Given the below income statement and balance sheet, calculate the following for the year 2019:

1. Payout Ratio

2. Average Collection Period

3.Return Asset

4.Times Interest Earned

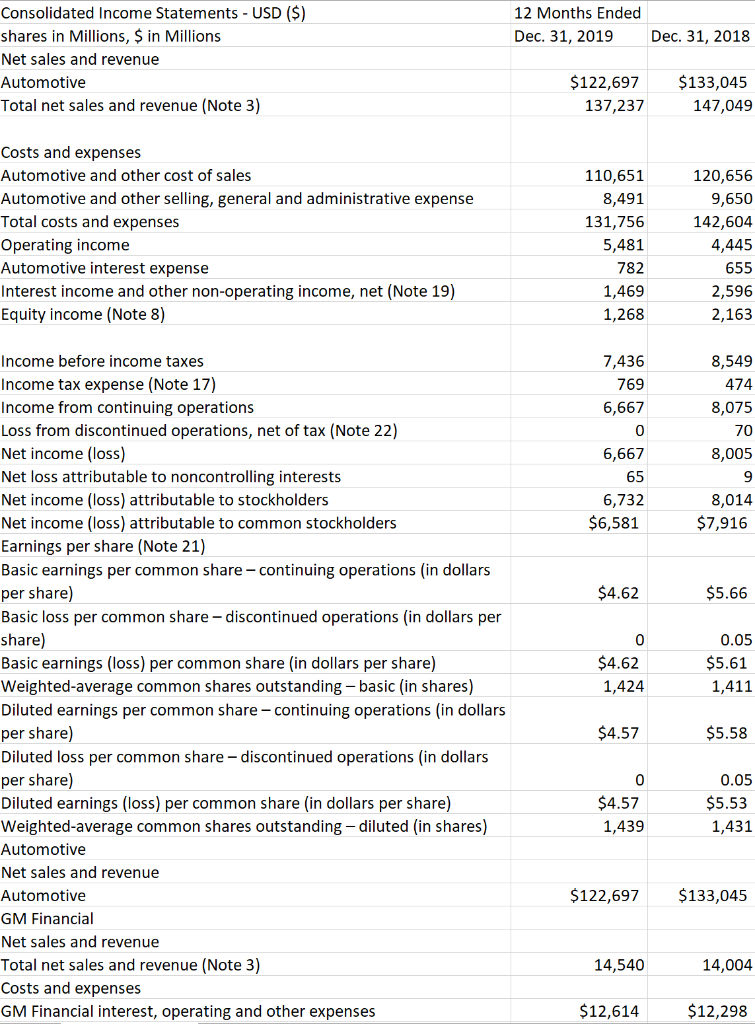

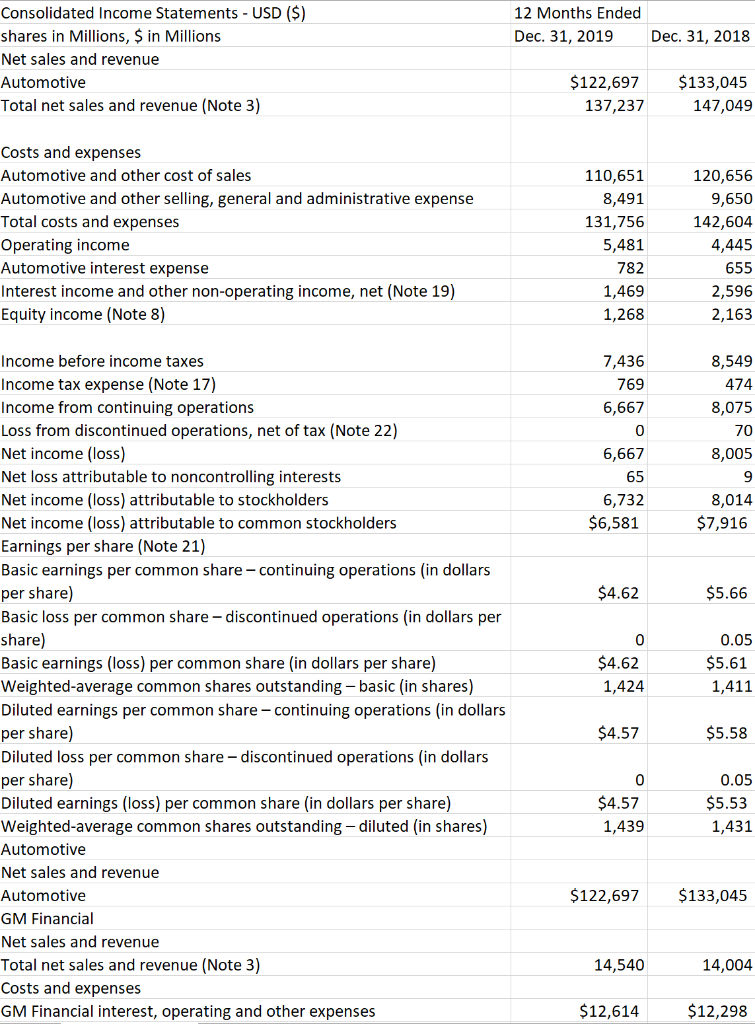

Income Statement for Automotive Company 1:

