Answered step by step

Verified Expert Solution

Question

1 Approved Answer

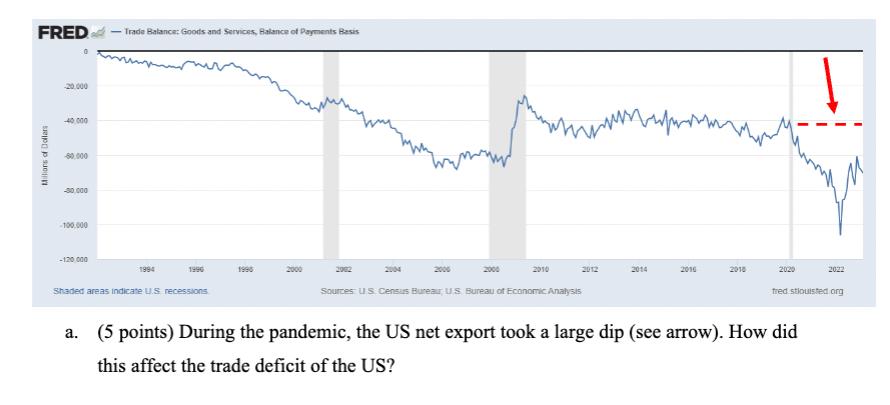

Given the data on the US trade balance (known as net export) below: FRED Millions of Dollars -20.000 -40.000 -30,000 -100.000 -120,000 -Trade Balance:

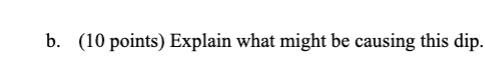

Given the data on the US trade balance (known as net export) below: FRED Millions of Dollars -20.000 -40.000 -30,000 -100.000 -120,000 -Trade Balance: Goods and Services, Balance of Payments Basis 1994 Shaded areas indicate US recessions 1996 2000 2002 Sources: U.S. Census Bureau US Bureau of Economic Analysis mupos 2014 2018 2020 2022 tred stlouisted org (5 points) During the pandemic, the US net export took a large dip (see arrow). How did this affect the trade deficit of the US? b. (10 points) Explain what might be causing this dip. c. (5 points) When US net export decreases (as shown in the graph), explain how this would affect the interest rate via the market for loanable funds. Include a graph for the market for loanable funds for full credit. Hint: Recall that we have this equation: Net Export= Net Capital Outflow We also have this equation: Saving Domestic Investment + Net Capital Outflow Supply of loanable funds Demand of loanable funds When Net Export decreases, what would happen to Net Capital Outflow? How would this affect the market for loanable fund? Given the data on the US trade balance (known as net export) below: FRED Millions of Dollars -20.000 -40.000 -30,000 -100.000 -120,000 -Trade Balance: Goods and Services, Balance of Payments Basis 1994 Shaded areas indicate US recessions 1996 2000 2002 Sources: US Census Bureau US Bureau of Economic Analysis mupos 2014 2018 2020 2022 fredstioulsted org (5 points) During the pandemic, the US net export took a large dip (see arrow). How did this affect the trade deficit of the US? b. (10 points) Explain what might be causing this dip. c. (5 points) When US net export decreases (as shown in the graph), explain how this would affect the interest rate via the market for loanable funds. Include a graph for the market for loanable funds for full credit. Hint: Recall that we have this equation: Net Export= Net Capital Outflow We also have this equation: Saving Domestic Investment + Net Capital Outflow Supply of loanable funds Demand of loanable funds When Net Export decreases, what would happen to Net Capital Outflow? How would this affect the market for loanable fund?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a 5 points The large dip in the US net export during the pandemic would have increased the US ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started