Question

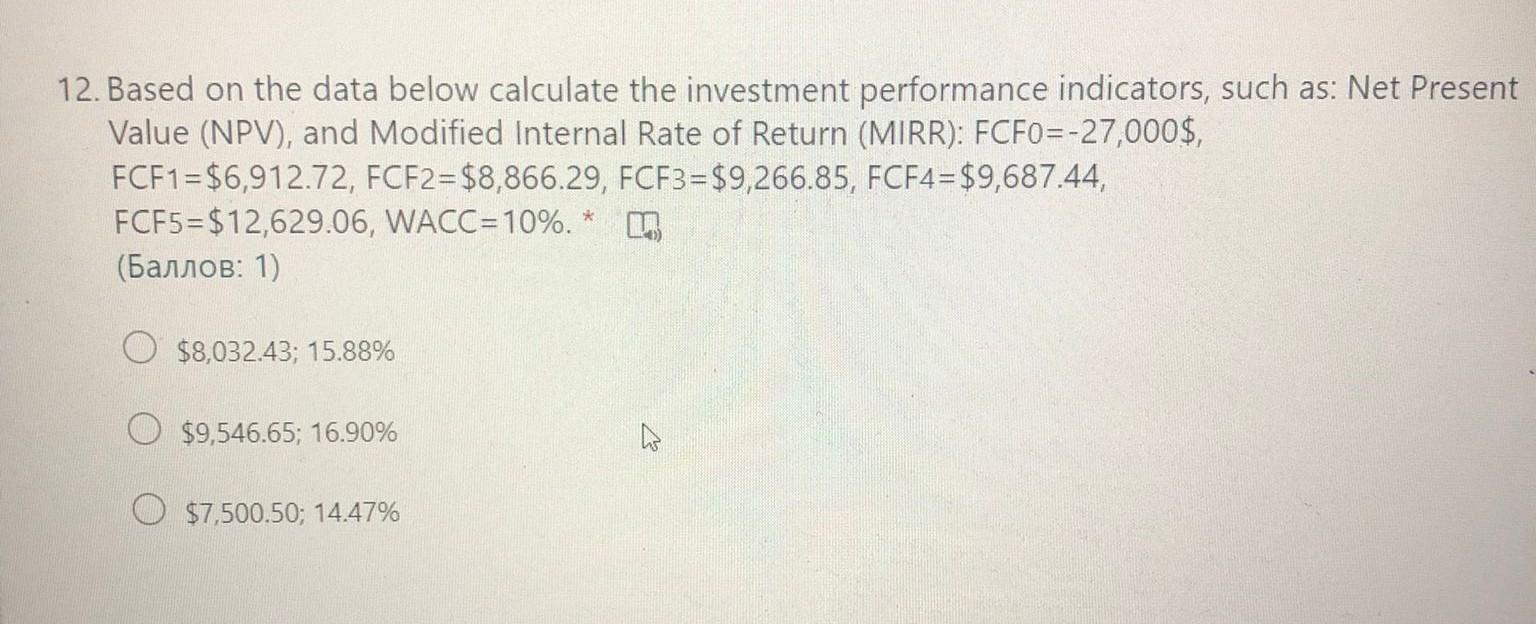

12. Based on the data below calculate the investment performance indicators, such as: Net Present Value (NPV), and Modified Internal Rate of Return (MIRR):

12. Based on the data below calculate the investment performance indicators, such as: Net Present Value (NPV), and Modified Internal Rate of Return (MIRR): FCF0=-27,000$, FCF1=$6,912.72, FCF2=$8,866.29, FCF3=$9,266.85, FCF4=$9,687.44, FCF5=$12,629.06, WACC=10%. * (: 1) $8,032.43; 15.88% $9,546.65; 16.90% $7,500.50; 14.47% 2

Step by Step Solution

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Investment perfor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Project Management A Managerial Approach

Authors: Jack R. Meredith, Samuel J. Mantel Jr.

8th edition

470533021, 978-0470533024

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App