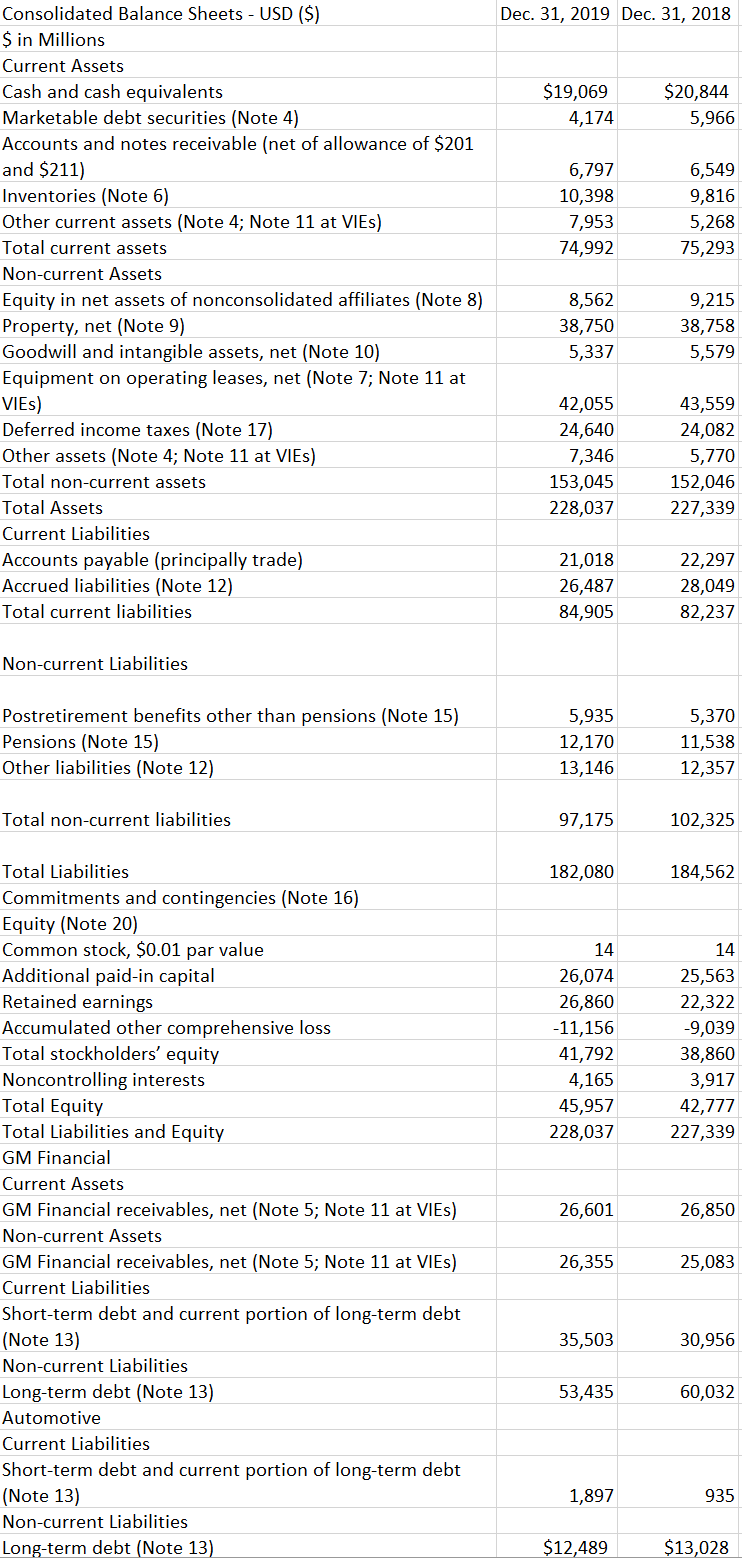

