Answered step by step

Verified Expert Solution

Question

1 Approved Answer

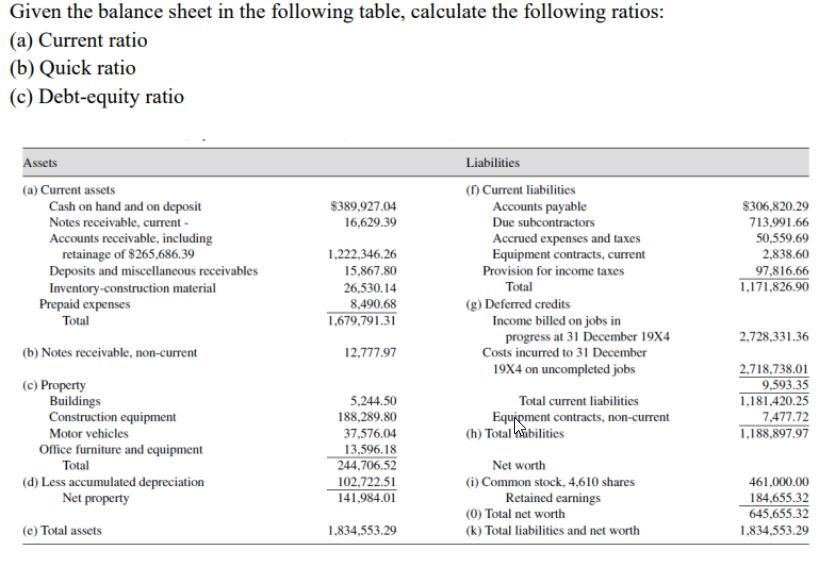

Given the balance sheet in the following table, calculate the following ratios: (a) Current ratio (b) Quick ratio (c) Debt-equity ratio Assets Liabilities (a)

Given the balance sheet in the following table, calculate the following ratios: (a) Current ratio (b) Quick ratio (c) Debt-equity ratio Assets Liabilities (a) Current assets () Current liabilities Cash on hand and on deposit Notes receivable, current - $389,927.04 Accounts payable Due subcontractors $306,820.29 16,629.39 713,991.66 Accounts receivable, including retainage of $265,686.39 Deposits and miscellaneous receivables Inventory-construction material Prepaid expenses Total Accrued expenses and taxes Equipment contracts, current Provision for income taxes 50,559.69 1,222,346.26 2,838.60 15,867.80 97,816.66 1,171,826.90 26,530.14 Total 8,490.68 1,679,791.31 (g) Deferred credits Income billed on jobs in progress at 31 December 19X4 Costs incurred to 31 December 2,728,331.36 (b) Notes receivable, non-current 12,777.97 2.718.738.01 9,593.35 1,181,420.25 7,477.72 1,188,897.97 19X4 on uncompleted jobs (c) Property Buildings Construction equipment Motor vehicles 5,244.50 Total current liabilities 188,289.80 Equioment contracts, non-current (h) Total habilities 37,576.04 Office furniture and equipment Total 13,596.18 244,706.52 102,722.51 141,984.01 Net worth (d) Less accumulated depreciation Net property (i) Common stock, 4,610 shares 461,000.00 Retained earnings (0) Total net worth 184,655.32 645,655.32 (e) Total assets 1,834,553.29 (k) Total liabilities and net worth 1,834,553.29

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Current Ratio Current ASSETS Current Liablity 167979131 11718...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started