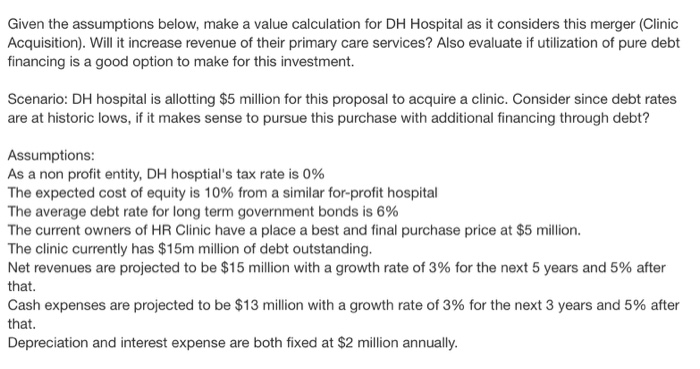

Given the assumptions below, make a value calculation for DH Hospital as it considers this merger (Clinic Acquisition). Will it increase revenue of their primary care services? Also evaluate if utilization of pure debt financing is a good option to make for this investment.

Scenario: DH hospital is allotting $5 million for this proposal to acquire a clinic. Consider since debt rates are at historic lows, if it makes sense to pursue this purchase with additional financing through debt?

Assumptions:

As a non profit entity, DH hosptial's tax rate is 0%

The expected cost of equity is 10% from a similar for-profit hospital

The average debt rate for long term government bonds is 6%

The current owners of HR Clinic have a place a best and final purchase price at $5 million.

The clinic currently has $15m million of debt outstanding.

Net revenues are projected to be $15 million with a growth rate of 3% for the next 5 years and 5% after that.

Cash expenses are projected to be $13 million with a growth rate of 3% for the next 3 years and 5% after that.

Depreciation and interest expense are both fixed at $2 million annually.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started