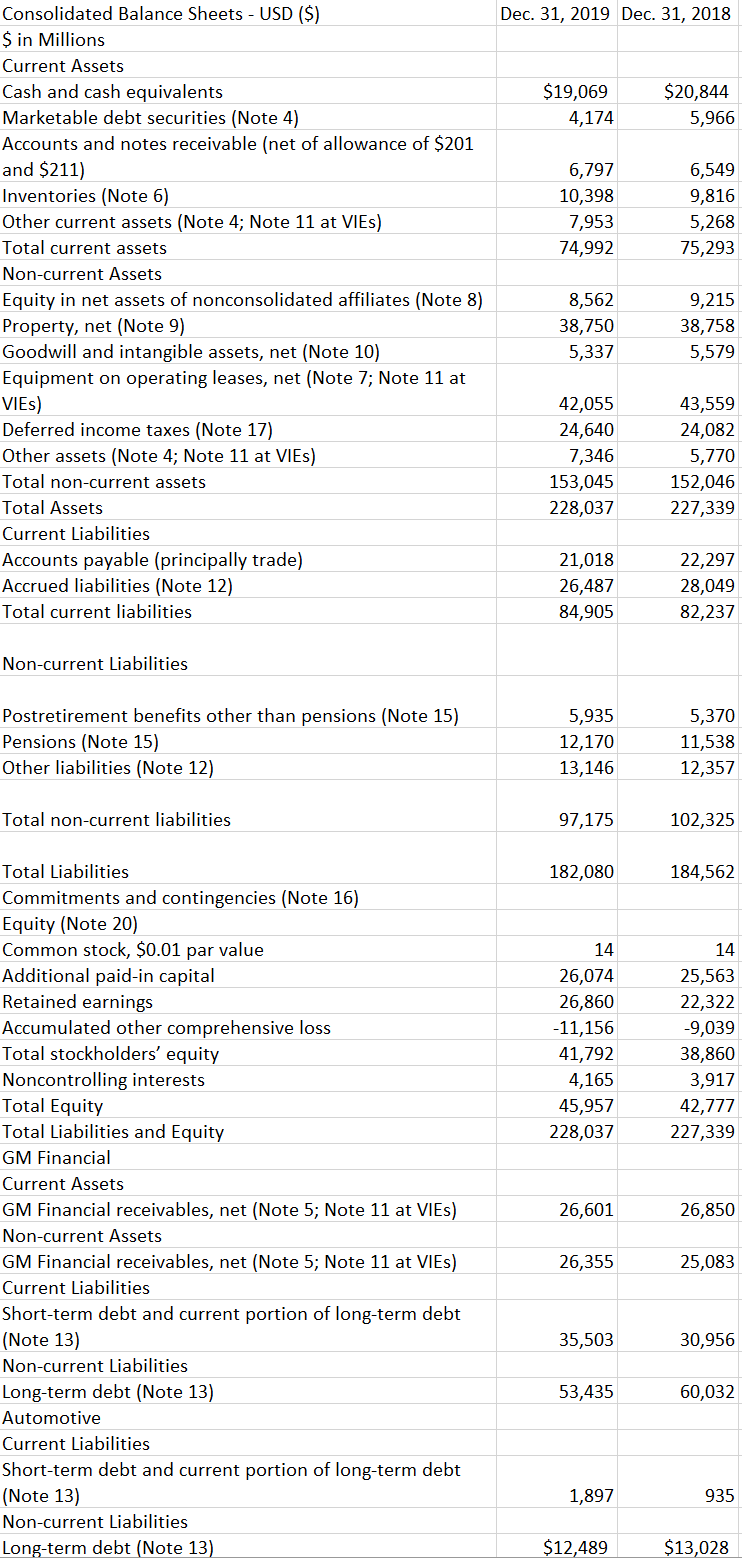

Balance Sheet for Automotive Company 1:

