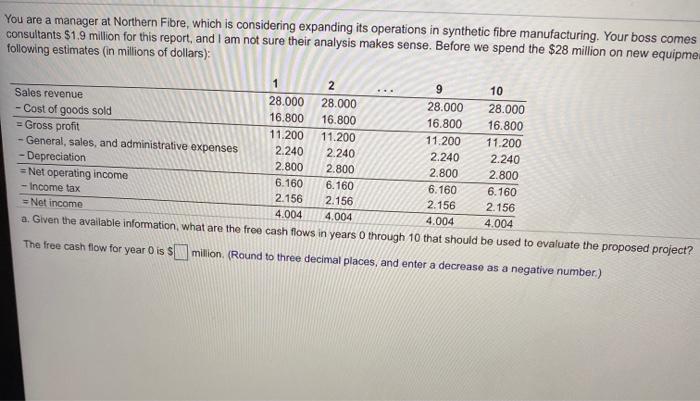

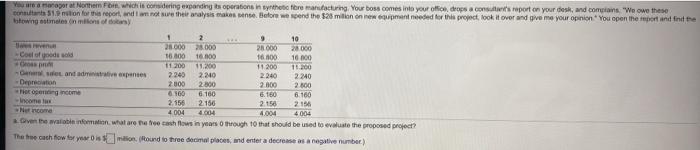

Given the available information what are the free cash flows in years 0 through 10 that should be used to evaluate the proposed project?

QUE 0 You are ager at the Forwiching engineering you to scorert on your desk and can west como nosotandanas Bond 52 sedmero como you and in the 1 2 Sre 10 28000 2800 20.000 -Congoods 16500 1500 16.000 16800 11 11200 1500 - Odde 11 200 2.240 224 2300 2.900 2800 2.800 2.800 2300 - Neeling income TOO TO 6.100 6.166 - home 2150 2.166 2.1 - Meme 2002 2004 4634 how the season 10th older The tech tow tryenten Pound to retain aceste de a avernet) You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes consultants 51.9 million for this report, and I am not sure their analysis makes sense. Before we spend the $28 million on new equipme following estimates (in millions of dollars): 1 2 9 10 Sales revenue 28.000 28.000 28.000 28.000 - Cost of goods sold 16.800 16.800 16.800 16.800 = Gross profit 11.200 11.200 11.200 11.200 - General, sales, and administrative expenses 2.240 2.240 2.240 2.240 -Depreciation 2.800 2.800 2.800 2.800 = Net operating income 6.160 6.160 6.160 6.160 -Income tax 2.156 2.156 2.156 2.156 = Net income 4.004 4.004 4.004 4.004 a. Given the available information, what are the free cash flows in years 0 through 10 that should be used to evaluate the proposed project? The free cash flow for year ois million (Round to three decimal places, and enter a decreaso as a negative number.) You are a raporton For which is considering expanding is operations in the fore manufacturing Your boss comes into your office drops acon's report on your desk, and compan"We owe these contation for this report and not sure the analysis as flore we spend the $28 milion newspanded for this propect took it over and give me your opinion. You open the report and find the towing estimates on millions of 1 2 9 10 ven 28.000 2000 20.000 28.000 Coelofoods sold 16.800 16.00 16.00 10 000 11.200 11.200 11 200 Land adventes 2.245 2.240 2.240 2240 -Depreciation 2.000 2.800 2.000 2.800 Pierogeno come 6.100 6.160 6.160 6.100 -Income 2.156 2156 219 Nincome 4004 4.004 4.004 4004 Over the woman what are free cash flows in years through to that should be used to evaluate the proposed prooch The cash flow forismo (found to three decimal places, and enter a decreases a negative number)