Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the asymmetry in potential returns for equity investments, how might this impact the behavioral finance concept of loss aversion in investment decision - making?

Given the asymmetry in potential returns for equity

investments, how might this impact the behavioral finance

concept of loss aversion in investment decisionmaking?

Asymmetric potential for high gains could lead more investors to

overcome loss aversion and invest in equities despite the risk.

Asymmetric potential for high oainscould

ovecome loss aversioniand finvestin bond's instead of equitie

Asymmetric potential for high gains would exacerbaterdoss aversion

causing investors to avoid equities.

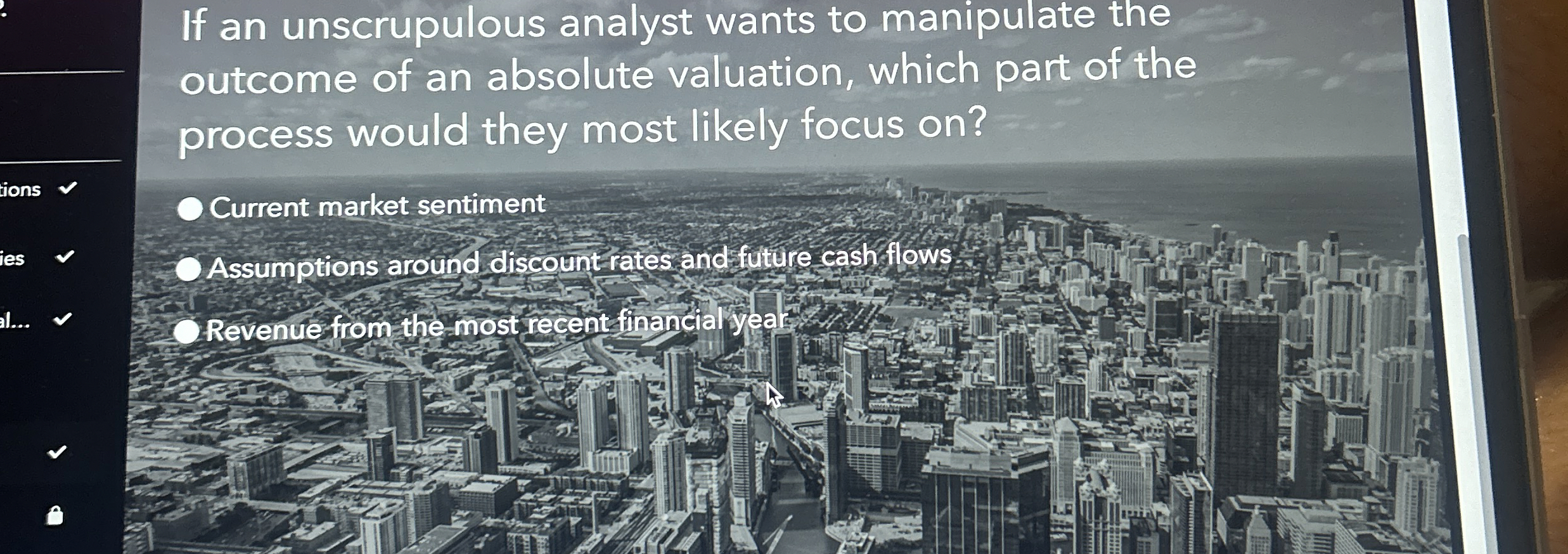

If an unscrupulous analyst wants to manipulate the

outcome of an absolute valuation, which part of the

process would they most likely focus on

Current market sentiment

Assumptions around discount hates and future cas fows

Prevenue from the most recent financial yal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started