12 Months Ended Dec. 31, 2019 Dec. 31, 2018 Consolidated Income Statements - USD ($) shares in Millions, $ in Millions Net sales and revenue Automotive Total net sales and revenue (Note 3) $122,697 137,237 $133,045 147,049 Costs and expenses Automotive and other cost of sales Automotive and other selling, general and administrative expense Total costs and expenses Operating income Automotive interest expense Interest income and other non-operating income, net (Note 19) Equity income (Note 8) 110,651 8,491 131,756 5,481 782 1,469 1,268 120,656 9,650 142,604 4,445 655 2,596 2,163 8,549 474 7,436 769 6,667 0 6,667 65 6,732 $6,581 8,075 70 8,005 9 8,014 $7,916 $4.62 $5.66 Income before income taxes Income tax expense (Note 17) Income from continuing operations Loss from discontinued operations, net of tax (Note 22) Net income (loss) Net loss attributable to noncontrolling interests Net income (loss) attributable to stockholders Net income (loss) attributable to common stockholders Earnings per share (Note 21) Basic earnings per common share - continuing operations (in dollars per share) Basic loss per common share-discontinued operations (in dollars per share) Basic earnings (loss) per common share (in dollars per share) Weighted average common shares outstanding - basic (in shares) Diluted earnings per common share - continuing operations (in dollars per share) Diluted loss per common share - discontinued operations (in dollars per share) Diluted earnings (loss) per common share (in dollars per share) Weighted average common shares outstanding-diluted (in shares) Automotive Net sales and revenue Automotive GM Financial Net sales and revenue Total net sales and revenue (Note 3) Costs and expenses GM Financial interest, operating and other expenses 0 $4.62 1,424 0.05 $5.61 1,411 $4.57 $5.58 0 $4.57 1,439 0.05 $5.53 1,431 $122,697 $133,045 14,540 14,004 $12,614 $12,298 Dec. 31, 2019 Dec. 31, 2018 $19,069 4,174 $20,844 5,966 6,797 10,398 7,953 74,992 6,549 9,816 5,268 75,293 Consolidated Balance Sheets - USD ($) $ in Millions Current Assets Cash and cash equivalents Marketable debt securities (Note 4) Accounts and notes receivable (net of allowance of $201 and $211) Inventories (Note 6) Other current assets (Note 4; Note 11 at VIES) Total current assets Non-current Assets Equity in net assets of nonconsolidated affiliates (Note 8) Property, net (Note 9) Goodwill and intangible assets, net (Note 10) Equipment on operating leases, net (Note 7; Note 11 at VIES) Deferred income taxes (Note 17) Other assets (Note 4; Note 11 at VIES) Total non-current assets Total Assets Current Liabilities Accounts payable (principally trade) Accrued liabilities (Note 12) Total current liabilities 8,562 38,750 5,337 9,215 38,758 5,579 42,055 24,640 7,346 153,045 228,037 43,559 24,082 5,770 152,046 227,339 21,018 26,487 84,905 22,297 28,049 82,237 Non-current Liabilities Postretirement benefits other than pensions (Note 15) Pensions (Note 15) Other liabilities (Note 12) 5,935 12,170 13,146 5,370 11,538 12,357 Total non-current liabilities 97,175 102,325 182,080 184,562 14 26,074 26,860 -11,156 41,792 4,165 45,957 228,037 14 25,563 22,322 -9,039 38,860 3,917 42,777 227,339 Total Liabilities Commitments and contingencies (Note 16) Equity (Note 20) Common stock, $0.01 par value Additional paid-in capital Retained earnings Accumulated other comprehensive loss Total stockholders' equity Noncontrolling interests Total Equity Total Liabilities and Equity GM Financial Current Assets GM Financial receivables, net (Note 5; Note 11 at VIES) Non-current Assets GM Financial receivables, net (Note 5; Note 11 at VIES) Current Liabilities Short-term debt and current portion of long-term debt (Note 13) Non-current Liabilities Long-term debt (Note 13) Automotive Current Liabilities Short-term debt and current portion of long-term debt (Note 13) Non-current Liabilities Long-term debt (Note 13) 26,601 26,850 26,355 25,083 35,503 30,956 53,435 60,032 1,897 935 $12,489 $13,028