Question

A sole trader's business made a profit of $32,500 during the year ended 31 March 20X8. This figure was after deducting $100 per week

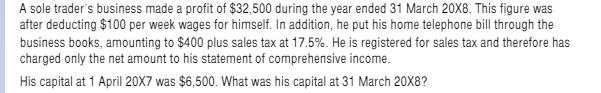

A sole trader's business made a profit of $32,500 during the year ended 31 March 20X8. This figure was after deducting $100 per week wages for himself. In addition, he put his home telephone bill through the business books, amounting to $400 plus sales tax at 17.5%. He is registered for sales tax and therefore has charged only the net amount to his statement of comprehensive income. His capital at 1 April 20X7 was $6,500. What was his capital at 31 March 20X8?

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution I Step 1 iComputation of amount of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Electric Circuits

Authors: Matthew Sadiku, Charles Alexander

3rd Edition

978-0073301150, 0073301159

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App